Sallie Mae 2012 Annual Report Download - page 37

Download and view the complete annual report

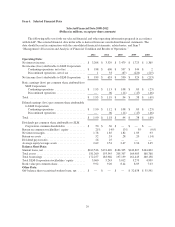

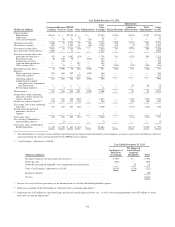

Please find page 37 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2012 we issued $9.7 billion in FFELP ABS, $4.2 billion in Private Education Loan ABS and $2.7 billion

of unsecured bonds, while reducing our total debt to $169 billion at December 31, 2012, compared to

$181 billion at December 31, 2011.

2013 Outlook

In 2013, we expect to continue the operating strength we demonstrated in 2012. We plan to increase 2013

“Core Earnings,” including in our Consumer Lending segment primarily through increasing loan originations,

improving Private Education Loan portfolio performance and reducing our unit costs. Credit losses within our

Private Education Loan portfolio are primarily driven by the quality of loan originations and the general

economic environment. We believe Private Education Loan charge-offs and provision for loan losses will

continue their downward trend. The fourth-quarter 2012 repayment cohort, at $1.7 billion, had better FICO

scores and higher cosigner rates than in previous years which should result in lower future losses. The underlying

portfolio has continued to improve with 65 percent of the loans cosigned, less than 9 percent non-traditional and

79 percent of our customers currently in repayment greater than 12 months for which a scheduled monthly

payment was due. In addition, the loans originated in 2012 had an average FICO score of 748 and were 90

percent cosigned; these statistics are our highest ever for an annual loan origination cohort.

We expect to remain an active participant in the capital markets in 2013. Our term ABS activity will feature

multiple transactions backed by both FFELP collateral, primarily reducing the ED Conduit Program Facility (see

Note 6, “Borrowings”), as well as Private Education Loan collateral. Recent transactions in all of the above

mentioned categories have been met with strong demand and provide term financing which is a key component

of our business model.

2013 Management Objectives

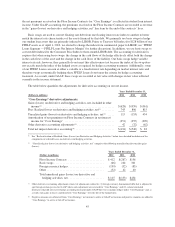

In 2013 we have set out five major goals to create shareholder value. They are: (1) prudently grow

Consumer Lending segment assets and revenues; (2) maximize cash flows form FFELP Loans; (3) reduce

operating expenses while improving efficiency and customer experience; (4) maintain our financial strength; and

(5) expand the Bank’s capabilities. Here is how we plan to achieve these objectives:

Prudently Grow Consumer Lending Segment Assets and Revenues

We will continue to pursue managed growth in our Private Education Loan portfolio in 2013 by leveraging

our Sallie Mae and Upromise brand while sustaining the credit quality of, and percentage of cosigners for, new

originations. We are currently targeting at least $4 billion in new loan originations for 2013, compared with

$3.3 billion in 2012. We will also continue to help our customers manage their borrowings and succeed in its

payoff, which we expect will result in lower charge-offs and provision for loan losses.

Maximize Cash Flows from FFELP Loans

In 2013, we will continue to purchase additional FFELP Loan portfolios. In February 2013, we sold our

ownership interest in one of our FFELP Consolidation Loan securitization trusts. We will continue to explore

alternative transactions and structures that can increase our ability to maximize the value of our ownership

interests in these trusts and allow us to diversify our holdings while maintaining servicing fee income. We must

also continue to reduce operating and overhead costs attributable to the maintenance and management of this

segment.

Reduce Operating Expenses While Improving Efficiency and Customer Experience

For 2013, we will reduce unit costs, and balance our Private Education Loan growth and the challenge of

increased regulatory oversight. We also plan to improve efficiency and customer experience by replacing certain

of our legacy systems and making enhancements to our self-service platform (such as an improved mobile

interface) and call centers (including improved call segmentation that routes an in-bound customer call directly to

the appropriate agent who can answer the customer’s inquiry).

35