IBM 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 117

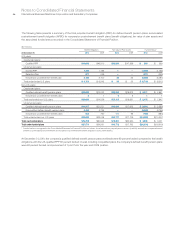

($ in millions)

Defined Benefit Pension Plans Nonpension Postretirement Benefit Plans

U.S. Plans Non-U.S. Plans U.S. Plan Non-U.S. Plans

For the year ended December 31: 2010 2009 2010 2009 2010 2009 2010 2009

Net loss at January 1 $14,880 $15,623 $17,172 $18,898 $397 $454 $167 $155

Current period loss/(gain) 1,456 (332) 1,130 (1,107) 96 (57) 24 24

Curtailments and settlements — — (10) 6 — — — —

Amortization of net loss included in net

periodic (income)/cost (471) (411) (712) (624) — — (12) (11)

Net loss at December 31 $15,865 $14,880 $17,580 $17,172 $492 $397 $180 $167

Prior service costs/(credits) at January 1 $ 159 $ 168 $ (1,104) $ (980) $ (14) $ (53) $ (19) $ (21)

Current period prior service costs/(credits) — — (28) (370) — — (0) (5)

Curtailments and settlements — — — 120 — — — —

Amortization of prior service (costs)/credits

included in net periodic (income)/cost (10) (10) 174 126 14 39 5 6

Prior service costs/(credits) at December 31 $ 149 $ 159 $ (958) $ (1,104) $ — $ (14) $ (14) $ (19)

Transition (assets)/liabilities at January 1 $ — $ — $ (1) $ (1) $ — $ — $ 1 $ 1

Amortization of transition assets/(liabilities)

included in net periodic (income)/cost — — 0 0 — — (0) 0

Transition (assets)/liabilities at December 31 $ — $ — $ (0) $ (1) $ — $ — $ 1 $ 1

Total loss recognized in accumulated

other comprehensive income/(loss)* $16,014 $15,038 $16,621 $16,067 $492 $ 382 $167 $148

* See note N, “Equity Activity,” on page 103 for the total change in the accumulated other comprehensive income/(loss) and the Consolidated Statement of Changes in Equity for

the components of net periodic (income)/cost, including the related tax effects, recognized in other comprehensive income/(loss) for the retirement-related benefit plans.

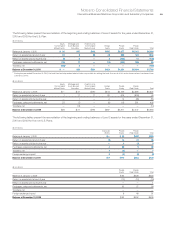

The following table presents the pre-tax estimated net loss, estimated prior service costs/(credits) and estimated transition (assets)/

liabilities of the retirement-related benefit plans that will be amortized from accumulated other comprehensive income/(loss) into net

periodic (income)/cost and recorded in the Consolidated Statement of Earnings in 2011.

($ in millions)

Defined Nonpension Post-

Benefit Pension Plans retirement Benefit Plans

U.S. Plans Non-U.S. Plans U.S. Plan Non-U.S. Plans

Net loss $844 $ 972 $— $13

Prior service costs/(credits) 9 (171) — (4)

Transition (assets)/liabilities — (0) — —

During the year ended December 31, 2010, the company paid

$22 million for mandatory pension insolvency insurance coverage

premiums in certain non-U.S. countries (Germany, Canada,

Luxembourg and the U.K.), a decrease of $118 million from the

year ended December 31, 2009, driven by a decline in insolvency

claims. Premiums were significantly higher during 2009 due to the

increased level of insolvencies experienced by other companies

as a result of the economic crisis.

No significant amendments of retirement-related benefit plans

occurred during the year ended December 31, 2010 that had a

material effect in the Consolidated Statement of Earnings.

During the year ended December 31, 2009, the company

approved changes to the United Kingdom Pension Plan which

included ending benefit accruals under this plan effective April 2011.

As a result of this action, the company recorded a curtailment gain

of $124 million included in 2009 net periodic (income)/cost and

reduced the PBO by $85 million. The company also amended its

cash balance and defined contribution plans in Japan to reduce

overall benefits for active participants for future years of service.

This amendment resulted in a decrease in the PBO of $359 million

and had no impact on 2009 net periodic (income)/cost.

During the year ended December 31, 2008, the IBM Board of

Directors approved a pension adjustment for certain U.S. retirees and

beneficiaries in the PPP. This adjustment provided a pension increase

to approximately 42,000 IBM retirees who retired before January 1,

1997. This adjustment resulted in an increase in the PBO of $222

million and had no impact on 2008 net periodic (income)/cost.

During the year ended December 31, 2008, the company

terminated one of its defined benefit pension plans in Japan that

resulted in a settlement gain of $140 million which was recorded

as part of 2008 net periodic (income)/cost and, also resulted in a

decrease in the PBO of $157 million.