IBM 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Management Discussion

International Business Machines Corporation and Subsidiary Companies

For the year, the company delivered $10.01 in diluted earnings

per share, an increase of 12.6 percent year to year. This was the

seventh consecutive year of double-digit earnings per share

growth. In 2007, the company developed a Road Map for growth

with an earnings per share objective for 2010 of $10 to $11 per

share. With its performance in 2009, the company achieved this

objective one year early.

Total revenue decreased 7.6 percent (5 percent adjusted for

currency) compared to 2008. Revenue from the growth markets

declined 3.5 percent, but increased 1 percent at constant currency.

Performance was led by the BRIC countries of Brazil, Russia, India

and China which increased 4 percent, adjusted for currency.

Segment performance was driven by Software which decreased

3.1 percent year to year (1 percent adjusted for currency) and Global

Technology Services which declined 4.9 percent (2 percent

adjusted for currency). Within Software, performance was led by key

branded middleware which increased revenue 1.1 percent (3 per-

cent adjusted for currency) compared to the prior year.

Gross profit margins improved reflecting the shift to higher

value businesses and the continued focus on productivity and

cost management. The consolidated gross profit margin increased

1.7 points versus 2008 to 45.7 percent. This was the sixth

consecutive year of improvement in the gross profit margin. Gross

profit margin performance by segment and the impact to the

consolidated gross margin was as follows:

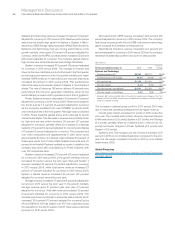

Gross Yr.-to-Yr. Consolidated

Margin Change Impact

Global Technology Services 35.0% 2.4 pts. 0.8 pts.

Global Business Services 28.2% 1.5 pts. 0.4 pts.

Software 86.0% 0.6 pts. 0.6 pts.

Systems and Technology 37.8% (0.2) pts. 0.1 pts.

Global Financing 47.5% (3.8) pts. (0.1) pts.

Total expense and other income decreased 11.4 percent in 2009

versus 2008. The year-to-year drivers were approximately:

• Operational expense, (9) points

• Currency,* (4) points

• Acquisitions,** 1 point

* Reflects impacts of translation and hedging programs.

** Includes acquisitions completed in prior 12-month period.

Pre-tax income grew 8.5 percent and the pre-tax margin was 18.9

percent, the highest level in more than a decade. Net income

increased 8.8 percent reflecting a slight improvement in the tax

rate. The effective tax rate for 2009 was 26.0 percent, compared

with 26.2 percent in 2008.

Diluted earnings per share improved 12.6 percent reflecting

the strong growth in net income and the benefits of the common

stock repurchase program. In 2009, the company repurchased

approximately 69 million shares of its common stock. Diluted

earnings per share of $10.01 increased $1.12 from the prior year

driven by the following factors:

• Revenue decrease at actual rates, $(0.68)

• Operating leverage, $ 1.46

• Common stock repurchases, $ 0.34

At December 31, 2009, the company’s balance sheet and liquidity

positions remained strong. Cash on hand was $12,183 million.

Total debt decreased $7,826 million year to year, and the company

generated $20,773 million in operating cash flow in 2009. The

company has consistently generated strong cash flow from oper-

ations and also continues to have access to additional sources of

liquidity through the capital markets and its global credit facility.

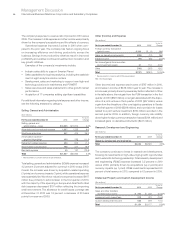

The following is an analysis of the 2009 versus 2008 reportable segment results for Global Services, Systems and Technology and

Software. The Global Financing segment analysis is included in the Global Financing section on pages 55 through 59.

Global Services

($ in millions)

Yr.-to-Yr.

Yr.-to-Yr. Change Adjusted

For the year ended December 31: 2009* 2008* Change for Currency

Global Services external revenue: $55,000 $58,891 (6.6)% (4.0)%

Global Technology Services: $37,347 $39,264 (4.9)% (2.0)%

Outsourcing 21,620 22,734 (4.9) (2.0)

Integrated Technology Services 8,771 9,283 (5.5) (2.9)

Maintenance 6,956 7,250 (4.1) (1.1)

Global Business Services $17,653 $19,628 (10.1)% (8.1)%

* Reclassified to conform with 2010 presentation.