Sallie Mae 2012 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

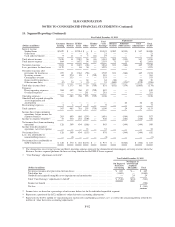

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

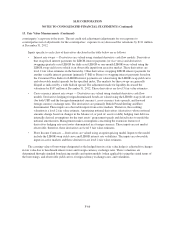

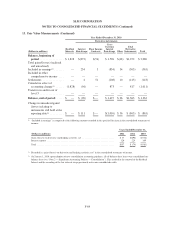

13. Fair Value Measurements (Continued)

prepayment speeds, default rates, recovery rates, cost of funds and capital levels. A number of significant inputs

into the models are internally derived and not observable to market participants nor can the resulting fair values

be validated against market transactions. As such, these are level 3 valuations.

Cash and Investments (Including “Restricted Cash and Investments”)

Cash and cash equivalents are carried at cost. Carrying value approximated fair value. These are level 2

valuations.

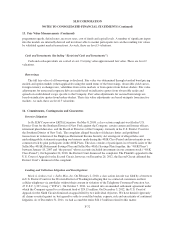

Borrowings

The full fair value of all borrowings is disclosed. Fair value was determined through standard bond pricing

models and option models (when applicable) using the stated terms of the borrowings, observable yield curves,

foreign currency exchange rates, volatilities from active markets or from quotes from broker-dealers. Fair value

adjustments for unsecured corporate debt are made based on indicative quotes from observable trades and

spreads on credit default swaps specific to the Company. Fair value adjustments for secured borrowings are

based on indicative quotes from broker-dealers. These fair value adjustments are based on inputs from inactive

markets. As such, these are level 3 valuations.

14. Commitments, Contingencies and Guarantees

Investor Litigation

In Re SLM Corporation ERISA Litigation. On May 8, 2008, a class action complaint was filed in U.S.

District Court for the Southern District of New York against the Company, certain current and former officers,

retirement plan fiduciaries, and the Board of Directors of the Company, formerly in the U.S. District Court for

the Southern District of New York. The complaint alleged breaches of fiduciary duties and prohibited

transactions in violation of the Employee Retirement Income Security Act arising out of alleged false and

misleading public statements regarding our business made during the 401K Class Period and investments in our

common stock by plan participants in the 401K Plans. The class consists of participants in or beneficiaries of the

Sallie Mae 401(K) Retirement Savings Plan and Sallie Mae 401(k) Savings Plan (together, the “401K Plans”)

between January 18, 2007 and “the present” whose accounts included investments in our common stock (“401K

Class Period”). On September 24, 2010, the District Court dismissed the complaint. The Plaintiffs appealed to the

U.S. Court of Appeals for the Second Circuit, however, on December 26, 2012, the Second Circuit affirmed the

District Court’s dismissal of the complaint.

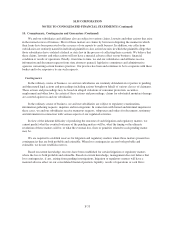

Lending and Collection Litigation and Investigations

Mark A. Arthur et al. v. Sallie Mae, Inc. On February 2, 2010, a class action lawsuit was filed by a borrower

in U.S. District Court for the Western District of Washington alleging that we contacted consumers on their

cellular telephones via autodialer without their consent in violation of the Telephone Consumer Protection Act,

47 U.S.C. § 227 et seq. (“TCPA”). On October 7, 2011, we entered into an amended settlement agreement under

which the Company agreed to a settlement fund of $24.15 million. On December 5, 2012, the U.S. Court of

Appeals for the Ninth Circuit dismissed an appeal filed by two individual objectors. We have denied vigorously

all claims asserted against us, but agreed to settle to avoid the burden, expense, risk and uncertainty of continued

litigation. As of December 31, 2011, we had accrued the entire $24.15 million related to this matter.

F-72