Sallie Mae 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

ÍANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the fiscal year ended December 31, 2012

or

‘TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission file numbers 001-13251

SLM Corporation

(Exact Name of Registrant as Specified in Its Charter)

Delaware 52-2013874

(State of Other Jurisdiction of

Incorporation or Organization)

(I.R.S. Employer

Identification No.)

300 Continental Drive, Newark, Delaware 19713

(Address of Principal Executive Offices) (Zip Code)

(302) 283-8000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act

Common Stock, par value $.20 per share.

Name of Exchange on which Listed:

The NASDAQ Global Select Market

6.97% Cumulative Redeemable Preferred Stock, Series A, par value $.20 per share

Floating Rate Non-Cumulative Preferred Stock, Series B, par value $.20 per share

Name of Exchange on which Listed:

The NASDAQ Global Select Market

Medium Term Notes, Series A, CPI-Linked Notes due 2017

Medium Term Notes, Series A, CPI-Linked Notes due 2018

6% Senior Notes due December 15, 2043

Name of Exchange on which Listed:

The NASDAQ Global Select Market

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes ÍNo ‘

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ‘No Í

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. Yes ÍNo ‘

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such files). Yes ÍNo ‘

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. ‘

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

Large accelerated filer ÍAccelerated filer ‘

Non-accelerated filer ‘Smaller reporting company ‘

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ‘No Í

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2012 was $7.3 billion (based on

closing sale price of $15.71 per share as reported for the NASDAQ Global Select Market).

As of January 31, 2013, there were 453,341,352 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement relating to the registrant’s Annual Meeting of Shareholders scheduled to be held on May 30, 2013 are

incorporated by reference into Part III of this Report.

Table of contents

-

Page 1

...Incorporation or Organization) 52-2013874 (I.R.S. Employer Identification No.) 300 Continental Drive, Newark, Delaware (Address of Principal Executive Offices) 19713 (Zip Code) (302) 283-8000 (Registrant's Telephone Number, Including Area Code) Securities registered pursuant to Section 12(b) of... -

Page 2

... and Related Transactions, and Director Independence ...Principal Accounting Fees and Services ...Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities ...Selected Financial Data ...Management's Discussion and Analysis of Financial Condition and... -

Page 3

... the code of ethics applicable to our chief executive officer, principal financial officer and principal accounting officer) and the governing charters for each committee of our board of directors are available free of charge on our website, as well as in print to any shareholder upon request. We... -

Page 4

...our Private Education Loans have been originated and funded by Sallie Mae Bank, a Utah industrial bank subsidiary (the "Bank"), regulated by the Utah Department of Financial Institutions ("UDFI") and the Federal Deposit Insurance Corporation ("FDIC"). We also provide servicing, loan default aversion... -

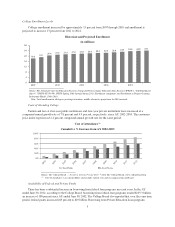

Page 5

... in College Pricing 2012. © 2012 The College Board. www.collegeboard.org (1) Cost of attendance is in current dollars and includes tuition, fees and on-campus room and board. Availability of Federal and Private Funds There has been a substantial increase in borrowing from federal loan programs in... -

Page 6

... our Smart Option Student Loan product to emphasize payments while in school and to shorten repayment terms based on loan amounts and class level; • obtained cosigners on an average of 90 percent of all Private Education Loans originated; and • offered through our rate reduction program... -

Page 7

...In addition, we process tuition refunds on behalf of colleges and universities. Step 2: Pursue federal government loan options. Sallie Mae encourages consumers to explore federal government loan options. Our free online tool, the Education Investment Planner, helps families estimate the full cost of... -

Page 8

...frequent market-leading communications designed to help customers successfully understand, manage, and reduce the costs of Private Education Loans. We use a variety of tools, including letters, emails, videos, text messages, monthly statements and 24/7 secure online account access and information on... -

Page 9

... deposits to fund its assets and periodically sells originated Private Education Loans to affiliates for inclusion in securitization trusts or collection. The Bank is also a key component of our Campus Solutions, Upromise Rewards and college-savings product businesses. Sallie Mae and its affiliates... -

Page 10

... timely address issues raised during any examination could result in limitations on our ability to obtain deposit funding in the Bank. We face competition for Private Education Loans from a group of the nation's larger banks and local credit unions. Business Services Segment FFELP - Related Revenues... -

Page 11

... count, defaulted borrower dollar amount, a survey of borrowers, a survey of schools and a survey of ED personnel (the "ED Scorecard"). Pursuant to the contract terms related to annual volume allocation of new loans, the maximum any servicer could be awarded is 40 percent of net new borrowers in... -

Page 12

... to help campus business offices increase their services to students and families. The product suite includes electronic billing, collection, payment and refund services plus full tuition payment plan administration. In 2012, we generated servicing revenue from over 1,000 campuses. FFELP Loans... -

Page 13

... overseeing several of our businesses will increase in number or change and consumer protection regulations and standards will evolve to become more detailed in scope. We expect this evolution will significantly add to our compliance, marketing, servicing and operating costs. While our current... -

Page 14

... 31, 2013 that it is seeking information on the financial products and services offered to students through colleges and universities, including products marketed through campus affinity relationships, such as financial aid disbursement accounts, student banking, prepaid cards and credit cards. The... -

Page 15

... and, from time to time, our student loan operations are reviewed by ED and Guarantors. As a servicer of federal student loans, we are subject to certain ED regulations regarding financial responsibility and administrative capability that govern all third-party servicers of insured student loans. In... -

Page 16

..., incorporated SLM Corporation as a business corporation in the State of Delaware, and dissolved the GSE. SLM Corporation is now a publicly-traded holding company operating through its various subsidiaries. Our principal executive offices are located at 300 Continental Drive, Newark, Delaware 19713... -

Page 17

... services industry, counterparty availability, changes affecting our assets, corporate and regulatory actions, absolute and comparative interest rate changes, ratings agencies' actions, general economic conditions and the legal, regulatory, accounting and tax environments governing our funding... -

Page 18

...meet cash requirements such as day-to-day operating expenses, extensions of credit on our Private Education Loans, required payments of principal and interest on our borrowings, and distributions to our shareholders. Our primary sources of liquidity and funding are from fees we collect for servicing... -

Page 19

...-related services in connection with our banking and payment services businesses. We also utilize third-party debt collectors significantly in the collection of defaulted Private Education Loans. If a service provider fails to provide the services we require or expect, or fails to meet applicable... -

Page 20

... affect our business strategy or future business prospects. We receive payments from the federal government on our FFELP Loan portfolio and for other services we provide to them, including servicing Direct Loans, default aversion and contingency collections. Funding to pay for these services may be... -

Page 21

... education decreases, if the cost of attendance of higher education decreases, if public resistance to higher education costs increases, or if the demand for higher education loans decreases, our consumer lending business could be negatively affected. In addition, the federal government, through... -

