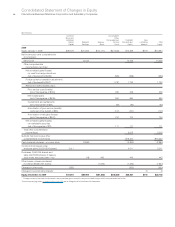

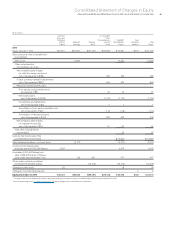

IBM 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

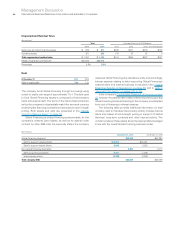

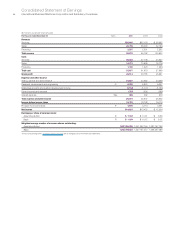

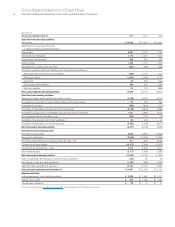

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies68

Note A.

Significant Accounting Policies

Basis of Presentation

The accompanying Consolidated Financial Statements and foot-

notes of the International Business Machines Corpor ation (IBM or

the company) have been prepared in accordance with accounting

principles generally accepted in the United States of America (GAAP).

Within the financial statements and tables presented, certain

columns and rows may not add due to the use of rounded numbers

for disclosure purposes. Percentages presented are calculated

from the underlying whole-dollar amounts. Certain prior year

amounts have been reclassified to conform to the current year

presentation. This is annotated where applicable.

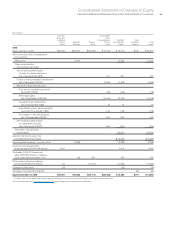

Noncontrolling interest amounts in income of $9 million, $5

million and $14 million, net of tax, for the years ended December

31, 2010, 2009 and 2008, respectively, are not presented separately

in the Consolidated Statement of Earnings due to immateriality, but

are reflected within the other (income) and expense line item.

Additionally, changes to noncontrolling interests in the Consolidated

Statement of Changes in Equity were $8 million, $(1) million and

$(26) million for the years ended December 31, 2010, 2009 and

2008, respectively. A separate roll forward is not presented due

to immateriality.

Principles of Consolidation

The Consolidated Financial Statements include the accounts of

IBM and its controlled subsidiaries, which are generally majority

owned. Any noncontrolling interest in the equity of a subsidiary is

reported in Equity in the Consolidated Statement of Financial

Position. Net income and losses attributable to the noncontrolling

interest is reported as described above in the Consolidated

Statement of Earnings. The accounts of variable interest entities

(VIEs) are included in the Consolidated Financial Statements, if

required. Investments in business entities in which the company

does not have control, but has the ability to exercise significant

influence over operating and financial policies, are accounted for

using the equity method and the company’s proportionate share

of income or loss is recorded in other (income) and expense. The

accounting policy for other investments in equity securities is

described on page 77 within “Marketable Securities.” Equity

investments in non-publicly traded entities are primarily accounted

for using the cost method. All intercompany transactions and

accounts have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with GAAP

requires management to make estimates and assumptions that

affect the amounts of assets, liabilities, revenue, costs, expenses

and other comprehensive income/(loss) that are reported in the

Consolidated Financial Statements and accompanying disclosures.

These estimates are based on management’s best knowledge of

current events, historical experience, actions that the company may

undertake in the future and on various other assumptions that are

believed to be reasonable under the circumstances. As a result,

actual results may be different from these estimates. See pages 50

to 53 for a discussion of the company’s critical accounting estimates.

Revenue

The company recognizes revenue when it is realized or realizable

and earned. The company considers revenue realized or realizable

and earned when it has persuasive evidence of an arrangement,

delivery has occurred, the sales price is fixed or determinable and

collectibility is reasonably assured. Delivery does not occur until

products have been shipped or services have been provided to

the client, risk of loss has transferred to the client, and either client

acceptance has been obtained, client acceptance provisions have

lapsed, or the company has objective evidence that the criteria

specified in the client acceptance provisions have been satisfied.

The sales price is not considered to be fixed or determinable until

all contingencies related to the sale have been resolved.

The company recognizes revenue on sales to solution providers,

resellers and distributors (herein referred to as “resellers”) when the

reseller has economic substance apart from the company, credit

risk, title and risk of loss to the inventory, the fee to the company is

not contingent upon resale or payment by the end user, the com-

pany has no further obligations related to bringing about resale or

delivery and all other revenue recognition criteria have been met.

The company reduces revenue for estimated client returns, stock

rotation, price protection, rebates and other similar allowances. (See

Schedule II, “Valuation and Qualifying Accounts and Reserves”

included in the company’s Annual Report on Form 10-K). Revenue

is recognized only if these estimates can be reasonably and reliably

determined. The company bases its estimates on historical results

taking into consideration the type of client, the type of transaction

and the specifics of each arrangement. Payments made under

cooperative marketing programs are recognized as an expense

only if the company receives from the client an identifiable benefit

sufficiently separable from the product sale whose fair value

can be reasonably and reliably estimated. If the company does

not receive an identifiable benefit sufficiently separable from the

product sale whose fair value can be reasonably estimated, such

payments are recorded as a reduction of revenue.

Revenue from sales of third-party vendor products or services

is recorded net of costs when the company is acting as an agent

between the client and the vendor and gross when the company

is a principal to the transaction. Several factors are considered to

determine whether the company is an agent or principal, most

notably whether the company is the primary obligor to the client,

or has inventory risk. Consideration is also given to whether the

company adds meaningful value to the vendor’s product or service,

was involved in the selection of the vendor’s product or service,

has latitude in establishing the sales price or has credit risk.

The company reports revenue net of any revenue-based taxes

assessed by governmental authorities that are imposed on and

concurrent with specific revenue-producing transactions. In addi-

tion to the aforementioned general policies, the following are the

specific revenue recognition policies for multiple-deliverable

arrangements and for each major category of revenue.