Sallie Mae 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

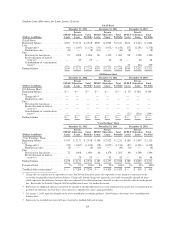

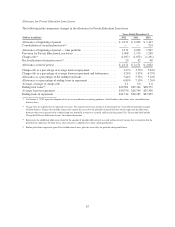

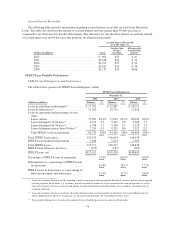

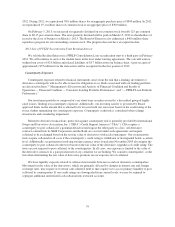

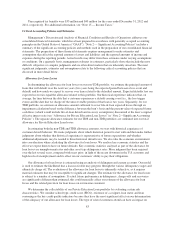

The table below stratifies the portfolio of Private Education Loans in forbearance by the cumulative number

of months the customer has used forbearance as of the dates indicated. As detailed in the table below, there has

been a continuing decline in the average months of forbearance used in our portfolio.

December 31,

2012 2011 2010

(Dollars in millions)

Forbearance

Balance

%of

Total

Forbearance

Balance

%of

Total

Forbearance

Balance

%of

Total

Cumulative number of months

customer has used forbearance:

Up to 12 months .................. $ 883 78% $ 887 64% $ 958 71%

13 to 24 months .................. 186 16 446 32 343 26

More than 24 months .............. 67 6 53 4 39 3

Total ........................... $1,136 100% $1,386 100% $1,340 100%

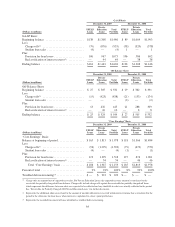

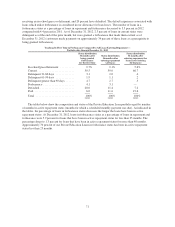

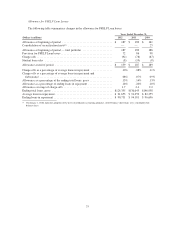

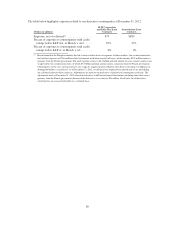

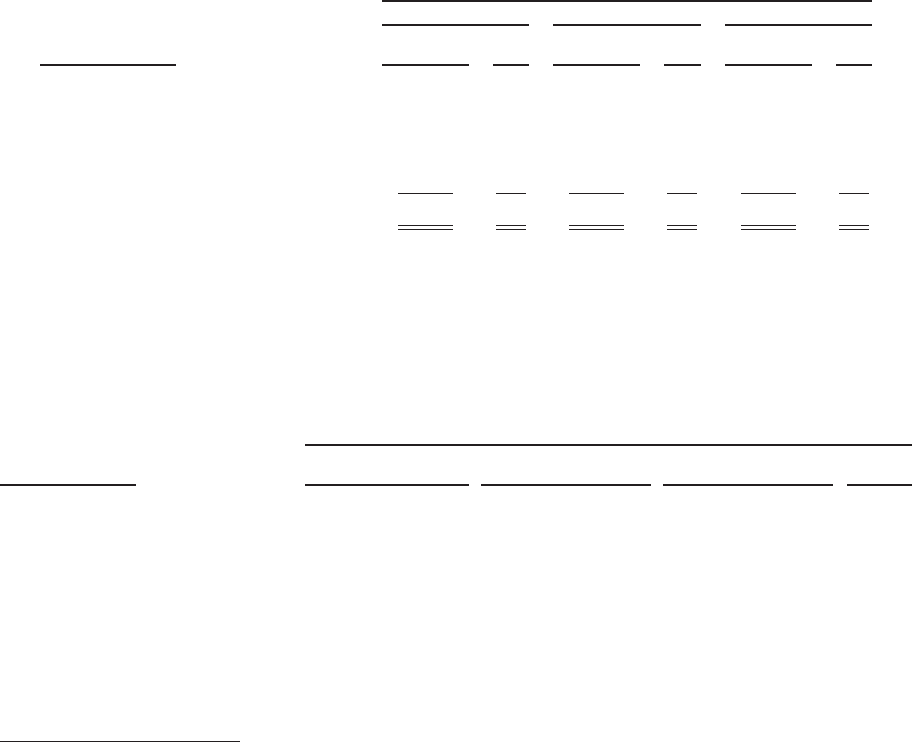

Private Education Loan Repayment Options

Certain loan programs allow customers to select from a variety of repayment options depending on their

loan type and their enrollment/loan status, which include the ability to extend their repayment term or change

their monthly payment. The chart below provides the optional repayment offerings in addition to the standard

level principal and interest payments as of December 31, 2012.

Loan Program

(Dollars in millions)

Signature and

Other Smart Option

Career

Training Total

$ in repayment ................. $24,261 $5,774 $1,479 $31,514

$ in total ...................... $29,522 $7,493 $1,539 $38,554

Payment method by enrollment

status:

In-school/grace ............ Deferred(1) Deferred(1),

interest-only or fixed

$25/month

Interest-only or fixed

$25/month

Repayment ................ Level principal and

interest or graduated

Level principal and

interest

Level principal and

interest

(1) “Deferred” includes loans for which no payments are required and interest charges are capitalized into the loan balance.

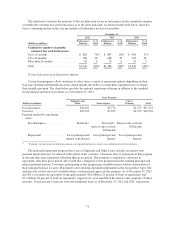

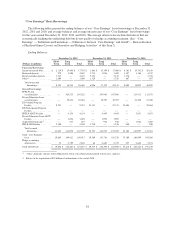

The graduated repayment program that is part of Signature and Other Loans includes an interest-only

payment feature that may be selected at the option of the customer. Customers elect to participate in this program

at the time they enter repayment following their grace period. This program is available to customers in

repayment, after their grace period, who would like a temporary lower payment from the required principal and

interest payment amount. Customers participating in this program pay monthly interest with no amortization of

their principal balance for up to 48 payments after entering repayment (dependent on the loan product type). The

maturity date of the loan is not extended when a customer participates in this program. As of December 31, 2012

and 2011, customers in repayment owing approximately $6.6 billion (21 percent of loans in repayment) and

$7.2 billion (24 percent of loans in repayment), respectively, were enrolled in the interest-only program. Of these

amounts, 10 percent and 11 percent were non-traditional loans as of December 31, 2012 and 2011, respectively.

73