IBM 2010 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2000**

2010

8.1 9.12.0

11% 40% 25%

$201612840

1.6

8% 9% 39% 44%

1.2 4.5 2.8

24%

2.7

21

%

11%

00 06 07 08 09 10

50%

25 8

0

4

12

$16

0

00 10 00 10

12%

19.7%

46.1%

37%

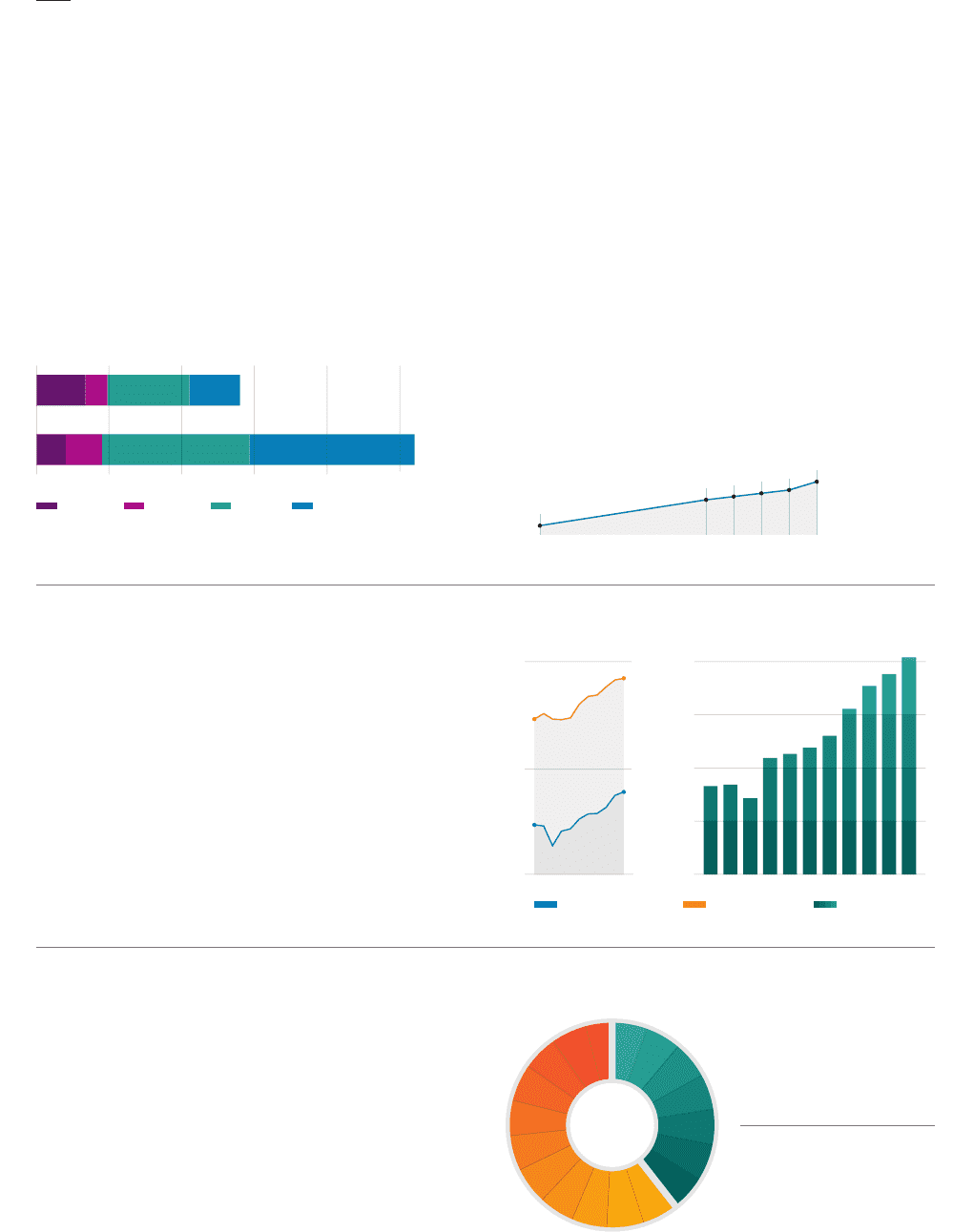

$70billion

Reinvested

Capital Expenditures & Acquisitions

$107billion

Returned to Shareholders

Share Repurchases & Dividends

$177

billion

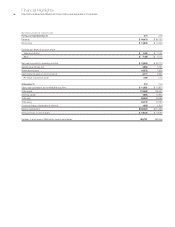

Hardware Financing Services Software

Pre-Tax Income Margin Gross Profit Margin Free Cash Flow

As the new century dawned, we saw change coming. The IT industry

and the broader economy were being transformed by the rising tide of

global integration, by a new computing model and by new client needs

for integration and innovation.

And that meant we needed to transform ourselves.

* Sum of external segment pre-tax income not equal to IBM pre-tax income.

** Excludes Enterprise Investments and not restated for stock-based compensation.

1. We changed our business mix toward

higher-value, more profitable technologies

and market opportunities.

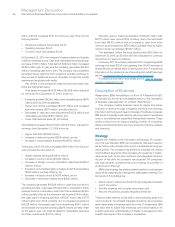

2. We became a globally integrated enterprise,

improving productivity and capturing new growth.

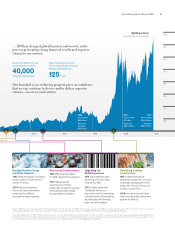

Since 2005, global integration has enabled IBM to gain $6 billion in

productivity savings while improving service quality. We have shifted

resources toward building client relationships and employee skills,

while positioning IBM for new market opportunities, such as business

analytics, Smarter Cities and infrastructure build-outs underway in

emerging markets.

4. We invested in future sources of growth

and provided record returns to shareholders …

Since the end of 2000, we invested $43 billion in capital

expenditures and $27 billion net on acquisitions (116 companies)

targeted toward high-value areas.

We returned $89 billion to our shareholders as share repurchases

and increased our dividend each year over the last decade.

At the end of 2010 our quarterly dividend per share was five

times higher than in 2000.

… while continuing to invest in R&D

—

nearly

$60 billion since the end of 2000.

3. By aligning our business model with our clients’

needs we generated superior financial results.

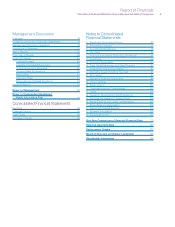

We achieved record earnings per share.

Diluted earnings per share in 2010 were $11.52, having nearly

tripled since the end of 2000, and marking eight consecutive

years of double-digit growth. Our focus on productivity

and a continuing shift in our business mix to more profitable

segments has helped drive our performance.

And record cash performance.

In 2010 our free cash flow, excluding the year-to-year change in

Global Financing receivables, was $16.3 billion—an increase of

$1.2 billion from 2009. Since the end of 2000 we have generated

$109 billion in free cash flow.

Primary Uses of Cash Since the End of 2000

Growth Markets Share of Geographic Revenue

(excluding divested businesses of PCs and printers)

Segment Pre-Tax Income*

($ in billions)

Financial Performance History

(% of total revenue, $ in billions)

10