Page 22

... levels of past due loans and forbearances and expected economic conditions. However, management's determination of the appropriate reserve level may under- or over-estimate future losses. If the credit quality of our customer base materially decreases, if a market risk changes significantly, or... -

Page 23

...our business, financial condition and results of operations. Private Education Loans The CFPB's July 2012 Report on this industry provided a number of recommendations including mandatory school certification that loan amounts not exceed student need, reconsideration by Congress of federal Bankruptcy... -

Page 24

... financial company to be supervised by the FRB. Designation of SLM Corporation as a so-called "SIFI" would impose significant additional statutorily-defined monitoring and compliance regimes on our business and could significantly increase the levels of risk-based capital and highly liquid assets... -

Page 25

...Be subject to new liquidity risk management and governance requirements, approval of liquidity risk models, and implementation of liquidity monitoring and compliance regimes; • Employ a chief risk officer to report directly to the chief executive officer and maintain a designated risk committee of... -

Page 26

... impact our business, financial condition and results of operations. Loans serviced under the FFELP are subject to the HEA and related regulations. Our servicing operations are designed and monitored to comply with the HEA, related regulations and program guidance; however, ED could determine... -

Page 27

... that our headquarters, loan servicing centers, data center, back-up facility and data management and collections centers are generally adequate to meet our long-term student loan and business goals. Our headquarters are currently in owned space at 300 Continental Drive, Newark, Delaware, 19713. 25 -

Page 28

... public statements regarding our business made during the 401(K) Class Period and investments in our common stock by plan participants in the 401(K) Plans. The class consists of participants in or beneficiaries of the Sallie Mae 401(K) Retirement Savings Plan and Sallie Mae 401(k) Savings Plan... -

Page 29

... Securities The following table provides information relating to our purchase of shares of our common stock in the three months ended December 31, 2012. Approximate Dollar Value of Shares that Total Number of May Yet Be Shares Purchased Purchased Under Average Price as Part of Publicly Publicly... -

Page 30

... a base investment of $100 at December 31, 2007 and reinvestment of dividends through December 31, 2012. Five Year Cumulative Total Shareholder Return $120 $100 $80 $60 $40 $20 $0 2007 2008 SLM Corporation 2009 2010 S&P 500 Financials 12/31/08 12/31/09 2011 2012 S&P Index Company/Index... -

Page 31

... ...Return on assets ...Dividend payout ratio ...Average equity/average assets ...Balance Sheet Data: Student loans, net ...Total assets ...Total borrowings ...Total SLM Corporation stockholders' equity ...Book value per common share ...Other Data: Off-balance sheet securitized student loans, net... -

Page 32

... business is to originate, service and collect loans we make to students and their families to finance the cost of education. The core of our marketing strategy is to generate student loan originations by promoting our products on campus through the financial aid office and through direct marketing... -

Page 33

..., our corporate credit rating, general economic conditions, investor demand for Private Education Loan asset-backed securities ("ABS") and corporate unsecured debt and competition in the deposit market. At December 31, 2012, 52 percent of our Private Education Loan portfolio was funded to term with... -

Page 34

... of Private Education Loans in repayment decreased from 10.1 percent at December 31, 2011 to 9.3 percent at December 31, 2012. Servicing and Contingency Revenues We earn servicing revenues from servicing student loans, Campus Solutions, and from account asset servicing related to 529 college-savings... -

Page 35

... Segment Assets and Revenues We continued to pursue managed growth in our Private Education Loan portfolio in 2012, exceeding our target with $3.3 billion in new originations for the year compared with $2.7 billion in 2011, a 22 percent increase. The average FICO score of our 2012 originations was... -

Page 36

... seeking to increase the FFELP-related loan servicing and collection work we do for third parties. In 2012 we also targeted significant growth in the total assets under management in our 529 college-savings plans. For the year ended December 31, 2012, our Business Services segment revenue was down... -

Page 37

... our financial strength; and (5) expand the Bank's capabilities. Here is how we plan to achieve these objectives: Prudently Grow Consumer Lending Segment Assets and Revenues We will continue to pursue managed growth in our Private Education Loan portfolio in 2013 by leveraging our Sallie Mae and... -

Page 38

... we ended 2012. We also plan to continue to issue FFELP ABS primarily to refinance our remaining FFELP loans in ED's Conduit Program prior to the Conduit Program's January 19, 2014 maturity date. Expand Bank Capabilities The Bank will fund our Private Education Loan originations in 2013. We will... -

Page 39

...31, 2012 2011 2010 Increase (Decrease) 2012 vs. 2011 2011 vs. 2010 $ % $ % (Dollars in millions, except per share amounts) Interest income FFELP Loans ...$3,251 $3,461 $3,345 $(210) Private Education Loans ...2,481 2,429 2,353 52 Other loans ...16 21 30 (5) Cash and investments ...21 19 26 2 Total... -

Page 40

... credit quality and delinquency trends of the Private Education Loan portfolio. In second-quarter 2012, we increased our focus on encouraging our customers to enter repayment plans in lieu of additional forbearance usage to better help customers manage their overall payment obligations. This change... -

Page 41

... in the consolidated statements of income related to the derivatives used to economically hedge these debt investments. • Operating expenses decreased $108 million primarily as a result of our on-going cost savings initiative. • Goodwill and acquired intangible assets impairment and amortization... -

Page 42

... other financial services companies based upon "Core Earnings." "Core Earnings" results are only meant to supplement GAAP results by providing additional information regarding the operational and performance indicators that are most closely used by management, our board of directors, rating agencies... -

Page 43

... $ 939 (Dollars in millions) Interest income: Student loans ...Other loans ...Cash and investments ...Total interest income ...Total interest expense ...Net interest income (loss) ...Less: provisions for loan losses ...Net interest income (loss) after provisions for loan losses ...Servicing revenue... -

Page 44

...Dollars in millions) Interest income: Student loans ...Other loans ...Cash and investments ...Total interest income ...Total interest expense ...Net interest income ...Less: provisions for loan losses ...Net interest income after provisions for loan losses ...Servicing revenue ...Contingency revenue... -

Page 45

...Dollars in millions) Interest income: Student loans ...Other loans ...Cash and investments ...Total interest income ...Total interest expense ...Net interest income ...Less: provisions for loan losses ...Net interest income after provisions for loan losses ...Servicing revenue ...Contingency revenue... -

Page 46

... for hedge accounting treatment because the pay down of principal of the student loans underlying the Floor Income embedded in those student loans does not exactly match the change in the notional amount of our written Floor Income Contracts. Additionally, the term, the interest rate index, and... -

Page 47

...; see "FFELP Loans Segment - FFELP Loans Net Interest Margin" for further discussion). In addition, we use basis swaps to convert debt indexed to the Consumer Price Index to three-month LIBOR debt. The accounting for derivatives requires that when using basis swaps, the change in the cash flows of... -

Page 48

... accounting requires net settlement income/expense on derivatives and realized gains/losses related to derivative dispositions (collectively referred to as "realized gains (losses) on derivative and hedging activities") that do not qualify as hedges to be recorded in a separate income statement line... -

