IBM 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies92

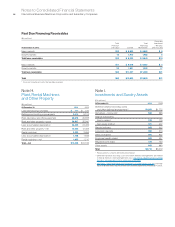

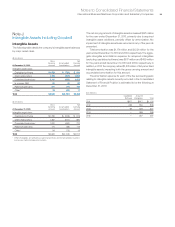

Past Due Financing Receivables

($ in millions)

Recorded

Total Total Investment

Past Due Financing > 90 Days

At December 31, 2010: > 90 days* Current Receivables and Accruing

Major markets $10 $ 6,552 $ 6,562 $ 5

Growth markets 13 1,970 1,983 5

Total lease receivables $22 $ 8,523 $ 8,545 $10

Major markets $11 $ 9,076 $ 9,087 $ 4

Growth markets 32 1,961 1,993 17

Total loan receivables $43 $11,037 $11,080 $21

Tot a l $65 $19,560 $19,625 $31

* Does not include accounts that are fully reserved.

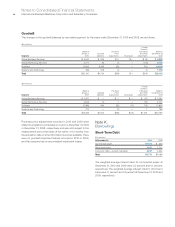

Note H.

Plant, Rental Machines

and Other Property

($ in millions)

At December 31: 2010 2009

Land and land improvements $ 777 $ 737

Buildings and building improvements 9,414 9,314

Plant, laboratory and office equipment 26,676 25,888

Plant and other property—gross 36,867 35,940

Less: accumulated depreciation 24,435 23,485

Plant and other property—net 12,432 12,455

Rental machines 3,422 3,656

Less: accumulated depreciation 1,758 1,946

Rental machines—net 1,665 1,710

Total— net $14,096 $14,165

Note I.

Investments and Sundry Assets

($ in millions)

At December 31: 2010 2009*

Deferred transition and setup costs

and other deferred arrangements** $1,853 $1,772

Derivatives — noncurrent + 588 565

Alliance investments:

Equity method 122 115

Non-equity method 531 477

Prepaid software 268 312

Long-term deposits 350 310

Other receivables 560 617

Employee benefit-related 409 427

Prepaid income taxes 434 123

Other assets 663 660

Tot a l $5,778 $5,379

* Reclassified to conform with 2010 presentation.

** Deferred transition and setup costs and other deferred arrangements are related

to Global Services client arrangements. Also see note A, “Significant Accounting

Policies,” on pages 68 to 79 for additional information.

+ See note L, “Derivative Financial Instruments,” on pages 96 through 101 for the fair

value of all derivatives reported in the Consolidated Statement of Financial Position.