IBM 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

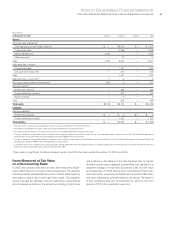

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies80

Also, in October 2009, the FASB issued guidance which

amended the scope of existing software revenue recognition

guidance. Tangible products containing software components and

non-software components that function together to deliver the

tangible product’s essential functionality are no longer within the

scope of software revenue recognition guidance and are accounted

for based on other applicable revenue recognition guidance. In

addition, the amendments require that hardware components of a

tangible product containing software components are always

excluded from the software revenue recognition guidance. This

guidance must be adopted in the same period that the company

adopts the amended guidance for arrangements with multiple

deliverables described in the preceding paragraph. Therefore,

the company elected to early adopt this guidance as of January 1,

2010 on a prospective basis for all new or materially modified

arrangements entered into on or after that date. The adoption of

this guidance did not have a material impact in the Consolidated

Financial Statements.

For transactions entered into prior to January 1, 2010, the com-

pany recognized revenue based on established revenue recognition

guidance as it related to the elements within the arrangement. For

the vast majority of the company’s arrangements involving multiple

deliverables, the fee from the arrangement was allocated to each

respective element based on its relative fair value, using VSOE. In

the limited circumstances when the company was not able to

determine VSOE for all of the elements of the arrangement, but

was able to obtain VSOE for any undelivered elements, revenue

was allocated using the residual method. Under the residual

method, the amount of revenue allocated to delivered elements

equaled the total arrangement consideration less the aggregate

fair value of any undelivered elements, and no revenue was recog-

nized until all elements without VSOE had been delivered. If VSOE

of any undelivered items did not exist, revenue from the entire

arrangement was initially deferred and recognized at the earlier of:

(i) delivery of those elements for which VSOE did not exist or (ii)

when VSOE was established. The residual method and recognition

of revenue on a ratable basis were generally used in circumstances

where VSOE, as applicable, was unavailable.

If the new amended accounting standards for multiple-deliver-

able arrangements and the changes to the scope of existing soft-

ware revenue recognition guidance were applied to transactions

in the year ended December 31, 2009, it would not have resulted

in a material change to the company’s reported revenue for that

fiscal year.

In addition, there would not have been a material impact

to revenue, as reported for the year ended December 31, 2010, if

the transactions entered into or materially modified on or after

January 1, 2010 were subject to the previous accounting guidance.

In terms of the timing and pattern of revenue recognition, the new

accounting guidance for revenue recognition is not expected to

have a material impact on revenue in future periods.

In June 2009, the FASB issued amendments to the accounting

rules for variable interest entities (VIEs). The new guidance eliminates

the quantitative approach previously required for determining

the primary beneficiary of a variable interest entity and requires

ongoing qualitative reassessments of whether an enterprise is the

primary beneficiary. The company adopted these amendments for

the interim and annual reporting periods beginning on January 1,

2010. The adoption of these amendments did not have a material

impact in the Consolidated Financial Statements.

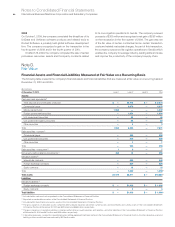

In September 2009, the FASB issued amended guidance

concerning fair value measurements of investments in certain

entities that calculate net asset value per share (or its equivalent). If

fair value is not readily determinable, the amended guidance permits,

as a practical expedient, a reporting entity to measure the fair value

of an investment using the net asset value per share (or its equivalent)

provided by the investee without further adjustment. In accordance

with the guidance, the company adopted these amendments for

the year ended December 31, 2009. There was no material impact

in the Consolidated Financial Statements.

In May 2009, the FASB issued guidelines on subsequent event

accounting which sets forth: 1) the period after the balance sheet

date during which management of a reporting entity should eval-

uate events or transactions that may occur for potential recognition

or disclosure in the financial statements; 2) the circumstances

under which an entity should recognize events or transactions

occurring after the balance sheet date in its financial statements;

and 3) the disclosures that an entity should make about events or

transactions that occurred after the balance sheet date. These

guidelines were effective for interim and annual periods ending

after June 15, 2009, and the company adopted them in the quarter

ended June 30, 2009. In February 2010, the guidance was

amended to remove the requirement to disclose the date through

which subsequent events were evaluated. There was no impact

in the consolidated financial results.

On January 1, 2009, the company adopted the revised FASB

guidance regarding business combinations which was required to

be applied to business combinations on a prospective basis. The

revised guidance requires that the acquisition method of accounting

be applied to a broader set of business combinations, amends

the definition of a business combination, provides a definition of a

business, requires an acquirer to recognize an acquired business

at its fair value at the acquisition date, and requires the assets and

liabilities assumed in a business combination to be measured and

recognized at their fair values as of the acquisition date (with limited

exceptions). There was no impact upon adoption and the effects

of this guidance depend on the nature and significance of business

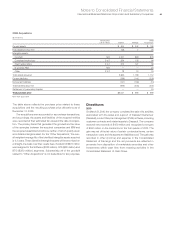

combinations occurring after the effective date. See note C,

“Acquisitions/Divestitures”, on pages 81 to 86 for further information.