IBM 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Management Discussion

International Business Machines Corporation and Subsidiary Companies

strength of the company’s global model and the results of the

strategic transformation of the business.

The company’s transformation, which started at the beginning

of the decade, has been focused on shifting the business to higher

value areas of the market, improving operating leverage through

productivity and investing in opportunities to drive future growth.

The overall changes to the business have been dramatic. Several

examples demonstrate the success of this transformation.

To capture the opportunity that exists in the emerging markets,

the company created a dedicated management system and

invested to drive market expansion and infrastructure development.

Since 2000, the company has added $10 billion in annual revenue

from its growth markets, and with a revenue growth rate that has

consistently exceeded the major markets, the revenue contribution

from the growth markets has increased significantly to 21 percent

of total geographic revenue in 2010.

Across the company’s portfolio, there has been a shift to higher

value areas while divesting commoditizing businesses. These

actions have contributed to a significant change in the mix of the

business. In 2000, Global Services segment pre-tax income was

$4.5 billion; in 2010, it was over $8 billion. The Software growth is

even more dramatic. In 2000, Software segment pre-tax income

was $2.8 billion; in 2010, it was over $9 billion, tripling since 2000

and now representing 44 percent of total segment pre-tax income.

At the consolidated level, since 2000, the company has added

$10 billion of pre-tax income, nearly tripled earnings per share and

generated over $162 billion in cash flow from operating activities.

The strong profit and cash generation has enabled the company

to invest in the business, while delivering significant shareholder

returns. In the past 10 years, the company has invested almost

$60 billion in research and development and approximately $32

billion in acquiring 116 companies, adding to its capabilities in high-

value areas like business analytics and smarter planet. From 2001-

2010, the company returned $107 billion to shareholders through

share repurchases and dividends, with almost $19 billion in 2010.

The company’s performance in 2010 marked the end of a very

successful decade. The changes that the company has made over

the last 10 years have strengthened the business and position it

well going forward.

For the year, the company delivered $11.52 in diluted earnings

per share, an increase of 15.1 percent year to year. This was the

eighth consecutive year of double-digit earnings per share growth.

In 2007, the company developed a Road Map for growth with an

earnings per share objective for 2010 of $10 to $11 per share. With

its performance in 2010, the company exceeded the low end of

its objective by $1.52 per share and the high end by $0.52 per

share. The resilience of the business model enabled the company

to exceed its objective even while managing through the severe

global recession.

Total revenue for 2010 increased 4.3 percent (3 percent adjusted

for currency) compared to 2009; excluding the divested Product

Lifecycle Management (PLM) operations, total revenue increased

4.9 percent (4 percent adjusted for currency). Revenue from the

growth markets increased 16.0 percent (11 percent adjusted for

currency) with performance led by the BRIC countries of Brazil,

Russia, India and China which increased 18 percent, adjusted for

currency. Within the growth markets, 40 countries grew revenue

at a double-digit rate at constant currency in 2010 compared to

the prior year. Segment performance was driven by Systems and

Technology which increased 11.0 percent year to year (11 percent

adjusted for currency) and Software which increased 5.1 percent

(5 percent adjusted for currency). Software revenue, excluding

PLM, grew 8.1 percent (8 percent adjusted for currency). Within

Software, performance was led by key branded middleware

which increased 10.8 percent (11 percent adjusted for currency)

compared to the prior year. Systems and Technology revenue

growth was driven by new product introductions and very strong

performance in the growth markets which increased 20 percent

(19 percent adjusted for currency).

The consolidated gross profit margin increased 0.3 points

versus 2009 to 46.1 percent, reflecting the improved business mix,

operating leverage and the continued success of the company’s

productivity initiatives. This was the seventh consecutive year

of improvement in the gross profit margin. Gross profit margin

performance by segment and the impact to the consolidated gross

margin was as follows:

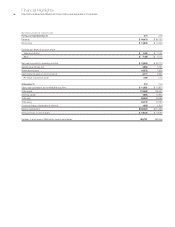

Gross Yr.-to-Yr. Consolidated

Margin Change Impact

Global Technology Services 34.7% (0.3) pts. (0.0) pts.

Global Business Services 28.3% 0.0 pts. 0.0 pts.

Software 86.9% 0.9 pts. 0.3 pts.

Systems and Technology 38.5% 0.7 pts. 0.0 pts.

Global Financing 51.3% 3.8 pts. 0.1 pts.

In 2010, the company continued to invest for innovation and

growth. These investments supported the introduction of the new

System z mainframe and POWER7 products and the success in

the performance of the growth markets. The company also invested

$6 billion to acquire 17 companies, adding significant new capa-

bilities to support its growth initiatives.

Total expense and other income increased 2.5 percent in 2010

versus 2009. The year-to-year drivers were approximately:

• Operational expense, (2) points

• Currency,* 1 point

• Acquisitions,** 3 points

* Reflects impacts of translation and hedging programs.

** Includes acquisitions completed in prior 12-month period.

Pre-tax income grew 8.7 percent and the pre-tax margin was 19.7

percent, an increase of 0.8 points versus 2009. Net income

increased 10.5 percent reflecting an improvement in the tax rate.

The effective tax rate was 24.8 percent, compared with 26.0

percent in the prior year. Net income margin improved 0.8 points

to 14.9 percent.

Diluted earnings per share improved 15.1 percent reflecting the

strong growth in net income and the benefits of the common stock

repurchase program. In 2010, the company repurchased approxi-

mately 118 million shares of its common stock. Diluted earnings per