Page 49

...upon market conditions and pricing, we may enter into additional Floor Income Contracts in the future. The balance of unamortized Floor Income Contracts will increase as we sell new contracts and decline due to the amortization of existing contracts. (Dollars in millions) 2012 December 31, 2011 2010... -

Page 50

... The following table includes "Core Earnings" results for our Consumer Lending segment. (Dollars in millions) Years Ended December 31, 2012 2011 2010 % Increase (Decrease) 2012 vs. 2011 2011 vs. 2010 "Core Earnings" interest income: Private Education Loans ...Cash and investments ...Total "Core... -

Page 51

...periods is primarily due to spread impacts from changes in the average balances of our other interest-earning assets. These assets consist primarily of securitization trust restricted cash and cash held at Sallie Mae Bank (the "Bank"). Our other interest-earning asset portfolio yields a negative net... -

Page 52

... expenses for our Consumer Lending segment include costs incurred to originate Private Education Loans and to service and collect on our Private Education Loan portfolio. For the years ended December 31, 2012, 2011 and 2010, operating expenses for our Consumer Lending segment totaled $265 million... -

Page 53

...2012 2011 2010 % Increase (Decrease) 2012 vs. 2011 2011 vs. 2010 Net interest income after provision ...Servicing revenue: Intercompany loan servicing ...Third-party loan servicing ...Guarantor servicing ...Other servicing ...Total servicing revenue ...Contingency revenue ...Other Business Services... -

Page 54

..., 2012, a 19 percent increase from 2011. Campus Solutions revenue is earned from our Campus Solutions business whose services include comprehensive transaction processing solutions and associated technology that we provide to college financial aid offices and students to streamline the financial aid... -

Page 55

...table includes "Core Earnings" results for our FFELP Loans segment. (Dollars in millions) Years Ended December 31, 2012 2011 2010 % Increase (Decrease) 2012 vs. 2011 2011 vs. 2010 "Core Earnings" interest income: FFELP Loans ...Cash and investments ...Total "Core Earnings" interest income . . Total... -

Page 56

...than the funding costs of the debt that has matured or has been repurchased during that same period. In addition, there were increased spread impacts from increases in the average balance of our other interest-earning assets. These assets are primarily securitization trust restricted cash. Our other... -

Page 57

... 31, 2012 Fixed Variable Borrower Borrower Rate Rate Total December 31, 2011 Fixed Variable Borrower Borrower Rate Rate Total (Dollars in billions) Student loans eligible to earn Floor Income ...Less: post-March 31, 2006 disbursed loans required to rebate Floor Income ...Less: economically hedged... -

Page 58

...Ended December 31, (Dollars in millions) 2012 2011 2010 Servicing revenue ...Gains on loans and investments, net ...Other ...Total other income, net ... $ 90 - - $ 90 $ 85 - 1 $ 86 $ 68 325 (5) $388 Servicing revenue for our FFELP Loans segment primarily consists of customer late fees. The gains... -

Page 59

..., stock-based compensation expense and certain information technology costs related to infrastructure and operations. The following table includes "Core Earnings" results for our Other segment. Years Ended December 31, 2012 2011 2010 % Increase (Decrease) 2012 vs. 2011 2011 vs. 2010 (Dollars in... -

Page 60

... Corporate overhead is comprised of costs related to executive management, the board of directors, accounting, finance, legal, human resources and stock-based compensation expense. Unallocated information technology costs are related to infrastructure and operations. 2012 versus 2011 The decrease... -

Page 61

... 2012 Balance Rate Years Ended December 31, 2011 2010 Balance Rate Balance (Dollars in millions) Rate Average Assets FFELP Loans ...Private Education Loans ...Other loans ...Cash and investments ...Total interest-earning assets ...Non-interest-earning assets ...Total assets ...Average Liabilities... -

Page 62

... customers still attending school and are not yet required to make payments on the loan. Includes loans in deferment or forbearance. December 31, 2010 FFELP Total Private Consolidation FFELP Education Loans Loans Loans (Dollars in millions) FFELP Stafford and Other Total Portfolio Total student... -

Page 63

Average Student Loan Balances (net of unamortized premium/discount) FFELP Stafford and Other Year Ended December 31, 2012 FFELP Total Private Consolidation FFELP Education Loans Loans Loans (Dollars in millions) Total Portfolio Total ...% of FFELP ...% of total ... $47,629 36% 28% FFELP Stafford ... -

Page 64

...Stafford and Other Year Ended December 31, 2012 FFELP Total Private Consolidation FFELP Education Loans Loans Loans (Dollars in millions) Total Portfolio Beginning balance ...Acquisitions and originations ...Capitalized interest and premium/discount amortization ...Consolidations to third parties... -

Page 65

...2012 December 31, 2011 December 31, 2010 Private Private Private FFELP Education Total FFELP Education Total FFELP Education Total Loans Loans Portfolio Loans Loans Portfolio Loans Loans Portfolio (Dollars in millions) GAAP Basis: Beginning balance ...$187 Less: Charge-offs(1) ...(92) Student loan... -

Page 66

...$ 532 (Dollars in millions) "Core Earnings" Basis December 31, 2009 December 31, 2008 Private Private FFELP Education Total FFELP Education Total Loans Loans Portfolio Loans Loans Portfolio "Core Earnings" Basis: Balance at beginning of period ...Less: Charge-offs(1) ...Student loan sales ...Plus... -

Page 67

... pay(1) ...Smart Option - deferred(1) ...Other ...Total Private Education Loan originations ...(1) $ 941 1,005 1,319 80 $3,345 $ 881 1,118 579 159 $2,737 $1,315 594 - 398 $2,307 Interest only, fixed pay and deferred describe the payment option while in school or in grace period. See "Consumer... -

Page 68

...making full payments due to hardship or other factors, consistent with established loan program servicing policies and procedures. The period of delinquency is based on the number of days scheduled payments are contractually past due. Based on number of months in an active repayment status for which... -

Page 69

... Loan Losses The following table summarizes changes in the allowance for Private Education Loan losses. (Dollars in millions) Years Ended December 31, 2012 2011 2010 Allowance at beginning of period ...Consolidation of securitization trusts(1) ...Allowance at beginning of period - total portfolio... -

Page 70

...Loans with a cosigner ...68% 30% 65% 65% 29% 62% 63% 28% 59% Average FICO at origination ...728 624 720 726 624 717 725 623 715 (1) (2) Ending total loans represent gross Private Education Loans, plus the receivable for partially charged-off loans. Includes loans that are required to make a payment... -

Page 71

... of total loans and of loans in repayment; and delinquency and forbearance percentages. Receivable for Partially Charged-Off Private Education Loans At the end of each month, for loans that are 212 days past due, we charge off the estimated loss of a defaulted loan balance. Actual recoveries... -

Page 72

... additional time to obtain employment and income to support their obligations, or to current customers who are faced with a hardship and request forbearance time to provide temporary payment relief. In these circumstances, a customer's loan is placed into a forbearance status in limited monthly... -

