IBM 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Software revenue of $21,396 million decreased 3.1 percent (1 percent

adjusted for currency) in 2009 compared to 2008. Adjusted for

currency, growth in the Key Branded Middleware products was

offset by decreased revenue in other components of the software

portfolio. Overall, the software business continued to perform well

in the uncertain environment. The company’s acquisitions increased

revenue and the company is continuing to invest in capabilities

that accelerate the development of new market opportunities like

business analytics and smarter planet.

Key Branded Middleware revenue increased 1.1 percent

(3 percent adjusted for currency) and represented 59 percent of

total Software revenue, an increase of 2 points from 2008. The

company continued to solidify its lead in the middleware market,

gaining share for nine consecutive quarters. Organic investments

and acquisitions in middleware capabilities continue to result in it

becoming a larger portion of the software portfolio and improving

the overall software revenue growth rate. Growth in 2009, adjusted

for currency, was led by WebSphere and Tivoli.

WebSphere revenue increased 10.5 percent (13 percent

adjusted for currency) in 2009 with strong performance through-

out the year. Application Servers, which provide customers with

a secure and resilient infrastructure for mission-critical business

applications, grew 5 percent adjusted for currency. Business

Integration software had double-digit revenue growth in 2009,

including strong contribution from ILOG, a company acquired

in the fourth quarter of 2008.

Information Management revenue decreased 0.5 percent

(increased 2 percent adjusted for currency) in 2009 versus the prior

year, with revenue growth, adjusted for currency, in both Information

Management solutions and infrastructure offerings. Cognos and

InfoSphere software, two key components of the business analytics

area, both had double-digit revenue growth adjusted for currency.

The acquisition of SPSS, which was completed in early October

2009, further expands the company’s business analytics capabilities.

Lotus revenue decreased 10.0 percent (8 percent adjusted for

currency) in 2009. Demand for Lotus software was impacted by

customer consolidations and downsizing throughout 2009.

Tivoli revenue increased 2.9 percent (5 percent adjusted for

currency) in 2009 when compared to 2008, driven by growth in

storage software. Tivoli storage revenue grew consistently

throughout the year as customers managed their rapidly growing

storage data.

Rational revenue increased 0.2 percent in 2009 as reported and

increased 3 percent adjusted for currency versus 2008. Rational’s

integrated software tools improve the speed, quality and efficiency

for customers with software development projects. Telelogic con-

tributed strong revenue growth in 2009 and extended the brand’s

reach into the systems development market opportunity.

Revenue from Other middleware products decreased 6.3

percent (3 percent adjusted for currency) in 2009 versus the prior

year. This software product set includes more mature products

which provide a more stable flow of revenue.

Operating systems product revenue decreased 7.4 percent

(5 percent adjusted for currency) in 2009 compared to 2008,

reflecting declining sales in all system brands.

Other revenue declined 13.9 percent (12 percent adjusted for

currency) versus 2008 primarily driven by a decrease in PLM

software.

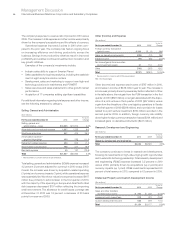

Software

($ in millions)

Yr.-to-Yr.

Yr.-to-Yr. Change Adjusted

For the year ended December 31: 2009* 2008* Change for Currency

Software external revenue: $21,396 $22,089 (3.1)% (0.8)%

Middleware $17,125 $17,305 (1.0)% 1.4%

Key Branded Middleware 12,524 12,392 1.1 3.4

WebSphere 10.5 12.7

Information Management (0.5) 1.9

Lotus (10.0) (7.9)

Tivoli 2.9 5.1

Rational 0.2 2.7

Other middleware 4,602 4,912 (6.3) (3.5)

Operating systems 2,163 2,337 (7.4) (4.9)

Other 2,108 2,448 (13.9) (12.0)

* Reclassified to conform with 2010 presentation.