IBM 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

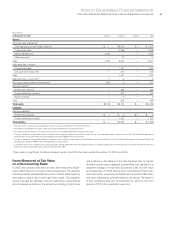

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 79

Common Stock

Common stock refers to the $.20 par value per share capital stock

as designated in the company’s Certificate of Incorporation.

Treasury stock is accounted for using the cost method. When

treasury stock is reissued, the value is computed and recorded

using a weighted-average basis.

Earnings Per Share of Common Stock

Earnings per share (EPS) is computed using the two-class method.

The two-class method determines EPS for each class of common

stock and participating securities according to dividends and

dividend equivalents and their respective participation rights in

undistributed earnings. Basic EPS of common stock is computed

by dividing net income by the weighted-average number of common

shares outstanding for the period. Diluted EPS of common stock is

computed on the basis of the weighted-average number of shares

of common stock plus the effect of dilutive potential common shares

outstanding during the period using the treasury stock method.

Dilutive potential common shares include outstanding stock options,

stock awards and convertible notes. See note R, “Earnings Per Share

of Common Stock,” on page 108 for additional information.

Note B.

Accounting Changes

New Standards to be Implemented

In December 2010, the Financial Accounting Standards Board

(FASB) issued amended guidance to clarify the acquisition date

that should be used for reporting pro-forma financial information

for business combinations. If comparative financial statements are

presented, the pro-forma revenue and earnings of the combined

entity for the comparable prior reporting period should be reported

as though the acquisition date for all business combinations that

occurred during the current year had been completed as of the

beginning of the comparable prior annual reporting period. The

amendments in this guidance are effective prospectively for business

combinations for which the acquisition date is on or after January

1, 2011. There will be no impact in the consolidated financial results

as the amendments relate only to additional disclosures.

In December 2010, the FASB issued amendments to the guid-

ance on goodwill impairment testing. The amendments modify

Step 1 of the goodwill impairment test for reporting units with zero

or negative carrying amounts. For those reporting units, an entity

is required to perform Step 2 of the goodwill impairment test if it

is more likely than not that a goodwill impairment exists. In making

that determination, an entity should consider whether there are

any adverse qualitative factors indicating that an impairment may

exist. The amendments are effective for fiscal years and interim

periods beginning January 1, 2011 and are not expected to have

a material impact in the Consolidated Financial Statements.

Standards Implemented

In July 2010, the FASB issued amendments to the disclosure

requirements about the credit quality of financing receivables and

the allowance for credit losses. The purpose of the additional

disclosures is to enable users of financial statements to better

understand the nature of credit risk inherent in an entity’s portfolio

of financing receivables and how that risk is analyzed. For end-of-

period balances, the new disclosures are required to be made in

all interim and annual periods ending on or after December 15,

2010. See Note G, “Financing Receivables,” on pages 90 to 92

and Note A, “Significant Accounting Policies,” on page 78 for the

company’s disclosures. For activity during a reporting period, the

disclosures are required to be included in all interim and annual

periods after January 1, 2011. In January 2011, the FASB issued an

amendment deferring the disclosures regarding troubled debt

restructurings until such time as new guidance on this topic is issued.

These changes did not have an impact in the consolidated financial

results as this guidance only relates to additional disclosures.

In January 2010, the FASB issued additional disclosure require-

ments for fair value measurements. According to the guidance, the

fair value hierarchy disclosures should be disaggregated by class

of assets and liabilities. A class is often a subset of assets or

liabilities within a line item in the statement of financial position. In

addition, significant transfers between Levels 1 and 2 of the fair

value hierarchy are required to be disclosed. These additional

requirements became effective January 1, 2010 for quarterly and

annual reporting. These amendments did not have an impact in

the consolidated financial results as this guidance relates only to

additional disclosures. See Note D, “Fair Value,” on pages 86 and

87 for the company’s disclosures. The guidance also requires more

detailed disclosures of the changes in Level 3 instruments. These

changes became effective January 1, 2011 and are not expected

to have an impact in the consolidated financial results as they

relate only to additional disclosures.

In October 2009, the FASB issued amended revenue recogni-

tion guidance for arrangements with multiple deliverables. The

new guidance requires the use of management’s BESP for the

deliverables in an arrangement when VSOE, vendor objective

evidence (VOE) or TPE of the selling price is not available. In

addition, excluding specific software revenue recognition guidance,

the residual method of allocating arrangement consideration is no

longer permitted, and an entity is required to allocate arrangement

consideration using the relative selling price method. In accordance

with the guidance, the company elected to early adopt its provi-

sions as of January 1, 2010 on a prospective basis for all new or

materially modified arrangements entered into on or after that date.

The adoption of this guidance did not have a material impact in

the Consolidated Financial Statements.