Sallie Mae 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

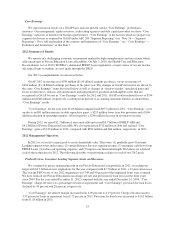

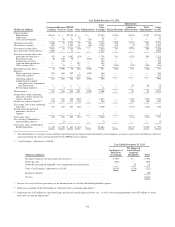

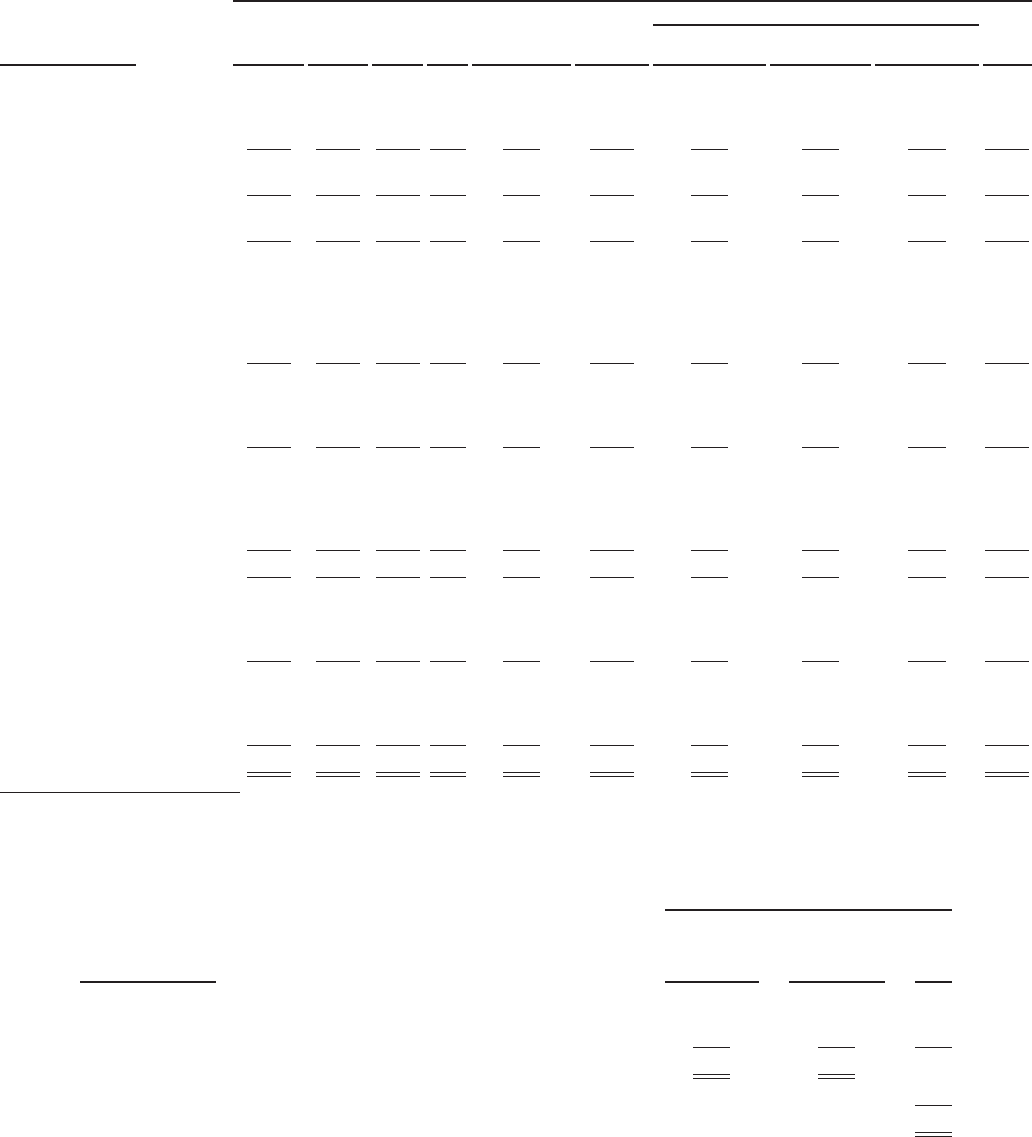

Year Ended December 31, 2010

(Dollars in millions)

