IBM 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

Management Discussion

International Business Machines Corporation and Subsidiary Companies

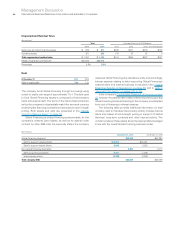

Global Financing Receivables and Allowances

The following table presents external financing receivables excluding

residual values, and the allowance for credit losses.

($ in millions)

At December 31: 2010 2009

Gross financing receivables $26,565 $25,508

Specific allowance for credit losses 305 416

Unallocated allowance for credit losses 96 120

Total allowance for credit losses 401 536

Net financing receivables $26,164 $24,972

Allowance for credit losses coverage 1.5% 2.1%

Roll Forward of Global Financing Receivables

Allowance for Credit Losses

($ in millions)

Allowance Additions/ Dec. 31,

Jan. 1, 2010 Used* (Reductions) Other** 2010

$536 $(121) $(9) $(4) $401

* Represents reserved receivables, net of recoveries, that were disposed of during

the period.

** Primarily represents translation adjustments.

The percentage of Global Financing receivables reserved decreased

from 2.1 percent at December 31, 2009 to 1.5 percent at December

31, 2010 primarily due to the disposition of receivables previously

reserved and the increase in gross financing receivables. Specific

reserves decreased 26.7 percent from $416 million at December 31,

2009 to $305 million at December 31, 2010. Unallocated reserves

decreased 20.2 percent from $120 million at December 31, 2009,

to $96 million at December 31, 2010. Global Financing’s bad debt

expense was a decrease of $9 million for 2010, compared to

an increase of $143 million for 2009. The year-to-year decrease

was primarily attributed to the decline of required specific reserve

additions and recoveries on previously reserved accounts.

Residual Value

Residual value is a risk unique to the financing business and man-

agement of this risk is dependent upon the ability to accurately

project future equipment values at lease inception. Global Financing

has insight into product plans and cycles for the IBM products

under lease. Based upon this product information, Global Financing

continually monitors projections of future equipment values and

compares them with the residual values reflected in the portfolio.

See note A, “Significant Accounting Policies,” on page 78 for the

company’s accounting policy for residual values.

Global Financing optimizes the recovery of residual values by

selling assets sourced from end of lease, leasing used equipment

to new clients, or extending lease arrangements with current

clients. Sales of equipment, which are primarily sourced from

equipment returned at the end of a lease, represented 47.4 percent

of Global Financing’s revenue in 2010 and 43.7 percent in 2009.

The increase was driven by higher sales revenue and lower financ-

ing revenue. The gross margin on these sales was 52.8 percent

and 51.3 percent in 2010 and 2009, respectively. The increase was

driven by an increase in the external used equipment sales margin.

The table on page 58 presents the recorded amount of

unguaranteed residual value for sales-type, direct financing and

operating leases at December 31, 2009 and 2010. In addition, the

table presents the residual value as a percentage of the related

original amount financed and a run out of when the unguaranteed

residual value assigned to equipment on leases at December 31,

2010 is expected to be returned to the company. In addition to

the unguaranteed residual value, on a limited basis, Global Financing

will obtain guarantees of the future value of the equipment to be

returned at end of lease. These third-party guarantees are

included in minimum lease payments as provided for by accounting

standards in the determination of lease classifications for the

covered equipment and provide protection against risk of loss

arising from declines in equipment values for these assets. The

residual value guarantee increases the minimum lease payments

that are utilized in determining the classification of a lease as a

sales-type lease or operating lease. The aggregate asset values

associated with the guarantees were $714 million and $569 million

for the financing transactions originated during the years ended

December 31, 2010 and 2009, respectively. In 2010, the residual

value guarantee program resulted in the company recognizing

approximately $453 million of revenue that would otherwise have

been recognized in future periods as operating lease revenue. If

the company had chosen to not participate in a residual value

guarantee program in 2010 and prior years, the 2010 impact would

be substantially mitigated by the effect of prior-year asset values

being recognized as operating lease revenue in the current

year. The associated aggregate guaranteed future values at the

scheduled end of lease were $43 million and $30 million for

the financing transactions originated during 2010 and 2009,

respectively. The cost of guarantees was $5 million for the year

ended December 31, 2010 and $4 million for the year ended

December 31, 2009.