IBM 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

Management Discussion

International Business Machines Corporation and Subsidiary Companies

The financial instruments that are included in the sensitivity

analysis comprise all of the company’s cash and cash equivalents,

marketable securities, short-term and long-term loans, commercial

financing and installment payment receivables, investments, long-

term and short-term debt and all derivative financial instruments.

The company’s derivative financial instruments generally include

interest rate swaps, foreign currency swaps and forward contracts.

To perform the sensitivity analysis, the company assesses the

risk of loss in fair values from the effect of hypothetical changes

in interest rates and foreign currency exchange rates on market-

sensitive instruments. The market values for interest and foreign

currency exchange risk are computed based on the present value

of future cash flows as affected by the changes in rates that

are attributable to the market risk being measured. The discount

rates used for the present value computations were selected

based on market interest and foreign currency exchange rates in

effect at December 31, 2010 and 2009. The differences in this

comparison are the hypothetical gains or losses associated with

each type of risk.

Information provided by the sensitivity analysis does not

necessarily represent the actual changes in fair value that the

company would incur under normal market conditions because,

due to practical limitations, all variables other than the specific

market risk factor are held constant. In addition, the results of the

model are constrained by the fact that certain items are specifically

excluded from the analysis, while the financial instruments relating

to the financing or hedging of those items are included by defini-

tion. Excluded items include short-term and long-term receivables

from sales-type and direct financing leases, forecasted foreign

currency cash flows and the company’s net investment in foreign

operations. As a consequence, reported changes in the values

of some of the financial instruments impacting the results of the

sensitivity analysis are not matched with the offsetting changes

in the values of the items that those instruments are designed to

finance or hedge.

As a globally integrated enterprise, the company operates in over

170 countries and is continuing to shift its business to the higher

value segments of enterprise computing. The company continually

assesses its resource needs with the objective of balancing its

workforce globally to improve the company’s global reach and com-

petitiveness. In 2010, total employees at IBM and its wholly owned

subsidiaries increased more than 27,000 compared to the prior year.

The results of the sensitivity analysis at December 31, 2010,

and 2009, are as follows:

Interest Rate Risk

At December 31, 2010, a 10 percent decrease in the levels of interest

rates with all other variables held constant would result in a decrease

in the fair market value of the company’s financial instruments of

$341 million as compared with a decrease of $274 million at

December 31, 2009. A 10 percent increase in the levels of interest

rates with all other variables held constant would result in an increase

in the fair value of the company’s financial instruments of $315 million

as compared to an increase of $251 million at December 31, 2009.

Changes in the relative sensitivity of the fair value of the company’s

financial instrument portfolio for these theoretical changes in

the level of interest rates are primarily driven by changes in the

company’s debt maturities, interest rate profile and amount.

Foreign Currency Exchange Rate Risk

At December 31, 2010, a 10 percent weaker U.S. dollar against

foreign currencies, with all other variables held constant, would

result in an increase in the fair value of the company’s financial

instruments of $546 million as compared with a decrease of $609

million at December 31, 2009. Conversely, a 10 percent stronger

U.S. dollar against foreign currencies, with all other variables

held constant, would result in a decrease in the fair value of the

company’s financial instruments of $546 million compared with

an increase of $609 million at December 31, 2009. The change in

impact from 2009 to 2010 was due to the change in the financial

asset and derivative portfolio.

Financing Risks

See the “Description of Business” on page 23 for a discussion of

the financing risks associated with the Global Financing business

and management’s actions to mitigate such risks.

The complementary workforce is an approximation of equivalent

full-time employees hired under temporary, part-time and limited

term employment arrangements to meet specific business needs

in a flexible and cost-effective manner.

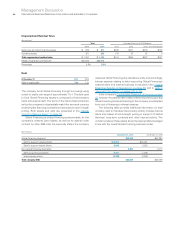

Employees and Related Workforce

Yr.-to-Yr. Change

For the year ended December 31: 2010 2009 2008 2010-09 2009-08

IBM/wholly owned subsidiaries 426,751 399,409 398,455 6.8% 0.2%

Less-than-wholly owned subsidiaries 9,334 11,421 11,642 (18.3) (1.9)

Complementary 27,784 26,946 27,983 3.1 (3.7)