Sallie Mae 2012 Annual Report Download - page 207

Download and view the complete annual report

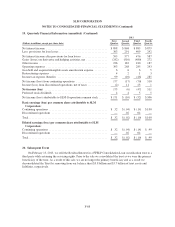

Please find page 207 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Non-traditional loans are loans to customers attending for-profit schools with an original FICO score of less than

670 and customers attending not-for-profit schools with an original FICO score of less than 640. The FICO score

used in determining whether a loan is non-traditional is the greater of the customer or cosigner FICO score at

origination.

Repayment Borrower Benefits — Financial incentives offered to borrowers based on pre-determined

qualifying factors, which are generally tied directly to making on-time monthly payments. The impact of

Repayment Borrower Benefits is dependent on the estimate of the number of borrowers who will eventually

qualify for these benefits and the amount of the financial benefit offered to the borrower. We occasionally change

Repayment Borrower Benefits programs in both amount and qualification factors. These programmatic changes

must be reflected in the estimate of the Repayment Borrower Benefits discount when made.

Residual Interest — When we securitize student loans, we retain the right to receive cash flows from the

student loans sold to trusts that we sponsor in excess of amounts needed to pay servicing, derivative costs (if

any), other fees, and the principal and interest on the bonds backed by the student loans. The Residual Interest,

which may also include reserve and other cash accounts, is the present value of these future expected cash flows,

which includes the present value of any Embedded Fixed Rate Floor Income described above. We value the

Residual Interest at the time of sale of the student loans to the trust and as of the end of each subsequent quarter.

Risk Sharing — When a FFELP Loan first disbursed on and after July 1, 2006 defaults, the federal

government guarantees 97 percent of the principal balance plus accrued interest (98 percent on loans disbursed

before July 1, 2006) and the holder of the loan is at risk for the remaining amount not guaranteed as a Risk

Sharing loss on the loan. FFELP Loans originated after October 1, 1993 are subject to Risk Sharing on loan

default claim payments unless the default results from the borrower’s death, disability or bankruptcy.

Special Allowance Payment (“SAP”) — FFELP Loans disbursed prior to April 1, 2006 (with the exception

of certain PLUS and Supplemental Loans to Students (“SLS”) loans discussed below) generally earn interest at

the greater of the borrower rate or a floating rate determined by reference to the average of the applicable floating

rates (91-day Treasury bill rate or commercial paper) in a calendar quarter, plus a fixed spread that is dependent

upon when the loan was originated and the loan’s repayment status. If the resulting floating rate exceeds the

borrower rate, ED pays the difference directly to us. This payment is referred to as the Special Allowance

Payment or SAP and the formula used to determine the floating rate is the SAP formula. We refer to the fixed

spread to the underlying index as the SAP spread. For loans disbursed after April 1, 2006, FFELP Loans

effectively only earn at the SAP rate, as the excess interest earned when the borrower rate exceeds the SAP rate

(Floor Income) must be refunded to ED.

Variable rate PLUS Loans and SLS Loans earn SAP only if the variable rate, which is reset annually,

exceeds the applicable maximum borrower rate. For PLUS Loans disbursed on or after January 1, 2000, this

limitation on SAP was repealed effective April 1, 2006.

Variable Rate Floor Income — Variable Rate Floor Income is Floor Income that is earned only through

the next date at which the borrower interest rate is reset to a market rate. For FFELP Stafford Loans whose

borrower interest rate resets annually on July 1, we may earn Floor Income based on a calculation of the

difference between the borrower rate and the then current interest rate.

G-4