Page 73

... Education Loan portfolio aged by number of months in active repayment status (months for which a scheduled monthly payment was due). As indicated in the tables, the percentage of loans in forbearance status decreases the longer the loans have been in active repayment status. At December 31, 2012... -

Page 74

... 90 days ...Total ...Unamortized discount ...Receivable for partially charged-off loans ...Allowance for loan losses ...Total Private Education Loans, net ...Loans in forbearance as a percentage of loans in repayment and forbearance ...(Dollars in millions) December 31, 2011 Loans in-school/grace... -

Page 75

... repayment offerings in addition to the standard level principal and interest payments as of December 31, 2012. Loan Program (Dollars in millions) Signature and Other Smart Option Career Training Total $ in repayment ...$ in total ...Payment method by enrollment status: In-school/grace ... $24,261... -

Page 76

... yet required to make payments on the loans, e.g., residency periods for medical students or a grace period for bar exam preparation, as well as loans for customers who have requested and qualify for other permitted program deferments such as military, unemployment, or economic hardship. Loans for... -

Page 77

..., 2012 2011 2010 Allowance at beginning of period ...Consolidation of securitization trusts(1) ...Allowance at beginning of period - total portfolio ...Provision for FFELP Loan losses ...Charge-offs ...Student loan sales ...Allowance at end of period ...Charge-offs as a percentage of average loans... -

Page 78

... to meet our funding needs for our businesses throughout market cycles, including during periods of financial stress and to avoid any mismatch between the maturity of assets and liabilities, our ongoing ability to fund originations of Private Education Loans and servicing our indebtedness and bank... -

Page 79

... principal amount of those loans. In addition, we will also no longer collect future servicing revenues or interest income on any loans put to ED. Sources of Liquidity and Available Capacity Ending Balances (Dollars in millions) December 31, 2012 2011 Sources of primary liquidity: Unrestricted cash... -

Page 80

... of unsecured debt, see "Note 6 - Borrowings." The following table reconciles encumbered and unencumbered assets and their net impact on total tangible equity. (Dollars in billions) December 31, 2012 2011 Net assets of consolidated variable interest entities (encumbered assets) - FFELP Loans ...Net... -

Page 81

... of Operations - Financial Condition - Consumer Lending Portfolio Performance" and "- FFELP Loan Portfolio Performance." Our investment portfolio is composed of very short-term securities issued by a diversified group of highly rated issuers, limiting our counterparty exposure. Additionally, our... -

Page 82

The table below highlights exposure related to our derivative counterparties at December 31, 2012. SLM Corporation and Sallie Mae Bank Contracts Securitization Trust Contracts (Dollars in millions) Exposure, net of collateral(1) ...Percent of exposure to counterparties with credit ratings below ... -

Page 83

...887 26,907 (Dollars in millions) Unsecured borrowings: Senior unsecured debt ...$ Brokered deposits ...Retail and other deposits ...Other(1) ...Total unsecured borrowings ...Secured borrowings: FFELP Loan securitizations ...Private Education Loan securitizations ...ED Conduit Program Facility ...ED... -

Page 84

... Rate 2010 Average Average Balance Rate (Dollars in millions) Unsecured borrowings: Senior unsecured debt ...$ Brokered deposits ...Retail and other deposits ...Other(1) ...Total unsecured borrowings ...Secured borrowings: FFELP Loan securitizations ...Private Education Loan securitizations . . ED... -

Page 85

... ended December 31, 2012 and 2011, respectively. For additional information, see "Note 15 - Income Taxes." Critical Accounting Policies and Estimates Management's Discussion and Analysis of Financial Condition and Results of Operations addresses our consolidated financial statements, which have been... -

Page 86

... to the rules governing FFELP payment requirements, our collection policies allow for periods of nonpayment for customers requesting additional payment grace periods upon leaving school or experiencing temporary difficulty meeting payment obligations. This is referred to as forbearance status and is... -

Page 87

...customer default behavior and a two year loss confirmation period to estimate the credit losses incurred in the loan portfolio at the reporting date. We apply the default rate projections, net of applicable Risk Sharing, to each category for the current period to perform our quantitative calculation... -

Page 88

...portfolio yield, net present value and average life. The significant assumptions used to project cash flows are prepayment speeds, default rates, cost of funds, the amount funded by debt versus equity, and required return on equity. In addition, the Floor Income component of our FFELP Loan portfolio... -

Page 89

... as assumptions regarding what we believe a third party would be willing to pay for all of the assets and liabilities of the business unit. This calculation requires us to estimate the appropriate discount and growth rates to apply to those projected cash flows and the appropriate control premium to... -

Page 90

...2013 and beyond and to further evolve as our Bank achieves "large bank" status under the Dodd-Frank Act. The steps taken in 2012 included: • The addition of a new, extended meeting of our Board focused exclusively on Sallie Mae's strategic direction and priorities. This meeting will occur annually... -

Page 91

...in accordance with our annual business plan. Internal Risk Oversight Committees. We have a number of standing management committees dedicated to oversight of various risks relating to our business. In 2012, we formed the Corporate Incentive Compensation Plan Committee and in 2013 we will initiate an... -

Page 92

... our incentive compensation plans. We expect the committee will also work in tandem with our newly formed Enterprise Risk Committee over the course of the year. Committee membership includes our Executive Vice President - Administration, Chief Compliance Officer, Chief Credit Officer, Deputy General... -

Page 93

... to meet our funding needs for our businesses throughout market cycles, including during periods of financial stress and to avoid any mismatch between the maturity of assets and liabilities, our ongoing ability to fund originations of Private Education Loans and servicing our indebtedness and bank... -

Page 94

... private education lending, collections or loan servicing businesses if compliance with legal and regulatory requirements is not properly implemented, documented or tested, as well as when an oversight program does not include appropriate audit and control features. The Audit Committee of our Board... -

Page 95

...with the risk management oversight activities conducted in the various aspects of our business on matters as diverse as the launch of new products and services, our credit underwriting activities and how we fund our operations. Our public relations, marketing and media teams constantly monitor print... -

Page 96

Common Stock The following table summarizes our common share repurchases and issuances. Years Ended December 31, 2012 2011 2010 Common stock repurchased(1) ...Average purchase price per share(2) ...Shares repurchased related to employee stock-based compensation plans(3) ...Average purchase price per... -

Page 97

... of balance sheet assets and liabilities at December 31, 2012 and 2011, based upon a sensitivity analysis performed by management assuming a hypothetical increase in market interest rates of 100 basis points and 300 basis points while funding spreads remain constant. Additionally, as it relates to... -

Page 98

(Dollars in millions) Fair Value At December 31, 2011 Interest Rates: Change from Change from Increase of Increase of 100 Basis 300 Basis Points Points $ % $ % Effect on Fair Values Assets FFELP Loans ...Private Education Loans ...Other earning assets ...Other assets ...Total assets gain/(loss) ... -

