IBM 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

Management Discussion

International Business Machines Corporation and Subsidiary Companies

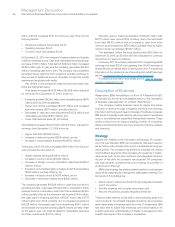

Software revenue of $22,485 million increased 5.1 percent (5 percent

adjusted for currency) in 2010 compared to 2009. Adjusting for the

divested PLM operations, revenue grew at 8.1 percent (8 percent

adjusted for currency) in 2010. Software revenue growth continued

to be led by the Key Branded Middleware products with strong

performance in the areas of business commerce, business analytics,

storage management and business integration. Overall, the

Software business performed well in 2010, delivering over $9 billion

in segment pre-tax profit, an increase of 12 percent as reported

versus 2009. In addition, the company continues to invest in addi-

tional capabilities for the software business through both organic

investments and the completion of 13 acquisitions in 2010.

Key Branded Middleware revenue increased 10.8 percent

(11 percent adjusted for currency) and gained market share again

in 2010 as the Software business extended its lead in the middle-

ware market. Software revenue continued to mix to the faster

growing branded middleware which accounted for 62 percent of

total software revenue in 2010, an increase of 3 points from 2009.

Adjusted for currency, growth in 2010 was led by growth in

WebSphere and Tivoli. The Software business continues to benefit

from the company’s growth initiatives, with business analytics

revenue up year over year.

WebSphere revenue increased 20.8 percent (21 percent

adjusted for currency) in 2010 with strong performance throughout

the year. Application Servers software had revenue growth of 12.0

percent (11.7 percent adjusted for currency) year to year. Business

Integration software, which includes the ILOG, Sterling Commerce

and Lombardi acquisitions, delivered strong revenue growth in

2010, up 33.6 percent (33 percent adjusted for currency). With the

2010 acquisitions of Sterling Commerce, Coremetrics and Unica

Corporation, the company expects continued market momentum

in its WebSphere commerce area.

Information Management revenue increased 8.6 percent

(8 percent adjusted for currency) in 2010 versus the prior year with

revenue growth in both Information Management solutions and

infrastructure offerings. The software business continued to expand

its Information Management capabilities through strategic acqui-

sitions, as the company completed the acquisitions of Netezza,

OpenPages, PSS Systems, Clarity Systems and Initiate Systems.

Tivoli revenue increased 15.0 percent (15 percent adjusted

for currency) in 2010 when compared to 2009, with revenue

growth in each element of the Integrated Service management

strategy—Systems management, Security and Storage manage-

ment. Tivoli provides clients an integrated approach to service

management.

Rational revenue increased 4.8 percent (5 percent adjusted for

currency) in 2010 versus 2009.

Operating systems revenue increased 5.5 percent (5 percent

adjusted for currency) in 2010 compared to 2009, driven by Power

Systems and System x related products.

Other software revenue decreased 16.6 percent (17 percent

adjusted for currency) due primarily to the divestiture of the PLM

operations in the first quarter of 2010.

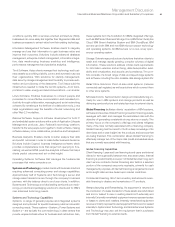

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2010 2009 Change

Software:

External gross profit $19,537 $18,405 6.2%

External gross profit margin 86.9% 86.0% 0.9 pts.

Pre-tax income $ 9,097 $ 8,095 12.4%

Pre-tax margin 35.8% 33.6% 2.1 pts.

Pre-tax income—normalized* $ 8,603 $ 8,005 7.5%

Pre-tax margin—normalized 33.8% 33.3% 0.6 pts.

* Excludes $98 million and $17 million of workforce rebalancing charges in the first

quarter of 2010 and 2009, respectively, and $(591) million related to the PLM gain in

the first quarter of 2010 and $(106) million related to the Geodis gain in the first

quarter of 2009.

Software gross profit of $19,537 million in 2010 increased 6.2

percent versus 2009, driven primarily by the year-to-year growth

in software revenue. The improvement in the gross profit margin

was primarily driven by the divestiture of the lower gross margin

PLM revenue. The Software segment delivered $9,097 million of

pre-tax profit in 2010, an increase of $1,002 million, or 12.4 percent,

versus 2009. The segment pre-tax profit margin expanded 2.1

points to 35.8 percent. On a normalized basis, segment pre-tax

income increased 7.5 percent and segment pre-tax margin

expanded 0.6 points to 33.8 percent.

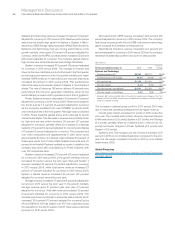

Systems and Technology

($ in millions)

Yr.-to-Yr.

Yr.-to-Yr. Change Adjusted

For the year ended December 31: 2010 2009 Change for Currency

Systems and Technology external revenue: $17,973 $16,190 11.0% 11.1%

System z 16.4% 17.7%

Power Systems (8.4) (8.5)

System x 27.5 26.8

Storage 7.6 8.1

Retail Store Solutions 22.4 23.2

Total Systems 9.5 9.6

Microelectronics OEM 24.8 24.7