Sallie Mae 2012 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

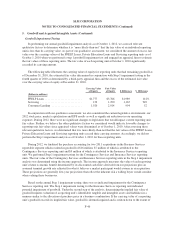

6. Borrowings (Continued)

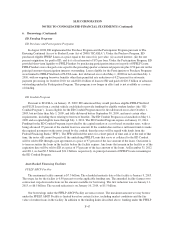

Auction Rate Securities

At December 31, 2012, we had $3.1 billion of auction rate securities outstanding in securitizations. Since

February 2008, problems in the auction rate securities market as a whole led to failures of the auctions pursuant

to which certain of our auction rate securities’ interest rates are set. As a result, $1.4 billion of our auction rate

securities as of December 31, 2012 bore interest at the maximum rate allowable under their terms. The maximum

allowable interest rate on our taxable auction rate securities is generally LIBOR plus 1.50 percent to 3.50 percent,

dependant on the security’s credit rating. The maximum allowable interest rate on many of our tax-exempt

auction rate securities is a formula driven rate, which produced various maximum rates up to 0.63 percent during

the fourth quarter of 2012. As of December 31, 2012, $1.7 billion of auction rate securities have had successful

auctions, resulting in an average rate of 2.12 percent.

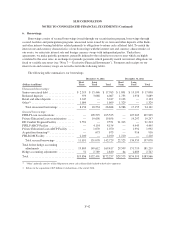

Reset Rate Notes

Certain tranches of our term asset-backed securities (“ABS”) are reset rate notes. Reset rate notes are

subject to periodic remarketing, at which time the interest rates on the notes are reset. We also have the option to

repurchase a reset rate note upon a failed remarketing and hold it as an investment until such time it can be

remarketed. In the event a reset rate note cannot be remarketed on the remarketing date, and is not repurchased,

the interest rate generally steps up to and remains at LIBOR plus 0.75 percent until such time as the bonds are

successfully remarketed or repurchased. Our repurchase of a reset rate note requires additional funding, the

availability and pricing of which may be less favorable to us than it was at the time the reset rate note was

originally issued. Unlike the repurchase of a reset rate note, the occurrence of a failed remarketing does not

require additional funding. As a result of the ongoing dislocation in the capital markets, at December 31, 2012,

$6.0 billion of our reset rate notes bore interest at, or were swapped to LIBOR plus 0.75 percent due to a failed

remarketing. Until capital markets conditions improve, it is possible these and additional reset rate notes will

experience failed remarketings. As of December 31, 2012, we had $7.5 billion and $1.5 billion of reset rate notes

due to be remarketed in 2013 and 2014, respectively, and an additional $2.7 billion to be newly remarketed

thereafter.

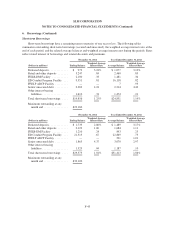

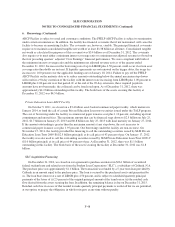

Federal Home Loan Bank of Des Moines (“FHLB-DM”)

On January 15, 2010, HICA Education Loan Corporation (“HICA”), our subsidiary, entered into a

borrowing agreement with the FHLB-DM. Under the agreement, the FHLB-DM will provide advances backed by

Federal Housing Finance Agency approved collateral which includes FFELP Loans (but does not include Private

Education Loans). The facility is available as long as we maintain membership with FHLB-DM. The amount,

price and tenor of future advances will vary and be subject to the agreement’s borrowing conditions, including,

among others, facility size, current usage, and availability of qualifying collateral from unencumbered FFELP

Loans, as then in effect and determined at the time of each borrowing. The maximum amount that can be

borrowed, as of December 31, 2012, subject to available collateral, is approximately $8.5 billion. As of

December 31, 2012, borrowing under the facility totaled $2.1 billion, matures by March 18, 2013, and was

secured by $2.7 billion of FFELP Loans. We have provided a guarantee to the FHLB-DM for the performance

and payment of HICA’s obligations.

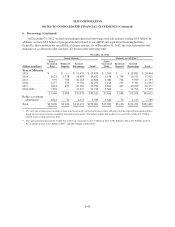

Other Funding Sources

Sallie Mae Bank

During the fourth quarter of 2008, the Bank, our Utah industrial bank subsidiary, began expanding its

deposit base to fund new Private Education Loan originations. The Bank raises deposits through intermediaries in

F-50