Page 99

... (losses) on derivatives and hedging activities, net" line on the consolidated statements of income). The difference between the asset and the funding is the funding gap for the specified index. This represents our exposure to interest rate risk in the form of basis risk and repricing risk, which... -

Page 100

... result in our cost of funds not moving in the same direction or with the same magnitude as the yield on our assets. While we believe this risk is low, as all of these indices are short-term with rate movements that are highly correlated over a long period of time, market disruptions (which have... -

Page 101

..., processed, summarized and reported within the time periods specified in the SEC's rules and forms and (b) accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer as appropriate, to allow timely decisions regarding required disclosure... -

Page 102

... controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. No change in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934, as... -

Page 103

...Management and Related Stockholder Matters The information contained in the 2013 Proxy Statement, including information appearing under "Equity Compensation Plan Information," "Ownership of Common Stock" and "Ownership of Common Stock by Directors and Executive Officers" in the 2013 Proxy Statement... -

Page 104

... 31, 2012, 2011 and 2010 ...Consolidated Statements of Cash Flows for the years ended December 31, 2012, 2011 and 2010 ...Notes to Consolidated Financial Statements ...2. Financial Statement Schedules All schedules are omitted because they are not applicable or the required information is shown... -

Page 105

... between HICA Education Loan Corporation and the Federal Home Loan Bank of Des Moines, dated January 15, 2010 (incorporated by reference to Exhibit 10.39 of the Company's Annual Report on Form 10-K filed on February 26, 2010). Asset Purchase Agreement between The Student Loan Corporation; Citibank... -

Page 106

... of the Company's Annual Report on Form 10-K filed on February 27, 2012). SLM Corporation Deferred Compensation Plan for Directors (incorporated by reference to Exhibit 10.30 of the Company's Annual Report on Form 10-K filed on February 27, 2012). Sallie Mae Supplemental Cash Account Retirement Plan... -

Page 107

...-2012 Incentive Plan Stock Option Agreement, Net Settled, Time Vested Options - 2011 (incorporated by reference to Exhibit 10.50 of the Company's Annual Report on Form 10-K filed on February 28, 2011). Form of SLM Corporation 2009-2012 Incentive Plan Restricted Stock and Restricted Stock Unit Term... -

Page 108

...of the Company's Quarterly Report on Form 10-Q filed on May 4, 2012). SLM Corporation 2012 Omnibus Incentive Plan (incorporated by reference to Appendix A of the Company's Definitive Proxy Statement for the 2012 Annual Meeting of Shareholders filed on April 13, 2012). Amended and Restated Sallie Mae... -

Page 109

... and Chief Executive Officer (Principal Executive Officer) Executive Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) Chairman of the Board of Directors Director Director Director Director Director Director Director Director Director February 26, 2013 February... -

Page 110

Signature Title Date /S/ WOLFGANG SCHOELLKOPF Wolfgang Schoellkopf /S/ STEVEN L. SHAPIRO Steven L. Shapiro /S/ J. TERRY STRANGE J. Terry Strange /S/ BARRY L. WILLIAMS Barry L. Williams Director Director Director Director February 26, 2013 February 26, 2013 February 26, 2013 February 26, 2013 ... -

Page 111

... Public Accounting Firm ...Consolidated Balance Sheets ...Consolidated Statements of Income ...Consolidated Statements of Comprehensive Income ...Consolidated Statements of Changes in Stockholders' Equity ...Consolidated Statements of Cash Flows ...Notes to Consolidated Financial Statements... -

Page 112

... Accounting Oversight Board (United States), the consolidated balance sheet of the Company as of December 31, 2012, and the related consolidated statements of income, comprehensive income, changes in stockholders' equity and cash flows for the year then ended, and our report dated February 26, 2013... -

Page 113

... SLM Corporation and subsidiaries as of December 31, 2012, and the related consolidated statements of income, comprehensive income, changes in stockholders' equity, and cash flows for the year then ended. These consolidated financial statements are the responsibility of the Company's management. Our... -

Page 114

... ACCOUNTING FIRM To the Board of Directors and Stockholders of SLM Corporation: In our opinion, the consolidated balance sheet as of December 31, 2011 and the related consolidated statements of income, comprehensive income, stockholders' equity and cash flows for each of two years in the period... -

Page 115

... Supplemental information - assets and liabilities of consolidated variable interest entities: December 31, 2012 FFELP Loans ...Private Education Loans ...Restricted cash and investments ...Other assets ...Short-term borrowings ...Long-term borrowings ...Net assets of consolidated variable interest... -

Page 116

SLM CORPORATION CONSOLIDATED STATEMENTS OF INCOME (In millions, except per share amounts) Years Ended December 31, 2012 2011 2010 Interest income: FFELP Loans ...Private Education Loans ...Other loans ...Cash and investments ...Total interest income ...Total interest expense ...Net interest income ... -

Page 117

... STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years Ended December 31, 2012 2011 2010 Net income ...Other comprehensive income (loss): Unrealized losses on derivatives: Unrealized hedging losses on derivatives ...Reclassification adjustments for derivative losses included in net income ...Total... -

Page 118

...benefit related to employee stock-based compensation plans ...Stock-based compensation expense ...Cumulative effect of accounting change ...Shares repurchased related to employee stock-based compensation plans ... Balance at December 31, 2010 ... F-8 See accompanying notes to consolidated financial... -

Page 119

...stock-based compensation plans ...Stock-based compensation expense ...Common stock repurchased ...Shares repurchased related to employee stock-based compensation plans ...Acquisition of noncontrolling interest ... F-9 Balance at December 31, 2011 ... See accompanying notes to consolidated financial... -

Page 120

... benefit related to employee stock-based compensation plans ...Stock-based compensation expense ...Common stock repurchased ...Shares repurchased related to employee stock-based compensation plans ... Balance at December 31, 2012 ... F-10 See accompanying notes to consolidated financial statements. -

Page 121

... intangible assets impairment and amortization expense ...Stock-based compensation expense ...Unrealized (gains) losses on derivative and hedging activities ...Provisions for loan losses ...Student loans originated for sale, net ...Decrease (increase) in restricted cash - other ...Decrease (increase... -

Page 122

...our Private Education Loans have been originated and funded by Sallie Mae Bank, a Utah industrial bank subsidiary (the "Bank"), regulated by the Utah Department of Financial Institutions ("UDFI") and the Federal Deposit Insurance Corporation ("FDIC"). We also provide servicing, loan default aversion... -

Page 123

...of changes in stockholders' equity; In the consolidated balance sheet for instruments carried at lower of cost or fair value with impairment charges recorded in the consolidated statement of income; and In the notes to the financial statements. Fair value is defined as the price to sell an asset or... -

Page 124

... consider the utilization of deferment, forbearance and extended repayment plans which lengthen the life-of-loan. For Repayment Borrower Benefits, the estimates of their effect on student loan yield are based on analyses of historical payment behavior of customers who are eligible for the incentives... -

