IBM 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Debt

The company’s funding requirements are continually monitored

and strategies are executed to manage the overall asset and liability

profile. Additionally, the company maintains sufficient flexibility to

access global funding sources as needed.

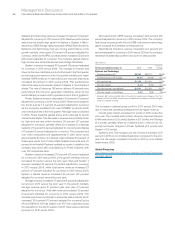

($ in millions)

At December 31: 2010 2009

Total company debt $28,624 $26,099

Total Global Financing segment debt: $22,823 $22,383

Debt to support external clients 19,583 19,091

Debt to support internal clients 3,240 3,292

Global Financing provides financing predominantly for the company’s

external client assets, as well as for assets under contract by other

IBM units. These assets, primarily for Global Services, generate

long-term, stable revenue streams similar to the Global Financing

asset portfolio. Based on their attributes, these Global Services

assets are leveraged with the balance of the Global Financing

asset base. The debt analysis above is further detailed in the

Global Financing section on page 58.

Given the significant leverage, the company presents a debt-

to-capitalization ratio which excludes Global Financing debt and

equity as management believes this is more representative of the

company’s core business operations. This ratio can vary from

period to period as the company manages its global cash and

debt positions.

“Core” debt-to-capitalization ratio (excluding Global Financing

debt and equity) was 22.6 percent at December 31, 2010 compared

to 16.0 percent at December 31, 2009. The increase was primarily

driven by an increase in non-Global Financing debt of $2,084 million.

With this amount of leverage, the company continues to have a high

degree of financial flexibility.

Consolidated debt-to-capitalization ratio at December 31, 2010

was 55.3 percent versus 53.4 percent at December 31, 2009.

Equity

Total equity increased $418 million primarily as a result of an

increase in retained earnings of $11,632 million and an increase of

$3,608 million in common stock, substantially offset by an increase

in treasury stock of $14,918 million driven by common stock

repurchases during 2010.

Consolidated Fourth-Quarter Results

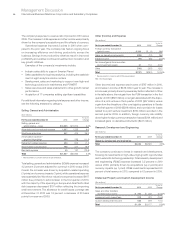

($ and shares in millions except per share amounts)

Yr.-to-Yr.

Percent/

Margin

For the fourth quarter: 2010 2009 Change

Revenue $29,019 $27,230 6.6%*

Gross profit margin 49.0% 48.3% 0.8 pts.

Total expense and other income $ 7,271 $ 6,765 7.5%

Total expense and other

income-to-revenue ratio 25.1% 24.8% 0.2 pts.

Income before income taxes $ 6,956 $ 6,381 9.0%

Provision for income taxes 1,698 1,568 8.3%

Net income $ 5,257 $ 4,813 9.2%

Net income margin 18.1% 17.7% 0.4 pts.

Earnings per share of common stock:

Assuming dilution $ 4.18 $ 3.59 16.4%

Weighted-average shares outstanding:

Assuming dilution 1,258.4 1,340.7 (6.1)%

* 7.1 percent adjusted for currency.

Snapshot

The fourth quarter of 2010 capped off a very good year as the

company continued the trend of improving business performance,

increasing constant currency revenue growth, expanding margins

and again delivering double-digit earnings per share growth. Diluted

earnings per share of $4.18 increased 16.4 percent versus the fourth

quarter of 2009 and represented the 32nd consecutive quarter of

earnings per share growth for the company. The company delivered

solid financial results while continuing a high level of investment to

drive future growth and delivering strong shareholder returns.

Total revenue increased 6.6 percent as reported (7 percent

adjusted for currency) versus the fourth quarter of 2009 driven by

hardware and software. This was the highest quarterly constant

currency revenue growth rate in nearly a decade. Systems and

Technology revenue increased 21.0 percent (22 percent adjusted

for currency) with growth in every platform and strong performance

in the System z mainframe product. Software revenue increased

7.0 percent (8 percent adjusted for currency) as reported, and was

up 10.5 percent (12 percent adjusted for currency) without the

divested PLM operations. Software’s 12 percent growth at constant

currency was double the growth rate of its strong performance in

the first three quarters of the year. Total Global Services revenue

growth of 2.0 percent (2 percent adjusted for currency) was con-

sistent with third-quarter 2010 performance. The estimated Global

Services backlog at actual currency rates was $142 billion, an

increase of $5 billion ($4 billion adjusted for currency) compared

to the December 31, 2009 level and an increase of $8 billion ($7

billion adjusted for currency) from September 30, 2010. From a

geographic perspective, major markets revenue increased 3.9

percent (5 percent adjusted for currency) led by constant currency

growth in the U.S., France and Italy. Total revenue in the growth

markets increased 15.4 percent (13 percent adjusted for currency)