IBM 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 81

In April 2009, the FASB issued an amendment to the revised

business combination guidance regarding the accounting for assets

acquired and liabilities assumed in a business combination that

arise from contingencies. The requirements of this amended

guidance carry forward without significant revision the guidance

on contingencies which existed prior to January 1, 2009. Assets

acquired and liabilities assumed in a business combination that

arise from contingencies are recognized at fair value if fair value

can be reasonably estimated. If fair value cannot be reasonably

estimated, the asset or liability would generally be recognized in

accordance with the Accounting Standards Codification (ASC)

Topic 450 on contingencies. There was no impact upon adoption.

In April 2008, the FASB issued new requirements regarding the

determination of the useful lives of intangible assets. In developing

assumptions about renewal or extension options used to determine

the useful life of an intangible asset, an entity needs to consider its

own historical experience adjusted for entity-specific factors. In the

absence of that experience, an entity shall consider the assumptions

that market participants would use about renewal or extension

options. The new requirements applied to intangible assets acquired

after January 1, 2009. The adoption of these new rules did not have

a material impact in the Consolidated Financial Statements.

In November 2008, the FASB issued guidance on accounting

for defensive intangible assets. A defensive intangible asset is an

asset acquired in a business combination or in an asset acquisition

that an entity does not intend to actively use. According to the

guidance, defensive intangible assets are considered to be a

separate unit of account and valued based on their highest and

best use from the perspective of an external market participant.

The company adopted this guidance on January 1, 2009, and

there was no impact to the Consolidated Financial Statements

upon adoption.

Note C.

Acquisitions/Divestitures

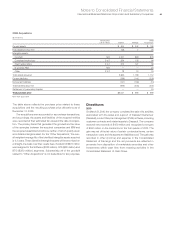

Acquisitions

2010

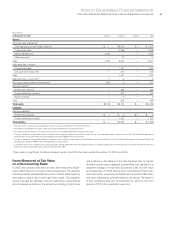

In 2010, the company completed 17 acquisitions at an aggregate

cost of $6,538 million.

Netezza Corporation (Netezza)—On November 10, 2010, the

company completed the acquisition of 100 percent of Netezza, for

cash consideration of $1,847 million. Netezza will expand the com-

pany’s business analytics initiatives to help clients gain faster

insights into their business information, with increased performance

at a lower cost of ownership. Netezza was integrated into the

Software segment upon acquisition, and goodwill, as reflected in

the table on page 82, has been entirely assigned to the Software

segment. It is expected that none of the goodwill will be deductible

for tax purposes. The overall weighted average useful life of the

identified intangible assets acquired is 6.9 years.

Sterling Commerce—On August 27, 2010, the company completed

the acquisition of 100 percent of Sterling Commerce, a wholly

owned subsidiary of AT&T, Inc., for cash consideration of $1,415

million. Sterling Commerce will expand the company’s ability to

help clients accelerate their interactions with customers, partners

and suppliers through dynamic business networks using either

on-premise or cloud delivery models. Sterling Commerce was

integrated into the Software segment upon acquisition, and good-

will, as reflected in the table on page 82, has been entirely assigned

to the Software segment. It is expected that none of the goodwill

will be deductible for tax purposes. The overall weighted average

useful life of the identified intangible assets acquired, excluding

goodwill, is 6.9 years.

Other Acquisitions—The Software segment also completed

acquisitions of 10 privately held companies and one publicly held

company: in the first quarter, Lombardi Software, Inc. (Lombardi),

Intelliden Inc. and Initiate Systems, Inc.; in the second quarter, Cast

Iron Systems; in the third quarter, BigFix, Inc., Coremetrics and

Datacap; and in the fourth quarter, Unica Corporation (Unica), a

publicly held company, PSS Systems, OpenPages, Inc. (OpenPages)

and Clarity Systems. Global Technology Services (GTS) completed

an acquisition in the first quarter: the core operating assets of

Wilshire Credit Corporation (Wilshire). Global Business Services

(GBS) also completed an acquisition in the first quarter: National

Interest Security Company, LLC, a privately held company. Systems

and Technology (STG) completed acquisitions of two privately held

companies: in the third quarter, Storwize; and in the fourth quarter,

BLADE Network Technologies (BLADE). All acquisitions were for

100 percent of the acquired companies.