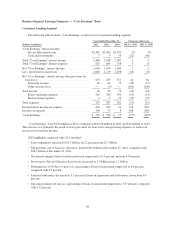

Sallie Mae 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Overhead

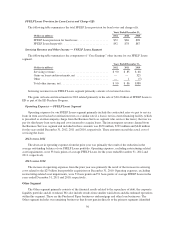

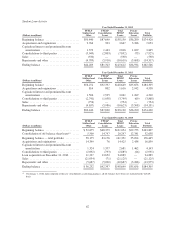

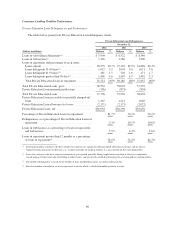

Corporate overhead is comprised of costs related to executive management, the board of directors,

accounting, finance, legal, human resources and stock-based compensation expense. Unallocated information

technology costs are related to infrastructure and operations.

2012 versus 2011

The decrease in overhead for the year ended December 31, 2012 compared with the year-ago period was

primarily the result of the current-year benefit of the cost-cutting efforts we implemented throughout 2011.

2011 versus 2010

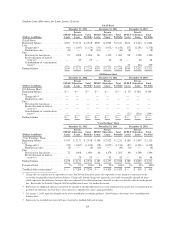

The increase in overhead from 2010 to 2011 was primarily the result of a change in the terms of our stock-

based compensation plans, additional expense related to the termination of our defined benefit pension plan, and

restructuring-related consulting expenses incurred in the first half of 2011. In the first quarter of 2011, we

changed our stock-based compensation plans so that retirement eligible employees would not forfeit unvested

stock-based compensation upon their retirement. This change had the effect of accelerating $11 million of future

stock-based compensation expenses associated with these unvested stock grants into the current period for those

retirement-eligible employees. We also recognized $16 million of additional expense in 2011 related to the

termination of our defined benefit pension plan due to changes in estimates related to the employee termination

benefits as well as changes in interest rates.

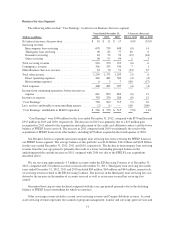

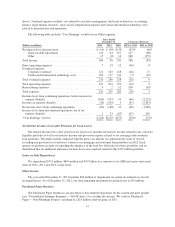

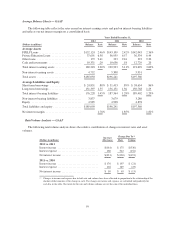

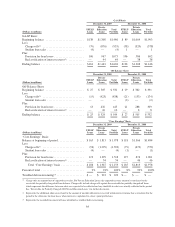

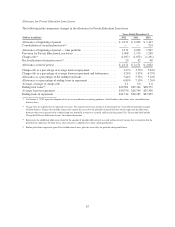

Financial Condition

This section provides additional information regarding the changes related to our loan portfolio assets and

related liabilities as well as credit performance indicators related to our loan portfolio. Certain of these

disclosures will show both GAAP-basis as well as “Core Earnings” basis disclosures. Because certain trusts were

not consolidated prior to the adoption of the new consolidation accounting guidance on January 1, 2010, these

trusts were treated as off-balance sheet for GAAP purposes but we considered them on-balance sheet for “Core

Earnings” purposes. Subsequent to the adoption of the new consolidation accounting guidance on January 1,

2010, this difference no longer exists because all of our trusts are treated as on-balance sheet for GAAP purposes.

Below and elsewhere in the document, “Core Earnings” basis disclosures include all historically (pre-January 1,

2010) off-balance sheet trusts as though they were on-balance sheet. We believe that providing “Core Earnings”

basis disclosures is meaningful because when we evaluate the performance and risk characteristics of the

Company we have always considered the effect of any off-balance sheet trusts as though they were on-balance

sheet.

58