IBM 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

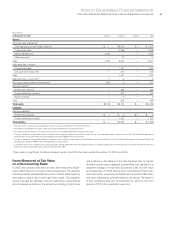

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies78

Financing Receivables

Financing receivables include sales-type leases, direct financing

leases and loans. Leases are accounted for in accordance with

lease accounting standards. Loan receivables are financial assets

recorded at amortized cost which approximates fair value. Financing

income is recognized on the accrual basis using the effective inter-

est method. Estimates of fair value are based on discounted future

cash flows using current interest rates offered for similar loans to

clients with similar credit ratings for the same remaining maturities.

The company determines its allowances for credit losses on financ-

ing receivables based on two portfolio segments: lease receivables

and loan receivables (see note G, “Financing Receivables,” on

pages 90 to 92). The company further segments the portfolio via

two classes: major markets and growth markets.

When calculating the allowances, the company considers its

ability to mitigate a potential loss by repossessing leased equip-

ment and by considering the current fair market value of any other

collateral. The value of the equipment is the net realizable value.

The allowance for credit losses for capital leases, installment sales

and customer loans includes an assessment of the entire balance

of the capital lease or loan, including amounts not yet due. The

methodologies that the company uses to calculate its receivables

reserves, which are applied consistently to its different portfolios,

are as follows:

Individually Evaluated—The company reviews all financing receiv-

ables considered at risk on a quarterly basis. The review primarily

consists of an analysis based upon current information available

about the client, such as financial statements, news reports, pub-

lished credit ratings, current market-implied credit analysis, as well

as the current economic environment, collateral net of reposses-

sion cost and prior collection history. For loans that are collateral

dependent, impairment is measured using the fair value of the

collateral when foreclosure is probable. Using this information, the

company determines the expected cash flow for the receivable and

calculates an estimate of the potential loss and the probability of

loss. For those accounts in which the loss is probable, the company

records a specific reserve.

Collectively Evaluated—The company records an unallocated

reserve that is calculated by applying a reserve rate to its different

portfolios, excluding accounts that have been specifically reserved.

This reserve rate is based upon credit rating, probability of default,

term, characteristics (lease/loan), and loss history. Factors that could

result in actual receivable losses that are materially different from the

estimated reserve include sharp changes in the economy, or a sig-

nificant change in the economic health of a particular client that

represents a concentration in the company’s receivables portfolio.

Other Credit Related Policies

Non-Accrual—

Certain receivables for which the company has

recorded a specific reserve may also be placed on non-accrual

status. Non-accrual assets are those receivables (impaired loans

or non-performing leases) with specific reserves and other

accounts for which it is likely that the company will be unable to

collect all amounts due according to original terms of the lease or

loan agreement. Income recognition is discontinued on these

receivables. Cash collections are first applied as a reduction to

principal outstanding. Any cash received in excess of principal

payments outstanding is recognized as interest income. Receivables

may be removed from non-accrual status, if appropriate, based

upon changes in client circumstances.

Write Off—Receivable losses are charged against the allowance

when management believes the uncollectibility of the receivable

is confirmed. Subsequent recoveries, if any, are credited to the

allowance.

Past Due—The company views receivables as past due when

payment has not been received after 90 days, measured from the

original billing date.

Impaired Loans—As stated above, the company evaluates all

financing receivables considered at-risk, including loans, for impair-

ment on a quarterly basis. The company considers any loan with

an individually evaluated reserve as an impaired loan. Depending

on the level of impairment, loans will also be placed on non-accrual

status as appropriate (see Non-Accrual discussion above). Global

Financing’s client loans are primarily for software and services and

are unsecured. These loans are subjected to credit analysis to

evaluate the associated risk and, when deemed necessary, actions

are taken to mitigate risks in the loan agreements which include

covenants to protect against credit deterioration during the life of

the obligation.

Estimated Residual Values of Lease Assets

The recorded residual values of the company’s lease assets are

estimated at the inception of the lease to be the expected fair value

of the assets at the end of the lease term. The company periodically

reassesses the realizable value of its lease residual values. Any

anticipated increases in specific future residual values are not

recognized before realization through remarketing efforts.

Anticipated decreases in specific future residual values that are

considered to be other-than-temporary are recognized immedi-

ately upon identification and are recorded as an adjustment to the

residual-value estimate. For sales-type and direct-financing leases,

this reduction lowers the recorded net investment and is recognized

as a loss charged to financing income in the period in which the

estimate is changed, as well as an adjustment to unearned income

to reduce future-period financing income.