IBM 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Expense

Total expense and other income increased 7.5 percent year to

year with an expense-to-revenue ratio of 25.1 percent compared

to 24.8 percent in the fourth quarter of 2009. The increase in total

expense and other income was primarily driven by the company’s

acquisitions over the past 12 months, a higher level of expense in

support of fourth-quarter revenue performance and investment

in capacity to support future growth. Within SG&A expense, work-

force rebalancing charges decreased approximately $60 million

compared to a relatively high level of activity in the fourth quarter

of 2009. With the year-to-year change in currencies, the hedge

of cash flow program generated a loss of approximately $40 million

in the fourth quarter of 2010 compared with a loss of over $250

million in the fourth quarter of 2009.

The company’s effective tax rate in the fourth quarter of 2010

was 24.4 percent compared with 24.6 percent in the fourth quarter

of 2009.

Share repurchases totaled $3,592 million in the fourth quarter.

The weighted-average number of diluted common shares out-

standing in the fourth quarter of 2010 was 1,258.4 million compared

with 1,340.7 million in the fourth quarter of 2009.

Cash Flow

The company ended the fourth quarter of 2010 with $10,661 million

in cash and cash equivalents, an increase of $801 million from

September 30, 2010. The company generated $6,795 million in

cash flow provided by operating activities, an increase of $347

million compared to the fourth quarter of 2009, driven primarily by

working capital/other ($978 million) and an increase in net income

($445 million), partially offset by Global Financing receivables

($1,060 million). Net cash used in investing activities of $4,082

million increased $1,587 million primarily due to increased acquisi-

tions of $1,859 million. Net cash used in financing activities of

$1,859 million increased $653 million due to higher payments to

repurchase common stock ($538 million), lower cash from other

common stock transactions ($401 million) and increased dividend

payments ($81 million), partially offset by an increased net benefit

associated with debt ($367 million).

Prior Year in Review

The “Prior Year in Review” section provides a summary of the

company’s financial performance in 2009 as compared to 2008.

For a detailed discussion of 2009 performance, see the 2009

Annual Report.

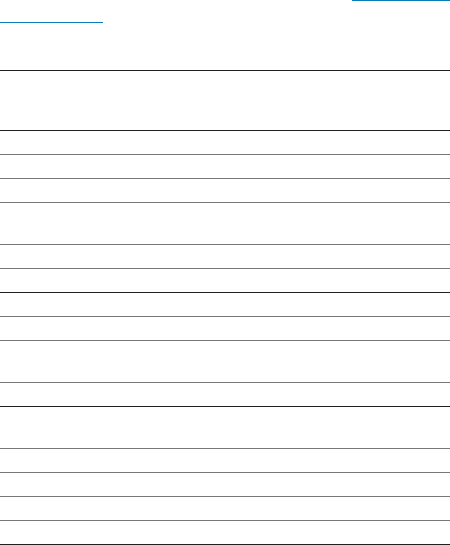

($ and shares in millions except per share amounts)

Yr.-to-Yr.

Percent/

Margin

For the year ended December 31: 2009 2008 Change

Revenue $ 95,758 $103,630 (7.6)%*

Gross profit margin 45.7% 44.1% 1.7 pts.

Total expense and other income $ 25,647 $ 28,945 (11.4)%

Total expense and other

income-to-revenue ratio 26.8% 27.9% (1.1) pts.

Income before income taxes $ 18,138 $ 16,715 8.5%

Provision for income taxes 4,713 4,381 7.6%

Net income $ 13,425 $ 12,334 8.8%

Net income margin 14.0% 11.9% 2.1 pts.

Earnings per share of

common stock:

Assuming dilution $ 10.01 $ 8.89 12.6%

Weighted-average shares

outstanding:

Assuming dilution 1,341.4 1,387.8 (3.3)%

Assets** $109,022 $109,524 (0.5)%

Liabilities** $ 86,267 $ 95,939 (10.1)%

Equity** $ 22,755 $ 13,584 67.5%

* (5.3) percent adjusted for currency.

** At December 31.

In 2009, in a difficult global economic environment, the company

continued to deliver value to its clients and strong financial results

to its investors—with profit growth driven by continued margin

expansion, expense productivity, market share gains in software

and systems and a continuing strong cash position. The company

again achieved record levels of pre-tax profit, earnings per share

and cash flow from operations—despite a decline in revenue. The

financial performance reflected the strength of the company’s global

model and the results of the strategic transformation of the business.