Sallie Mae 2012 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FFELP — The Federal Family Education Loan Program, formerly the Guaranteed Student Loan Program, a

program that was discontinued in 2010.

FFELP Consolidation Loans — Under the FFELP, borrowers with multiple eligible student loans may

have consolidated them into a single student loan with one lender at a fixed rate for the life of the loan. The new

loan is considered a FFELP Consolidation Loan. The borrower rate on a FFELP Consolidation Loan is fixed for

the term of the loan and was set by the weighted average interest rate of the loans being consolidated, rounded up

to the nearest 1/8th of a percent, not to exceed 8.25 percent. Holders of FFELP Consolidation Loans are eligible

to earn interest under the Special Allowance Payment (“SAP”) formula. In April 2008, we suspended originating

new FFELP Consolidation Loans.

FFELP Stafford and Other Student Loans — Education loans to students or parents of students that are

guaranteed or reinsured under the FFELP. The loans are primarily Stafford loans but also include PLUS and

HEAL loans. The FFELP was discontinued in 2010.

Fixed Rate Floor Income — Fixed Rate Floor Income is Floor Income associated with student loans with

borrower rates that are fixed to term (primarily FFELP Consolidation Loans and Stafford Loans originated on or

after July 1, 2006).

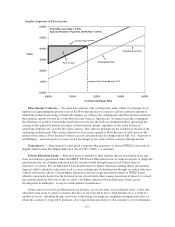

Floor Income — For loans disbursed before April 1, 2006, FFELP Loans generally earn interest at the

higher of either the borrower rate, which is fixed over a period of time, or a floating rate based on the SAP

formula. We generally finance our student loan portfolio with floating rate debt whose interest is matched closely

to the floating nature of the applicable SAP formula. If interest rates decline to a level at which the borrower rate

exceeds the SAP formula rate, we continue to earn interest on the loan at the fixed borrower rate while the

floating rate interest on our debt continues to decline. In these interest rate environments, we refer to the

additional spread it earns between the fixed borrower rate and the SAP formula rate as Floor Income. Depending

on the type of student loan and when it was originated, the borrower rate is either fixed to term or is reset to a

market rate each July 1. As a result, for loans where the borrower rate is fixed to term, we may earn Floor Income

for an extended period of time, and for those loans where the borrower interest rate is reset annually on July 1,

we may earn Floor Income to the next reset date. In accordance with legislation enacted in 2006, lenders are

required to rebate Floor Income to ED for all FFELP Loans disbursed on or after April 1, 2006.

The following example shows the mechanics of Floor Income for a typical fixed rate FFELP Consolidation

Loan (with a commercial paper-based SAP spread of 2.64 percent):

Fixed Borrower Rate ................... 4.25%

SAP Spread over Commercial Paper Rate . . (2.64)

Floor Strike Rate(1) .................... 1.61%

(1) The interest rate at which the underlying index (Treasury bill

or commercial paper) plus the fixed SAP spread equals the

fixed borrower rate. Floor Income is earned anytime the

interest rate of the underlying index declines below this rate.

Based on this example, if the quarterly average commercial paper rate is over 1.61 percent, the holder of the

student loan will earn at a floating rate based on the SAP formula, which in this example is a fixed spread to

commercial paper of 2.64 percent. On the other hand, if the quarterly average commercial paper rate is below

1.61 percent, the SAP formula will produce a rate below the fixed borrower rate of 4.25 percent and the loan

holder earns at the borrower rate of 4.25 percent.

G-2