Page 125

... impairment calculation based on the difference between the loan's basis and the present value of expected future cash flows (which would include life-of-loan default and recovery assumptions) discounted at the loan's original effective interest rate (see "Allowance for Private Education Loan Losses... -

Page 126

... to the rules governing FFELP payment requirements, our collection policies allow for periods of nonpayment for customers requesting additional payment grace periods upon leaving school or experiencing temporary difficulty meeting payment obligations. This is referred to as forbearance status and is... -

Page 127

... for these programs are generally low while the customer is in school. At December 31, 2012, 15 percent of the principal balance in the higher education Private Education Loan portfolio was related to customers who are in an in-school/grace/deferment status and not required to make payments. As this... -

Page 128

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2. Significant Accounting Policies (Continued) Cash and Cash Equivalents Cash and cash equivalents includes term federal funds, Eurodollar deposits, commercial paper, asset-backed commercial paper, treasuries, money market funds ... -

Page 129

... compensation received. We periodically repurchase our outstanding debt in the open market or through public tender offers. We record a gain or loss on the early extinguishment of debt based upon the difference between the carrying cost of the debt and the amount paid to the third party and is net... -

Page 130

... buy certain delinquent loans from certain Private Education Loan securitization trusts. The option to exercise the clean-up call and purchase the student loans from the trust when the asset balance is 10 percent or less of the original loan balance. The option (in certain trusts) to call rate reset... -

Page 131

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2. Significant Accounting Policies (Continued) We do not record servicing assets or servicing liabilities when our securitization trusts are accounted for as on-balance sheet secured financings. As of December 31, 2012 and 2011, all of... -

Page 132

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2. Significant Accounting Policies (Continued) Servicing Revenue Servicing revenue includes third-party loan servicing, account asset servicing, Campus Solutions revenue and Guarantor servicing revenue. We perform loan servicing ... -

Page 133

... but are not limited to tradenames, customer and other relationships, and non-compete agreements. Acquired intangible assets with finite lives are amortized over their estimated useful lives in proportion to their estimated economic benefit. Finite-lived acquired intangible assets are reviewed for... -

Page 134

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 2. Significant Accounting Policies (Continued) Severance Plan. The benefits payable under the Severance Plan relate to past service and they accumulate and vest. Accordingly, we recognize severance costs to be paid pursuant to ... -

Page 135

... debt with a primary emphasis on charged-off credit card receivables, and sub-performing and non-performing mortgage loans (Purchased Paper businesses). At December 31, 2012, we have sold all of these businesses. Statement of Cash Flows Included in our financial statements is the consolidated... -

Page 136

... Education Loans. The Private Education Loans we make are largely to bridge the gap between the cost of higher education and the amount funded through financial aid, federal loans or customers' resources. Private Education Loans bear the full credit risk of the customer. We manage this additional... -

Page 137

... Programs. Certain Collection Tools - Private Education Loans Forbearance involves granting the customer a temporary cessation of payments (or temporary acceptance of smaller than scheduled payments) for a specified period of time. Using forbearance extends the original term of the loan. Forbearance... -

Page 138

... customer is returned to a current repayment status. In more limited instances, delinquent customers will also be granted additional forbearance time. During 2009, we instituted an interest rate reduction program to assist customers in repaying their Private Education Loans through reduced payments... -

Page 139

... the additional allowance related to the amount of uncollectible interest reserved within interest income that is transferred in the period to the allowance for loan losses when interest is capitalized to a loan's principal balance. Ending total loans for Private Education Loans includes the... -

Page 140

... FINANCIAL STATEMENTS (Continued) 4. Allowance for Loan Losses (Continued) Allowance for Loan Losses Year Ended December 31, 2011 Private Education Other FFELP Loans Loans Loans (Dollars in millions) Total Allowance for Loan Losses Beginning balance ...Total provision ...Charge-offs(1) ...Student... -

Page 141

... Charged-Off Private Education Loans" for further discussion. Represents the additional allowance related to the amount of uncollectible interest reserved within interest income that is transferred in the period to the allowance for loan losses when interest is capitalized to a loan's principal... -

Page 142

... charged-off loans) of our Private Education Loan portfolio stratified by the key credit quality indicators. Private Education Loans Credit Quality Indicators December 31, 2012 December 31, 2011 Balance(3) % of Balance Balance(3) % of Balance (Dollars in millions) Credit Quality Indicators School... -

Page 143

...CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 4. Allowance for Loan Losses (Continued) The following tables provide information regarding the loan status and aging of past due loans. FFELP Loan Delinquencies December 31, 2011 2010 % Balance % Balance (Dollars in millions) 2012... -

Page 144

... during employment transition or who have temporarily ceased making full payments due to hardship or other factors, consistent with established loan program servicing policies and procedures. The period of delinquency is based on the number of days scheduled payments are contractually past due... -

Page 145

... loan program servicing policies and procedures. The period of delinquency is based on the number of days scheduled payments are contractually past due. (2) (3) Receivable for Partially Charged-Off Private Education Loans At the end of each month, for loans that are 212 days past due, we charge... -

Page 146

... than three months, an interest rate reduction or an extended repayment plan are classified as TDRs. Forbearance provides customers the ability to defer payments for a period of time, but does not result in the forgiveness of any principal or interest. While in forbearance status, interest continues... -

Page 147

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 4. Allowance for Loan Losses (Continued) At December 31, 2012 and 2011, all of our TDR loans had a related allowance recorded. The following table provides the recorded investment, unpaid principal balance and related allowance ... -

Page 148

... qualify for deferment, that need additional time to obtain employment or who have temporarily ceased making full payments due to hardship or other factors. The period of delinquency is based on the number of days scheduled payments are contractually past due. (2) (3) The following table provides... -

Page 149

... days past due portfolio for all periods presented. Accrued Interest Receivable As of December 31, Greater Than Allowance for 90 Days Uncollectible Total Past Due Interest (Dollars in millions) 2012 Private Education Loans - Traditional ...Private Education Loans - Non-Traditional ...Total ...2011... -

Page 150

...Contingency Services and Insurance Services reporting units in the Step 1 impairment analysis was determined using the income approach. The income approach measures the value of each reporting unit's future economic benefit determined by its discounted cash flows derived from our projections plus an... -

Page 151

... if our stock price declines to a depressed level resulting in deterioration in our total market capitalization, the fair value of the FFELP Loans, Servicing, Private Education Loans and Contingency Services reporting units could be significantly reduced, and we may be required to record a charge to... -

Page 152

...31, 2012 Long Term Total Short Term December 31, 2011 Long Term Total (Dollars in millions) Unsecured borrowings: Senior unsecured debt ...Brokered deposits ...Retail and other deposits ...Other(1) ...Total unsecured borrowings ...Secured borrowings: FFELP Loan securitizations ...Private Education... -

Page 153

... tables summarize outstanding short-term borrowings (secured and unsecured), the weighted average interest rates at the end of each period, and the related average balances and weighted average interest rates during the periods. Rates reflect stated interest of borrowings and related discounts... -

