Sallie Mae 2012 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

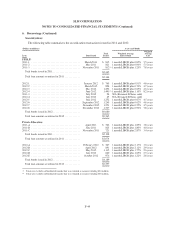

4. Allowance for Loan Losses (Continued)

Accrued Interest Receivable

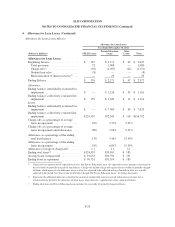

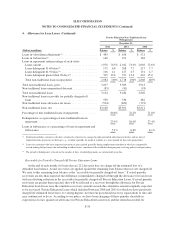

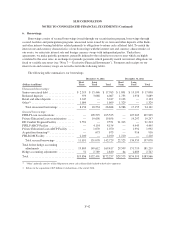

The following table provides information regarding accrued interest receivable on our Private Education

Loans. The table also discloses the amount of accrued interest on loans greater than 90 days past due as

compared to our allowance for uncollectible interest. The allowance for uncollectible interest exceeds the amount

of accrued interest on our 90 days past due portfolio for all periods presented.

Accrued Interest Receivable

As of December 31,

(Dollars in millions) Total

Greater Than

90 Days

Past Due

Allowance for

Uncollectible

Interest

2012

Private Education Loans — Traditional .................. $ 798 $39 $45

Private Education Loans — Non-Traditional ............. 106 16 22

Total ............................................. $ 904 $55 $67

2011

Private Education Loans — Traditional .................. $ 870 $36 $44

Private Education Loans — Non-Traditional ............. 148 18 28

Total ............................................. $1,018 $54 $72

2010

Private Education Loans — Traditional .................. $1,062 $35 $57

Private Education Loans — Non-Traditional ............. 209 20 37

Total ............................................. $1,271 $55 $94

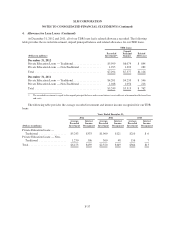

5. Goodwill and Acquired Intangible Assets

Goodwill

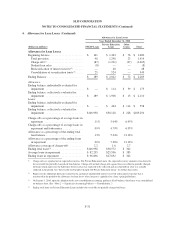

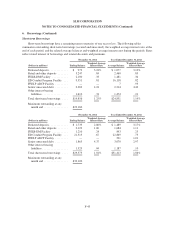

All acquisitions must be assigned to a reporting unit or units. A reporting unit is the same as, or one level

below, a reportable segment. We have four reportable segments: Consumer Lending, Business Services, FFELP

Loans and Other. The following table summarizes our goodwill, accumulated impairments and net goodwill for

our reporting units and reportable segments.

As of December 31, 2012 As of December 31, 2011

(Dollars in millions) Gross

Accumulated

Impairments Net Gross

Accumulated

Impairments Net

Total FFELP Loans reportable segment ............ $194 $ (4) $190 $194 $ (4) $190

Total Consumer Lending reportable segment ........ 147 — 147 147 — 147

Business Services reportable segment:

Servicing .................................. 50 — 50 50 — 50

Contingency Services ......................... 136 (129) 7 136 (129) 7

Wind-down Guarantor Servicing ................ 256 (256) — 256 (256) —

Insurance Services ........................... 9 (9) — 11 — 11

Upromise .................................. 140 (140) — 140 (140) —

Total Business Services reportable segment ......... 591 (534) 57 593 (525) 68

Total ........................................ $932 $(538) $394 $934 $(529) $405

F-39