IBM 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies106

Note P.

Ta xes

($ in millions)

For the year ended December 31: 2010 2009 2008

Income before income taxes:

U.S. operations $ 9,140 $ 9,524 $ 8,424

Non-U.S. operations 10,583 8,614 8,291

Total income before income taxes $19,723 $18,138 $16,715

The provision for income taxes by geographic operations is as

follows:

($ in millions)

For the year ended December 31: 2010 2009 2008

U.S. operations $2,000 $2,427 $2,348

Non-U.S. operations 2,890 2,286 2,033

Total provision for income taxes $4,890 $4,713 $4,381

The components of the provision for income taxes by taxing juris-

diction are as follows:

($ in millions)

For the year ended December 31: 2010 2009 2008

U.S. federal:

Current $ 190 $ 473 $ 338

Deferred 1,015 1,341 1,263

1,205 1,814 1,601

U.S. state and local:

Current 279 120 216

Deferred 210 185 205

489 305 421

Non-U.S.:

Current 3,127 2,347 1,927

Deferred 69 247 432

3,196 2,594 2,359

Total provision for income taxes 4,890 4,713 4,381

Provision for social security, real estate,

personal property and other taxes 4,018 3,986 4,076

Total taxes included in net income $8,908 $8,699 $8,457

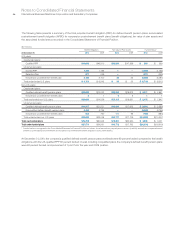

A reconciliation of the statutory U.S. federal tax rate to the company’s

effective tax rate is as follows:

For the year ended December 31: 2010 2009 2008

Statutory rate 35% 35% 35%

Foreign tax differential (10) (9) (8)

State and local 2 1 1

Other (2) (1) (2)

Effective rate 25% 26% 26%

In the fourth quarter of 2010, the Internal Revenue Service (IRS)

concluded its examination of the company’s income tax returns

for 2006 and 2007 and issued a final Revenue Agent’s Report

(RAR). The company has agreed with all of the adjustments in the

RAR with the exception of proposed adjustments relating to the

valuation of certain IP. The company disagrees with the IRS on

these specific matters and intends to contest the proposed adjust-

ments through the IRS appeals process and the courts, if neces-

sary. The company has redetermined its unrecognized tax benefits,

including all similar items in open tax years, based on the agreed

and disputed adjustments contained in the RAR and associated

information and analysis.

The 2010 effective tax rate benefited by 6.4 points from the

completion of the IRS examination discussed above including asso-

ciated reserve redeterminations. In addition, the effective tax rate

also benefited from the utilization of foreign tax credits as well as

the company’s geographic mix of pre-tax income and incentives.

These benefits were partially offset by the 2010 tax charges

related to certain intercompany payments made by foreign sub-

sidiaries, tax impacts of certain business restructuring transactions

and the tax costs associated with the intercompany licensing of

certain IP.

The net impact of the above items is primarily reflected as part

of the foreign tax differential.

The effect of tax law changes on deferred tax assets and

liabilities did not have a material impact on the company’s effective

tax rate.

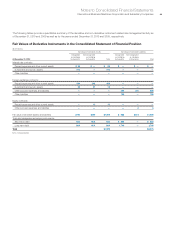

The significant components of deferred tax assets and liabilities

that are recorded in the Consolidated Statement of Financial

Position were as follows:

Deferred Tax Assets

($ in millions)

At December 31: 2010 2009

Retirement benefits $ 4,131 $ 3,921

Share-based and other compensation 1,570 1,853

Deferred income 1,080 847

Domestic tax loss/credit carryforwards 948 859

Foreign tax loss/credit carryforwards 758 680

Bad debt, inventory and warranty reserves 564 605

Depreciation 470 485

Capitalized research and development 291 539

Other 1,486 1,999

Gross deferred tax assets 11,298 11,788

Less: valuation allowance 795 812

Net deferred tax assets $10,503 $10,976