Page 154

... TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 6. Borrowings (Continued) Long-term Borrowings The following tables summarize outstanding long-term borrowings (secured and unsecured), the weighted average interest rates at the end of the periods, and the related average balances during the periods... -

Page 155

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 6. Borrowings (Continued) At December 31, 2012, we had outstanding long-term borrowings with call features totaling $3.6 billion. In addition, we have $5.9 billion of pre-payable debt related to our ABCP and acquisition financing... -

Page 156

... of Assets Securing Debt Outstanding Loans Cash Other Assets Total (Dollars in millions) Short Term Debt Outstanding Long Term Total Secured Borrowings - VIEs: ED Conduit Program Facility ...$ 9,551 $ - $ 9,551 $ 9,645 $ 410 FFELP ABCP Facility ...- 4,154 4,154 4,405 77 Private Education Loan... -

Page 157

... those relating to borrower benefits. The ED Conduit Program was launched on May 11, 2009 and accepted eligible loans through July 1, 2010. The ED Conduit Program expires on January 19, 2014. Funding for the ED Conduit Program is provided by the capital markets at a cost based on market rates, with... -

Page 158

... 2012 was $4.5 billion. Private Education Loan ABCP Facility On October 5, 2011, we closed on a $3.4 billion asset-backed commercial paper facility, which matures in January 2014, to fund the call of certain Private Education Loan trust securities issued under the TALF program. The cost of borrowing... -

Page 159

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 6. Borrowings (Continued) Securitizations The following table summarizes the securitization transactions issued in 2011 and 2012. (Dollars in millions) Total Issued AAA-rated bonds Weighted Average Interest Rate Weighted Average ... -

Page 160

...the performance and payment of HICA's obligations. Other Funding Sources Sallie Mae Bank During the fourth quarter of 2008, the Bank, our Utah industrial bank subsidiary, began expanding its deposit base to fund new Private Education Loan originations. The Bank raises deposits through intermediaries... -

Page 161

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 6. Borrowings (Continued) the brokered Certificate of Deposit ("CD") market and through direct retail deposit channels. As of December 31, 2012, bank deposits totaled $7.8 billion of which $4.1 billion were brokered term deposits... -

Page 162

...-currency swaps with highly-rated counterparties. In addition, the trusts have entered into $14.2 billion of interest rates swaps which are primarily used to convert Prime received on securitized student loans to LIBOR paid on the bonds. At December 31, 2012, the net positive exposure on swaps... -

Page 163

... of the swaps are determined based on a review of our asset/liability structure, our assessment of future interest rate relationships, and on other factors such as short-term strategic initiatives. Hedge accounting requires that when using basis swaps, the change in the cash flows of the hedge... -

Page 164

... bifurcated from securitization debt as well as derivatives related to our Total Return Swap Facility. The following table reconciles gross positions with the impact of master netting agreements to the balance sheet classification: Other Assets December 31, December 31, 2012 2011 $ 2,785 (544) 2,241... -

Page 165

.... These adjustments decreased the overall net asset positions at December 31, 2012 and 2011 by $107 million and $111 million, respectively. Cash Flow Dec. 31, Dec. 31, 2012 2011 Fair Value Dec. 31, Dec. 31, 2012 2011 Trading Dec. 31, Dec. 31, 2012 2011 Total Dec. 31, Dec. 31, 2012 2011 (Dollars in... -

Page 166

... 31, 2012 December 31, 2011 Collateral held: Cash (obligation to return cash collateral is recorded in short-term borrowings)(1) ...Securities at fair value - on-balance sheet securitization derivatives (not recorded in financial statements)(2) ...Total collateral held ...Derivative asset at fair... -

Page 167

... trusts' credit ratings. 8. Other Assets The following table provides the detail of our other assets. December 31, 2012 Ending % of Balance Balance December 31, 2011 Ending % of Balance Balance (Dollars in millions) Derivatives at fair value ...Accrued interest receivable, net ...Income tax asset... -

Page 168

... This retirement decreased the balance in treasury stock by $1.9 billion, with corresponding decreases of $14 million in common stock and $1.9 billion in additional paid-in capital. There was no impact to total equity from this transaction. Dividend and Share Repurchase Program In 2012, we increased... -

Page 169

...Net income attributable to SLM Corporation common stock ...Denominator: Weighted average shares used to compute basic EPS ...Effect of dilutive securities: Dilutive effect of stock options, non-vested deferred compensation and restricted stock, restricted stock units and Employee Stock Purchase Plan... -

Page 170

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 11. Stock-Based Compensation Plans and Arrangements (Continued) The total stock-based compensation cost recognized in the consolidated statements of income for the years ended December 31, 2012, 2011 and 2010 was $47 million, $56... -

Page 171

... TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 11. Stock-Based Compensation Plans and Arrangements (Continued) The following table summarizes stock option activity for the year ended December 31, 2012. Weighted Average Exercise Price per Share Weighted Average Remaining Contractual Term (Dollars... -

Page 172

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 11. Stock-Based Compensation Plans and Arrangements (Continued) The following table summarizes restricted stock activity for the year ended December 31, 2012. Weighted Average Grant Date Fair Value Number of Shares Non-vested ... -

Page 173

... yield is based on the projected annual dividend payment per share based on the current dividend amount at the grant date divided by the stock price at the grant date. The fair values were amortized to compensation cost on a straight-line basis over a one-year vesting period. As of December 31, 2012... -

Page 174

... by modeling loan cash flows using stated terms of the assets and internally-developed assumptions to determine aggregate portfolio yield, net present value and average life. The significant assumptions used to determine fair value are prepayment speeds, default rates, cost of funds, required return... -

Page 175

... bond pricing models and option models (when applicable) using the stated terms of the borrowings, observable yield curves, foreign currency exchange rates, volatilities from active markets or from quotes from broker-dealers. Fair value adjustments for unsecured corporate debt are made based on... -

Page 176

... estimate. Amortizing notional derivatives (derivatives whose notional amounts change based on changes in the balance of, or pool of, assets or debt) hedging trust debt use internally derived assumptions for the trust assets' prepayment speeds and default rates to model the notional amortization... -

Page 177

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 13. Fair Value Measurements (Continued) The following table summarizes the valuation of our financial instruments that are marked-to-market on a recurring basis. Fair Value Measurements on a Recurring Basis December 31, 2012 ... -

Page 178

... CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 13. Fair Value Measurements (Continued) The following tables summarize the change in balance sheet carrying value associated with level 3 financial instruments carried at fair value on a recurring basis. Year Ended December 31, 2012... -

Page 179

... the following amounts recorded in the specified line item in the consolidated statements of income: Years Ended December 31, (Dollars in millions) Gains (losses) on derivative and hedging activities, net ...Interest expense ...Total ...2012 $ 37 120 $157 2011 $(298) 224 $ (74) 2010 $(732) 169 $(563... -

