IBM 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 107

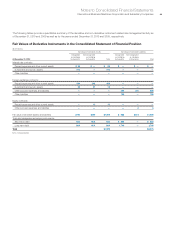

Deferred Tax Liabilities

($ in millions)

At December 31: 2010 2009

Leases $1,950 $2,129

Depreciation 1,223 1,138

Goodwill and intangible assets 909 639

Software development costs 638 409

Retirement benefits 338 389

Other 1,114 874

Gross deferred tax liabilities $6,172 $5,578

For income tax return purposes, the company has foreign and

domestic loss carryforwards, the tax effect of which is $909 million,

as well as domestic and foreign credit carryforwards of $797 million.

Substantially all of these carryforwards are available for at least

two years or are available for 10 years or more.

The valuation allowance at December 31, 2010 principally

applies to certain foreign, state and local loss carryforwards that,

in the opinion of management, are more likely than not to expire

unutilized. However, to the extent that tax benefits related to these

carryforwards are realized in the future, the reduction in the valu-

ation allowance will reduce income tax expense. The year-to-year

change in the allowance balance was a decrease of $17 million.

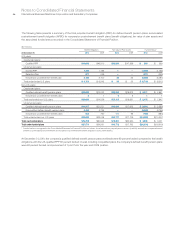

The amount of unrecognized tax benefits at December 31, 2010

increased by $503 million in 2010 to $5,293 million. A reconciliation

of the beginning and ending amount of unrecognized tax benefits

is as follows:

($ in millions)

2010 2009 2008

Balance at January 1 $ 4,790 $3,898 $3,094

Additions based on tax positions

related to the current year 1,054 554 1,481

Additions for tax positions of prior years 1,768 634 747

Reductions for tax positions

of prior years (including impacts

due to a lapse in statute) (1,659) (277) (1,209)

Settlements (660) (19) (215)

Balance at December 31 $ 5,293 $4,790 $3,898

The additions to unrecognized tax benefits related to the current

and prior years are primarily attributable to non-U.S. issues, certain

tax incentives and credits, acquisition-related matters and state

issues. The settlements and reductions to unrecognized tax

benefits for tax positions of prior years are primarily related to

non-U.S. audits and to the conclusion of the IRS examination of

the company’s income tax returns for 2006 and 2007 discussed on

page 106, as well as impacts due to lapses in statutes of limitation.

In April 2010, the company appealed the determination of a

non-U.S. local taxing authority with respect to certain foreign tax

losses. The tax benefit of these losses, approximately $1,475 million,

has been included in unrecognized tax benefits within 2010 addi-

tions for tax positions of prior years. This amount includes the

portion of these losses that had been utilized against a prior year

liability. As this amount was disallowed and a tax payment made

in the first quarter of 2010 it has also been included as part of the

settlements amount for 2010. No final determination has been

reached on this matter.

The liability at December 31, 2010 of $5,293 million can be

reduced by $444 million of offsetting tax benefits associated with

the correlative effects of potential transfer pricing adjustments, state

income taxes and timing adjustments. The net amount of $4,849

million, if recognized, would favorably affect the company’s effective

tax rate. The net amounts at December 31, 2009 and 2008 were

$4,213 million and $3,366 million, respectively.

Interest and penalties related to income tax liabilities are

included in income tax expense. During the year ended December

31, 2010, the company recognized a $15 million benefit in interest

expense and penalties; in 2009, the company recognized $193

million in interest expense and penalties, and in 2008, the company

recognized $96 million in interest expense and penalties. The

company has $374 million for the payment of interest and penalties

accrued at December 31, 2010 and had $479 million accrued at

December 31, 2009.

Within the next 12 months, the company believes it is reasonably

possible that the total amount of unrecognized tax benefits asso-

ciated with certain positions may be reduced. The company

expects that certain U.S. federal, foreign and state issues may be

concluded in the next 12 months. The company estimates that the

unrecognized tax benefits at December 31, 2010 could be reduced

by $280 million.

With limited exception, the company is no longer subject to U.S.

federal, state and local or non-U.S. income tax audits by taxing

authorities for years through 2004. The years subsequent to 2004

contain matters that could be subject to differing interpretations of

applicable tax laws and regulations as it relates to the amount and/

or timing of income, deductions and tax credits. Although the out-

come of tax audits is always uncertain, the company believes that

adequate amounts of tax and interest have been provided for any

adjustments that are expected to result for these years.