IBM 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies110

Stock Options

Stock options are awards which allow the employee to purchase

shares of the company’s stock at a fixed price. Stock options are

granted at an exercise price equal to the company stock price on

the date of grant. These awards, which generally vest 25 percent

per year, are fully vested four years from the date of grant and have

a contractual term of 10 years. The company also had a stock-

based program (“the Buy-First Program”) under the Plans for its

senior executives, designed to drive improved performance and

increase the ownership executives have in the company. These

executives had the opportunity to receive at-the-money stock

options by agreeing to defer a certain percentage of their annual

incentive compensation into IBM equity, where it was held for

three years or until retirement. In 2005, this program was expanded

to cover all executives of the company. Options under this program

became fully vested three years from the date of grant and

had a contractual term of 10 years. The Buy-First Program was

discontinued on December 31, 2006.

The company estimates the fair value of stock options at the

date of grant using the Black-Scholes valuation model. Key inputs

and assumptions used to estimate the fair value of stock options

include the grant price of the award, the expected option term,

volatility of the company’s stock, the risk-free rate and the com-

pany’s dividend yield. Estimates of fair value are not intended to

predict actual future events or the value ultimately realized by

employees who receive equity awards, and subsequent events

are not indicative of the reasonableness of the original estimates

of fair value made by the company.

During the years ended December 31, 2010, 2009 and 2008,

the company did not grant stock options.

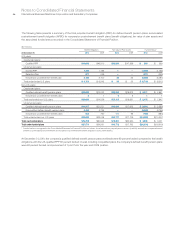

The following table summarizes option activity under the Plans during the years ended December 31, 2010, 2009 and 2008.

2010 2009 2008

Wtd. Avg. No. of Shares Wtd. Avg. No. of Shares Wtd. Avg. No. of Shares

Exercise Price Under Option Exercise Price Under Option Exercise Price Under Option

Balance at January 1 $ 98 73,210,457 $102 119,307,170 $100 157,661,257

Options exercised 134 (33,078,316) 120 (28,100,192) 91 (36,282,000)

Options canceled/expired 108 (934,413) 127 (17,996,521) 109 (2,072,087)

Balance at December 31 $ 94 39,197,728 $ 98 73,210,457 $102 119,307,170

Exercisable at December 31 $ 94 39,197,728 $ 98 72,217,126 $102 114,445,381

The shares under option at December 31, 2010 were in the following exercise price ranges:

Options Outstanding and Exercisable

Wtd. Avg.

Number Remaining

Wtd. Avg. of Shares Aggregate Contractual

Exercise Price Range Exercise Price Under Option Intrinsic Value Life (in Years)

$61– $85 $ 77 12,169,508 $ 846,212,907 2.3

$86 – $105 98 18,978,978 932,730,564 3.0

$106 and over 112 8,049,242 279,500,723 1.3

$ 94 39,197,728 $2,058,444,194 2.4

In connection with various acquisition transactions, there was an

additional 1.1 million stock-based awards, consisting of stock

options and restricted stock units, outstanding at December 31,

2010, as a result of the company’s assumption of stock-based

awards previously granted by the acquired entities. The weighted-

average exercise price of these awards was $58 per share.

Exercises of Employee Stock Options

The total intrinsic value of options exercised during the years ended

December 31, 2010, 2009 and 2008 was $1,072 million, $639 million

and $1,073 million, respectively. The total cash received from

employees as a result of employee stock option exercises for the

years ended December 31, 2010, 2009 and 2008 was approximately

$3,347 million, $2,744 million and $3,320 million, respectively. In

connection with these exercises, the tax benefits realized by the

company for the years ended December 31, 2010, 2009 and 2008

were $351 million, $243 million and $356 million, respectively.

The company settles employee stock option exercises

primarily with newly issued common shares and, occasionally, with

treasury shares. Total treasury shares held at December 31, 2010

and 2009 were approximately 934 million and 822 million shares,

respectively.