Consumer

Lending

Business

Services

FFELP

Loans Other Eliminations(1)

Total

“Core

Earnings”

Adjustments

Total

GAAPReclassifications

Additions/

(Subtractions)

Total

Adjustments(2)

Interest income:

Student loans ............... $2,353 $ — $2,766 $ — $ — $5,119 $ 888 $(309) $ 579 $5,698

Other loans ................. — — — 30 — 30 — — — 30

Cash and investments ......... 14 17 9 3 (17) 26 — — — 26

Total interest income ........... 2,367 17 2,775 33 (17) 5,175 888 (309) 579 5,754

Total interest expense ........... 758 — 1,407 45 (17) 2,193 69 13(4) 82 2,275

Net interest income ............. 1,609 17 1,368 (12) — 2,982 819 (322) 497 3,479

Less: provisions for loan losses . . . 1,298 — 98 23 — 1,419 — — — 1,419

Net interest income after provisions

for loan losses ............... 311 17 1,270 (35) — 1,563 819 (322) 497 2,060

Servicing revenue ............ 72 912 68 1 (648) 405 — — — 405

Contingency revenue ......... — 330 — — — 330 — — — 330

Gains on debt repurchases ..... — — — 317 — 317 — — — 317

Other income (loss) .......... — 51 320 13 — 384 (819) 405(5) (414) (30)

Total other income (loss) ........ 72 1,293 388 331 (648) 1,436 (819) 405 (414) 1,022

Expenses:

Direct operating expenses ..... 350 500 736 12 (648) 950 — — — 950

Overhead expenses ........... — — — 258 — 258 — — — 258

Operating expenses ............ 350 500 736 270 (648) 1,208 — — — 1,208

Goodwill and acquired intangible

assets impairment and

amortization ................ — — — — — — — 699 699 699

Restructuring expenses .......... 12 7 54 12 — 85 — — — 85

Total expenses ................ 362 507 790 282 (648) 1,293 — 699 699 1,992

Income (loss) from continuing

operations, before income tax

expense (benefit) ............ 21 803 868 14 — 1,706 — (616) (616) 1,090

Income tax expense (benefit)(3) . . . 8 288 311 4 — 611 — (118) (118) 493

Net income (loss) from continuing

operations .................. 13 515 557 10 — 1,095 — (498) (498) 597

Loss from discontinued operations,

net of tax benefit ............. — — — (67) — (67) — — — (67)

Net income (loss) .............. $ 13 $ 515 $ 557 $ (57) $ — $1,028 $ — $(498) $(498) $ 530

(1) The eliminations in servicing revenue and direct operating expense represent the elimination of intercompany servicing revenue where the Business Services

segment performs the loan servicing function for the FFELP Loans segment.

(2) “Core Earnings” adjustments to GAAP:

Year Ended December 31, 2010

(Dollars in millions)

Net Impact of

Derivative

Accounting

Net Impact of

Goodwill and

Acquired

Intangibles Total

Net interest income after provisions for loan losses ............................ $497 $— $497

Total other loss ........................................................ (414) — (414)

Goodwill and acquired intangible assets impairment and amortization ............. — 699 699

Total “Core Earnings” adjustments to GAAP ................................. $ 83 $(699) (616)

Income tax benefit ...................................................... (118)

Net loss .............................................................. $(498)

(3) Income taxes are based on a percentage of net income before tax for the individual reportable segment.

(4) Represents a portion of the $(54) million of “other derivative accounting adjustments.”

(5) Represents the $454 million of “unrealized gains on derivative and hedging activities, net” as well as the remaining portion of the $(54) million of “other

derivative accounting adjustments.”

43