Page 180

.... (Dollars in millions) Fair Value at December 31, 2012 Valuation Technique Input Range (Weighted Average) Derivatives Consumer Price Index/LIBOR basis swaps ...Prime/LIBOR basis swaps ... $ 92 (165) Discounted cash flow Bid/ask adjustment to discount rate 0.02% - 0.04% (0.05%) Discounted cash... -

Page 181

... assets FFELP Loans ...Private Education Loans ...Cash and investments(1) ...Total earning assets ...Interest-bearing liabilities Short-term borrowings ...Long-term borrowings ...Total interest-bearing liabilities ...Derivative financial instruments Floor Income Contracts ...Interest rate swaps... -

Page 182

... bond pricing models and option models (when applicable) using the stated terms of the borrowings, observable yield curves, foreign currency exchange rates, volatilities from active markets or from quotes from broker-dealers. Fair value adjustments for unsecured corporate debt are made based on... -

Page 183

... of collecting their accounts. We believe that these claims, lawsuits and other actions will not have a material adverse effect on our business, financial condition or results of operations. Finally, from time to time, we and our subsidiaries and affiliates receive information and document requests... -

Page 184

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 15. Income Taxes Reconciliations of the statutory U.S. federal income tax rates to our effective tax rate for continuing operations follow: Years Ended December 31, 2012 2011 2010 Statutory rate ...State tax, net of federal ... -

Page 185

... to deferred tax assets and liabilities include the following: (Dollars in millions) December 31, 2012 2011 Deferred tax assets: Loan reserves ...Market value adjustments on student loans, investments and derivatives ...Stock-based compensation plans ...Deferred revenue ...Operating loss and credit... -

Page 186

... and service Private Education Loans. The Private Education Loans we make are primarily to bridge the gap between the cost of higher education and the amount funded through financial aid, federal loans or customers' resources. We will continue to offer loan products to parents and graduate students... -

Page 187

... deposits to fund its assets and periodically sells originated Private Education Loans to affiliates for inclusion in securitization trusts or collection. The Bank is also a key component of our Campus Solutions, Upromise Rewards and college-savings product businesses. Sallie Mae and its affiliates... -

Page 188

... TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 16. Segment Reporting (Continued) Our primary Business Services activities that are not directly related to the FFELP include: Upromise Upromise generates revenue by providing program management services for 529 college-savings plans with assets of... -

Page 189

... include costs related to executive management, the board of directors, accounting, finance, legal, human resources, stock-based compensation expense and information technology costs related to infrastructure and operations. At December 31, 2012 and 2011, the Other segment had total assets of... -

Page 190

... revenues and expenses are netted within the appropriate financial statement line items consistent with the income statement presentation provided to management. Changes in management structure or allocation methodologies and procedures may result in changes in reported segment financial information... -

Page 191

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 16. Segment Reporting (Continued) Segment Results and Reconciliations to GAAP Year Ended December 31, 2012 Adjustments Total Consumer Business FFELP Elimina"Core Reclassi- Additions/ Total Total Lending Services Loans Other tions... -

Page 192

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 16. Segment Reporting (Continued) Year Ended December 31, 2011 Adjustments Total Consumer Business FFELP Elimina"Core Reclassi- Additions/ Total Total Lending Services Loans Other tions(1) Earnings" fications (Subtractions) ... -

Page 193

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 16. Segment Reporting (Continued) Year Ended December 31, 2010 Adjustments Total Additions/ Consumer Business FFELP Elimina"Core Reclassi- (SubtracTotal Total (1) Lending Services Loans Other tions Earnings" fications tions) ... -

Page 194

... table reflects aggregate adjustments associated with these areas. (Dollars in millions) Years Ended December 31, 2012 2011 2010 "Core Earnings" adjustments to GAAP: Net impact of derivative accounting(1) ...Net impact of goodwill and acquired intangible assets(2) ...Net tax effect(3) ...Total... -

Page 195

...originate, service and/or collect loans made to students and their families to finance the cost of their education. We provide funding, delivery and servicing support for education loans in the United States, through our Private Education Loan programs and as a servicer and collector of loans for ED... -

Page 196

... Sallie Mae. Defaulted Direct Loans are collected by 22 private sector companies, including Sallie Mae. Because of the concentration of our business in servicing and collecting on Direct Loans, we are exposed to risks associated with ED reducing the amount of new loan servicing and collections... -

Page 197

SLM CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 19. Quarterly Financial Information (unaudited) First Quarter 2012 Second Third Quarter Quarter Fourth Quarter (Dollars in millions, except per share data) Net interest income ...Less: provisions for loan losses ...Net interest... -

Page 198

... CORPORATION NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 19. Quarterly Financial Information (unaudited) (Continued) First Quarter 2011 Second Third Quarter Quarter Fourth Quarter (Dollars in millions, except per share data) Net interest income ...Less: provisions for loan losses ...Net... -

Page 199

... the death, bankruptcy or permanent, total disability of the borrower; • closing of the student's school prior to the end of the academic period; • false certification of the borrower's eligibility for the loan by the school; and • an unpaid school refund. Claims are paid from federal assets... -

Page 200

... of Education ("ED") had to approve its eligibility under standards established by regulation. Financial Need Analysis Subject to program limits and conditions, student loans generally were made in amounts sufficient to cover the student's estimated costs of attending school, including tuition and... -

Page 201

..., Special Allowance Payments are more restricted. The annual and aggregate amounts of PLUS Loans were limited only to the difference between the cost of the student's education and other financial aid received, including scholarship, grants and other student loans. Consolidation Loan Program The... -

Page 202

...the guaranty agency is not successful. A guaranty agency also refers defaulted loans to ED to "offset" any federal income tax refunds or other federal reimbursement which may be due the borrowers. Some states have similar offset programs. To be eligible, FFELP loans must meet the requirements of the... -

Page 203

... for all the benefits under the HEA for which he or she is not eligible as a borrower on a defaulted loan, such as new federal aid, and the negative credit record is expunged. No student loan may be rehabilitated more than once. The July 1, 2009 technical corrections made to the HEA under H.R. 1777... -

Page 204

... "Managed net income" in certain instances. Direct Loans - Educational loans provided by the DSLP (see definition below) to students and parent borrowers directly through ED (see definition below) rather than through a bank or other lender. DSLP - The William D. Ford Federal Direct Loan Program. ED... -

Page 205

... Income for an extended period of time, and for those loans where the borrower interest rate is reset annually on July 1, we may earn Floor Income to the next reset date. In accordance with legislation enacted in 2006, lenders are required to rebate Floor Income to ED for all FFELP Loans disbursed... -

Page 206

... Private Education Loan business, we use the term "non-traditional loans" to describe education loans made to certain customers that have or are expected to have a high default rate as a result of a number of factors, including having a lower tier credit rating, low program completion and graduation... -

Page 207

... changes must be reflected in the estimate of the Repayment Borrower Benefits discount when made. Residual Interest - When we securitize student loans, we retain the right to receive cash flows from the student loans sold to trusts that we sponsor in excess of amounts needed to pay servicing...