IBM 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 105

negligence and recklessness, private nuisance and trespass.

Plaintiffs in these cases seek medical monitoring and claim

damages in unspecified amounts for a variety of personal injuries

and property damages allegedly arising out of the presence of

groundwater contamination and vapor intrusion of groundwater

contaminants into certain structures in which plaintiffs reside or

resided, or conducted business, allegedly resulting from the

release of chemicals into the environment by the company at its

former manufacturing and development facility in Endicott. These

complaints also seek punitive damages in an unspecified amount.

The first trial in these cases is set for March 2012.

The company is party to, or otherwise involved in, proceedings

brought by U.S. federal or state environmental agencies under the

Comprehensive Environmental Response, Compensation and

Liability Act (CERCLA), known as “Superfund,” or laws similar to

CERCLA. Such statutes require potentially responsible parties to

participate in remediation activities regardless of fault or ownership

of sites. The company is also conducting environmental investiga-

tions, assessments or remediations at or in the vicinity of several

current or former operating sites globally pursuant to permits,

administrative orders or agreements with country, state or local

environmental agencies, and is involved in lawsuits and claims

concerning certain current or former operating sites.

The company is also subject to ongoing tax examinations and

governmental assessments in various jurisdictions. Along with many

other U.S. companies doing business in Brazil, the company is

involved in various challenges with Brazilian authorities regarding

non-income tax assessments and non-income tax litigation matters.

These matters include claims for taxes on the importation of com-

puter software. In November 2008, the company won a significant

case in the Superior Chamber of the federal administrative tax court

in Brazil, and in late July 2009, the company received written con-

firmation regarding this decision. The total potential amount related

to the remaining matters for all applicable years is approximately

$650 million. The company believes it will prevail on these matters

and that this amount is not a meaningful indicator of liability.

The company records a provision with respect to a claim, suit,

investigation or proceeding when it is probable that a liability has

been incurred and the amount of the loss can be reasonably esti-

mated. Claims and proceedings are reviewed at least quarterly and

provisions are taken or adjusted to reflect the impact and status of

settlements, rulings, advice of counsel and other information

pertinent to a particular matter. Any recorded liabilities, including

any changes to such liabilities for the year ended December 31,

2010, were not material to the Consolidated Financial Statements.

Based on its experience, the company believes that the damage

amounts claimed in the matters previously referred to are not a

meaningful indicator of the potential liability. Claims, suits, investiga-

tions and proceedings are inherently uncertain and it is not possible

to predict the ultimate outcome of the matters previously discussed.

While the company will continue to defend itself vigorously, it is

possible that the company’s business, financial condition, results

of operations or cash flows could be affected in any particular

period by the resolution of one or more of these matters.

Whether any losses, damages or remedies finally determined

in any such claim, suit, investigation or proceeding could reason-

ably have a material effect on the company’s business, financial

condition, results of operations or cash flows will depend on a

number of variables, including: the timing and amount of such

losses or damages; the structure and type of any such remedies;

the significance of the impact any such losses, damages or

remedies may have in the Consolidated Financial Statements; and

the unique facts and circumstances of the particular matter which

may give rise to additional factors.

Commitments

The company’s extended lines of credit to third-party entities

include unused amounts of $3,415 million and $3,576 million at

December 31, 2010 and 2009, respectively. A portion of these

amounts was available to the company’s business partners to

support their working capital needs. In addition, the company has

committed to provide future financing to its clients in connection

with client purchase agreements for approximately $2,825 million

and $2,788 million at December 31, 2010 and 2009, respectively.

The company has applied the guidance requiring a guarantor

to disclose certain types of guarantees, even if the likelihood of

requiring the guarantor’s performance is remote. The following is a

description of arrangements in which the company is the guarantor.

The company is a party to a variety of agreements pursuant

to which it may be obligated to indemnify the other party with

respect to certain matters. Typically, these obligations arise in the

context of contracts entered into by the company, under which

the company customarily agrees to hold the other party harmless

against losses arising from a breach of representations and

covenants related to such matters as title to assets sold, certain

IP rights, specified environmental matters, third-party performance

of nonfinancial contractual obligations and certain income taxes.

In each of these circumstances, payment by the company is

conditioned on the other party making a claim pursuant to the

procedures specified in the particular contract, the procedures of

which typically allow the company to challenge the other party’s

claims. While typically indemnification provisions do not include a

contractual maximum on the company’s payment, the company’s

obligations under these agreements may be limited in terms of

time and/or nature of claim, and in some instances, the company

may have recourse against third parties for certain payments made

by the company.

It is not possible to predict the maximum potential amount of

future payments under these or similar agreements due to the

conditional nature of the company’s obligations and the unique

facts and circumstances involved in each particular agreement.

Historically, payments made by the company under these agree-

ments have not had a material effect on the company’s business,

financial condition or results of operations.

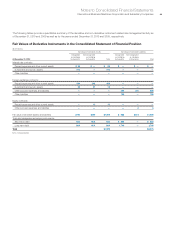

In addition, the company guarantees certain loans and financial

commitments. The maximum potential future payment under these

financial guarantees was $48 million and $85 million at December

31, 2010 and 2009, respectively. The fair value of the guarantees

recognized in the Consolidated Statement of Financial Position is

not material.