IBM 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 91

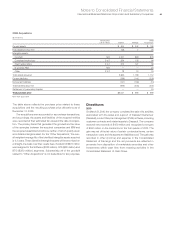

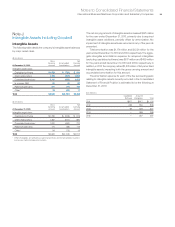

Financing Receivables on Non-Accrual Status

The following table presents the recorded investment in financing

receivables which are on non-accrual status.

($ in millions)

At December 31: 2010

Major markets $ 69

Growth markets 33

Total lease receivables $101

Major markets $141

Growth markets 123

Total loan receivables $264

Total receivables $366

Impaired Loans

The following table presents impaired client loan receivables.

($ in millions)

Recorded Related

At December 31, 2010: Investment Allowance

Major markets $196 $119

Growth markets 132 68

Tot a l $328 $187

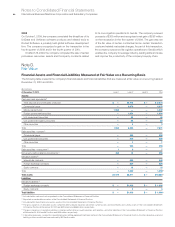

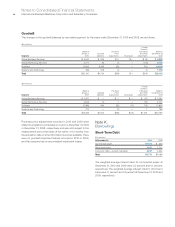

Credit Quality Indicators

The company’s credit quality indicators are based on rating agency

data, publicly available information and information provided by

the companies, and are reviewed periodically based on the relative

level of risk. The resulting indicators are a numerical rating system

that maps to Moody’s Investors Service credit ratings as shown

below. Moody’s has not provided to the company a credit rating

on its clients.

The following table presents the gross recorded investment

for each class of receivables, by credit quality indicator. Receivables

with a credit quality indicator ranging from Aaa to Baa3 are

considered investment grade. All others are considered non-

investment grade.

Lease Receivables

($ in millions)

Major Growth

At December 31, 2010: Markets Markets

Credit rating:

Aaa – Aa3 $ 787 $ 178

A1 – A3 1,444 178

Baa1 – Baa3 2,494 833

Ba1 – Ba2 853 397

Ba3 – B1 525 238

B2 – B3 262 99

Caa – D 197 59

Tot a l $6,562 $1,983

Loan Receivables

($ in millions)

Major Growth

At December 31, 2010: Markets Markets

Credit rating:

Aaa – Aa3 $1,090 $ 179

A1 – A3 1,999 179

Baa1 – Baa3 3,453 837

Ba1 – Ba2 1,181 399

Ba3 – B1 727 239

B2 – B3 363 100

Caa – D 273 60

Tot a l $9,087 $1,993

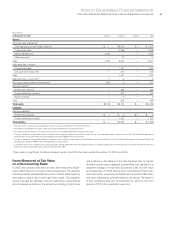

At December 31, 2010, the industries which make up Global

Financing’s receivables portfolio consist of: Financial (36 percent),

Government (16 percent), Manufacturing (14 percent), Retail

(9 percent), Services (8 percent), Communications (5 percent) and

Other (12 percent).