IBM 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 103

As of December 31, 2010, the company was unable to estimate

the range of settlement dates and the related probabilities for certain

asbestos remediation AROs. These conditional AROs are primarily

related to the encapsulated structural fireproofing that is not

subject to abatement unless the buildings are demolished and

non-encapsulated asbestos that the company would remediate

only if it performed major renovations of certain existing buildings.

Because these conditional obligations have indeterminate settle-

ment dates, the company could not develop a reasonable estimate

of their fair values. The company will continue to assess its ability

to estimate fair values at each future reporting date. The related

liability will be recognized once sufficient additional information

becomes available. The total amounts accrued for ARO liabilities,

including amounts classified as current in the Consolidated

Statement of Financial Position were $176 million and $126 million

at December 31, 2010 and 2009, respectively.

Note N.

Equity Activity

The authorized capital stock of IBM consists of 4,687,500,000

shares of common stock with a $.20 per share par value, of which

1,227,993,544 shares were outstanding at December 31, 2010 and

150,000,000 shares of preferred stock with a $.01 per share par

value, none of which were outstanding at December 31, 2010.

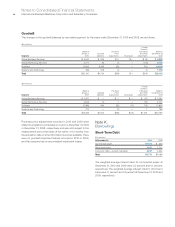

Stock Repurchases

The Board of Directors authorizes the company to repurchase IBM

common stock. The company repurchased 117,721,650 common

shares at a cost of $15,419 million, 68,650,727 common shares at

a cost of $7,534 million and 89,890,347 common shares at a cost

of $10,563 million in 2010, 2009 and 2008, respectively. These

amounts reflect transactions executed through December 31 of

each year. Actual cash disbursements for repurchased shares

may differ due to varying settlement dates for these transactions.

At December 31, 2010, $8,694 million of Board common stock

repurchase authorization was still available. The company plans

to purchase shares on the open market or in private transactions

from time to time, depending on market conditions.

Other Stock Transactions

The company issued the following shares of common stock as part

of its stock-based compensation plans and employee stock purchase

plan: 34,783,386 shares in 2010, 30,034,808 shares in 2009 and

39,374,439 shares in 2008.The company issued 7,929,318 treasury

shares in 2010, 6,408,265 treasury shares in 2009 and 5,882,800

treasury shares in 2008, as a result of exercises of stock options by

employees of certain recently acquired businesses and by non-U.S.

employees. Also, as part of the company’s stock-based compensa-

tion plans, 2,334,932 common shares at a cost of $297 million,

1,550,846 common shares at a cost of $161 million and 1,505,107

common shares at a cost of $166 million in 2010, 2009 and 2008,

respectively, were remitted by employees to the company in order

to satisfy minimum statutory tax withholding requirements. These

amounts are included in the treasury stock balance in the

Consolidated Statement of Financial Position and the Consolidated

Statement of Changes in Equity.

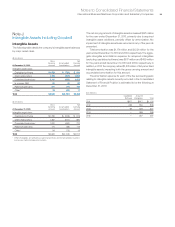

Accumulated Other Comprehensive Income/(Loss) (net of tax)

($ in millions)

Net Unrealized Foreign Net Change Net Unrealized Accumulated

Gains/(Losses) Currency Retirement- Gains/(Losses) Other

on Cash Flow Translation Related on Marketable Comprehensive

Hedge Derivatives Adjustments* Benefit Plans Securities Income/(Loss)

December 31, 2008 $ 74 $ 103 $(22,025) $ 2 $(21,845)

Change for period (556) 1,732 1,727 111 3,015

December 31, 2009 (481) 1,836 (20,297) 113 (18,830)

Change for period 385 643 (992) 51 87

December 31, 2010 $ (96) $2,478 $(21,289) $164 $(18,743)

* Foreign currency translation adjustments are presented gross except for any associated hedges which are presented net of tax.

Note O.

Contingencies and Commitments

Contingencies

As a company with a substantial employee population and with

clients in more than 170 countries, IBM is involved, either as

plaintiff or defendant, in a variety of ongoing claims, demands,

suits, investigations, tax matters and proceedings that arise from

time to time in the ordinary course of its business. The company

is a leader in the information technology industry and, as such,

has been and will continue to be subject to claims challenging its

IP rights and associated products and offerings, including claims

of copyright and patent infringement and violations of trade secrets

and other IP rights. In addition, the company enforces its own IP

against infringement, through license negotiations, lawsuits or

otherwise. Also, as is typical for companies of IBM’s scope and

scale, the company is party to actions and proceedings in various

jurisdictions involving a wide range of labor and employment issues