IBM 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

Management Discussion

International Business Machines Corporation and Subsidiary Companies

the acquisition of Netezza, the value of business analytics can be

extended to both large enterprises and smaller clients with a system

that is simple, economical and offers quick time-to-value. Netezza

got off to a strong start in the quarter and complements the

company’s business analytics and optimization capabilities.

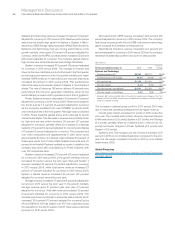

The fourth quarter concluded a strong year for the software

segment. Software gross profit increased 0.9 points to 88.5 percent.

The Software segment delivered pre-tax profit of $3,172 million,

an increase of 3.7 percent with a pre-tax margin of 40.6 percent.

Systems and Technology revenue of $6,277 million increased

21.0 percent (22 percent adjusted for currency), the best quarterly

revenue performance in over a decade. Revenue was driven by

growth in all brands with strong double-digit growth in System z,

Power Systems entry systems, System x, Storage disk products,

Retail Store Solutions and Microelectronics OEM. Both the major

markets and growth markets had revenue growth in excess of 20

percent in the quarter. Total servers gained 3 points of market

share with each of the server brands gaining share while Storage

held share. System z revenue increased 69.2 percent (72 percent

adjusted for currency). This performance reflects the value and

innovation System z delivers to clients. System z MIPS shipments

increased 58 percent year to year. The fourth-quarter MIPS per-

formance was the highest quarterly growth in six years. Power

Systems revenue increased 1.8 percent (3 percent adjusted for

currency) and gained share for the 11th consecutive quarter. This

was the first quarter with the complete POWER7 product line avail-

able. The newly introduced entry systems had strong customer

acceptance with revenue growth of 29.9 percent (31 percent

adjusted for currency) year to year. Mid-range Power Systems

revenue grew 6.7 percent (8 percent adjusted for currency), the

third consecutive quarter of revenue growth. The high-end prod-

uct set has strong momentum entering 2011 as it shipped nearly

200 high-end 795 servers in the fourth quarter of 2010, three times

as many as the third quarter of 2010. The company’s competitive

take outs continued in the fourth quarter, with over 280 displace-

ments driving approximately $325 million of business. Storage

revenue increased 8.3 percent (10 percent adjusted for currency)

led by the growth markets which increased 23 percent adjusted

for currency, the third consecutive quarter of growth above 20

percent. Total disk revenue increased 10.9 percent (13 percent

adjusted for currency) driven by the continued strength in high-end

storage, XIV and the DS8000 product. XIV added more than 200

new customers to its platform in the fourth quarter. Storage had

a successful launch of its new V7000 mid-range product which

was sold out in the fourth quarter. System x revenue increased

18.3 percent (18 percent adjusted for currency), the fifth consecu-

tive quarter of double-digit revenue growth. High-end System x

revenue increased 31.0 percent (31 percent adjusted for currency)

and System x blades revenue grew 14.1 percent (14 percent

adjusted for currency). Retail Stores Solutions revenue increased

25.6 percent (27 percent adjusted for currency) and extended the

company’s leadership position as a point of sale provider.

Microelectronics OEM revenue increased 29.6 percent (30 percent

adjusted for currency) in the fourth quarter with strong growth from

networking and game console products.

Systems and Technology gross margin of 43.9 percent

increased 1.4 points versus the fourth quarter of 2009 primarily

reflecting a richer revenue mix to System z. The Systems and

Technology segment pre-tax profit increased 45.1 percent to

$1,208 million. Pre-tax margin increased 3.2 points to 18.6 percent

compared to the fourth quarter of 2009.

Global Financing revenue of $628 million increased 1.2 percent

(1 percent adjusted for currency), driven primarily by an increase

in used equipment sales revenue. The Global Financing segment

fourth-quarter pre-tax profit increased 14.0 percent to $567 million

and the pre-tax margin expanded 3.4 points to 47.1 percent from

the fourth quarter of 2009. The company’s financing business

delivered good results as the global economy continued to emerge

from a challenging credit environment.

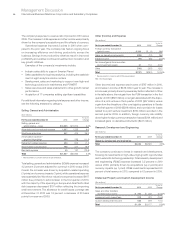

Geographic Revenue

Total geographic revenue of $28,234 million increased 6.2 percent

(7 percent adjusted for currency) year to year in the fourth quarter

with constant currency growth in all geographies. Revenue from

the major markets increased 3.9 percent (5 percent adjusted

for currency) and improved 5 points from the constant currency

performance in the third quarter. The fourth-quarter revenue

growth was driven by the U.S., France and Italy. The U.S.—the

company’s largest market—grew 10 percent, representing the

strongest year-to-year growth in 11 years. Revenue from the growth

markets increased 15.4 percent (13 percent adjusted for currency);

adjusted for currency, revenue growth outpaced the major markets

by 8 points in the quarter. In the BRIC countries, which represented

approximately 41 percent of the growth markets revenue in the

quarter, revenue increased 18.7 percent (17 percent adjusted for

currency) with growth in each of the four countries led by strong

growth in China (up 27.0 percent, 25 percent adjusted for currency)

and Russia (up 45.2 percent, 46 percent adjusted for currency).

Revenue growth in the growth markets continues to be broad

based with double-digit growth in 50 countries, adjusted for

currency, up from 32 countries in the third quarter of 2010. In the

fourth quarter, the company gained share overall in the growth

markets as well as in hardware and software. Total Americas

revenue of $12,151 million increased 9.4 percent (9 percent adjusted

for currency). EMEA revenue decreased 1.8 percent (increased

4 percent adjusted for currency) to $9,516 million. Adjusted for

currency, revenue performance was led by France with strong

double-digit growth (7.3 percent, 17 percent adjusted for currency)

and solid performance in Italy (declined 3.9 percent, increased

5 percent adjusted for currency). Revenue performance was mixed

across the other major market countries with the U.K. down

1.5 percent (up 2 percent adjusted for currency), Germany down

10.7 percent (3 percent adjusted for currency) and Spain down 6.2

percent (up 2 percent adjusted for currency). Asia Pacific revenue

increased 13.6 percent (7 percent adjusted for currency) to $6,567

million, with the growth markets up 19.7 percent (14 percent

adjusted for currency) and Japan up 6.5 percent (decreased

2 percent adjusted for currency).