Sallie Mae 2012 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

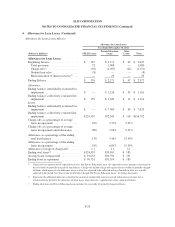

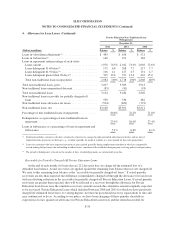

4. Allowance for Loan Losses (Continued)

partially charged-off Private Education Loans and we will continue to do so. Differences in actual future

recoveries on these defaulted loans could affect our receivable for partially charged-off Private Education Loans.

There was $198 million and $148 million in allowance for Private Education Loan losses at December 31, 2012

and 2011, respectively, providing for possible additional future charge-offs related to the receivable for partially

charged-off Private Education Loans.

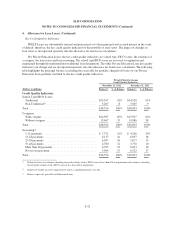

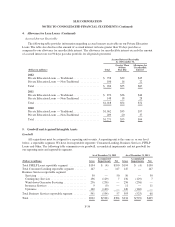

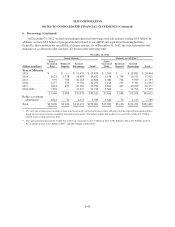

The following table summarizes the activity in the receivable for partially charged-off loans.

Years Ended December 31,

(Dollars in millions) 2012 2011 2010

Receivable at beginning of period .............................. $1,241 $1,040 $ 499

Expected future recoveries of current period defaults(1) ............. 351 391 459

Recoveries(2) ............................................... (189) (155) (104)

Charge-offs(3) .............................................. (56) (35) (43)

Consolidation of securitization trusts(4) .......................... — — 229

Receivable at end of period ................................... 1,347 1,241 1,040

Allowance for estimated recovery shortfalls(5) ..................... (198) (148) —

Net receivable at end of period ................................ $1,149 $1,093 $1,040

(1) Represents the difference between the loan balance and our estimate of the amount to be collected in the future.

(2) Current period cash collections.

(3) Represents the current period recovery shortfall – the difference between what was expected to be collected and what was actually

collected. These amounts are included in the Private Education Loan total charge-offs as reported in the “Allowance for Loan

Losses Metrics” tables.

(4) On January 1, 2010, upon the adoption of the new consolidation accounting guidance all off-balance sheet loans were consolidated

on-balance sheet.

(5) The allowance for estimated recovery shortfalls of the receivable for partially charged-off Private Education Loans is a component

of the $2.2 billion overall allowance for Private Education Loan losses as of December 31, 2012 and 2011, respectively.

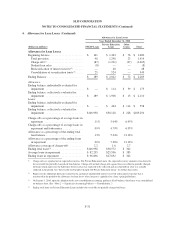

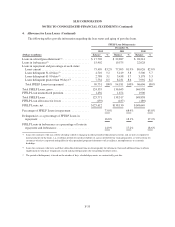

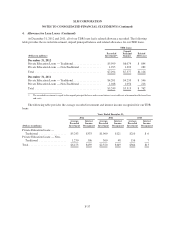

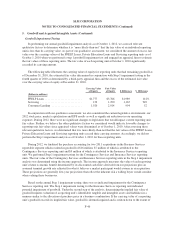

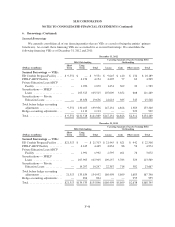

Troubled Debt Restructurings (“TDRs”)

We modify the terms of loans for certain customers when we believe such modifications may increase the

ability and willingness of a customer to make payments and thus increase the ultimate overall amount collected

on a loan. These modifications generally take the form of a forbearance, a temporary interest rate reduction or an

extended repayment plan. For customers experiencing financial difficulty, certain Private Education Loans for

which we have granted either a forbearance of greater than three months, an interest rate reduction or an extended

repayment plan are classified as TDRs. Forbearance provides customers the ability to defer payments for a period

of time, but does not result in the forgiveness of any principal or interest. While in forbearance status, interest

continues to accrue and is capitalized to principal when the loan re-enters repayment status. The recorded

investment of loans granted a forbearance that were classified as TDRs was $6.4 billion and $4.5 billion at

December 30, 2012 and 2011, respectively. The recorded investment for TDRs from loans granted interest rate

reductions or extended repayment plans was $0.9 billion and $0.7 billion at December 31, 2012 and 2011,

respectively. At December 31, 2012 and 2011, the percentage of loans granted forbearance that have migrated to

a TDR classification due to the extension of the forbearance period was 43 percent and 33 percent, respectively.

F-36