IBM 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Management Discussion

International Business Machines Corporation and Subsidiary Companies

The company’s expense-to-revenue ratio improved in 2010 versus

2009. The increase in total expense and other income was primarily

driven by the company’s acquisitions and the effects of currency.

Operational expense improved 2 points in 2010 when com-

pared to the prior year. The company has had an ongoing focus

on increasing efficiency and driving productivity across the

business. Savings from productivity initiatives result in improved

profitability and enables continued investments in innovation and

key growth initiatives.

Examples of the company’s investments include:

• Industry sales skills to support Smarter Planet

•

Sales capabilities for business analytics, including the establish-

ment of eight analytics solution centers

• Development, sales and marketing to support new high-end

technology solutions in mainframes and POWER7

•

Sales resources and sales enablement to drive growth market

performance

• Acquisition of 17 companies adding significant capabilities

For additional information regarding total expense and other income,

see the following analyses by category.

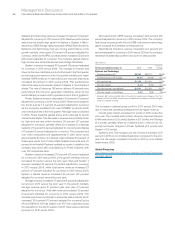

Selling, General and Administrative

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2010 2009* Change

Selling, general and

administrative — base $18,585 $17,872 4.0%

Advertising and promotional expense 1,337 1,255 6.6

Work force reductions 641 474 35.3

Amor tization expense —

acquired intangibles 253 285 (11.3)

Retirement-related expense 494 503 (1.7)

Stock-based compensation 488 417 16.9

Bad debt expense 40 147 (72.5)

Tot a l $21,837 $20,952 4.2%

* Reclassified to conform with 2010 presentation.

Total selling, general and administrative (SG&A) expense increased

4.2 percent (3 percent adjusted for currency) in 2010 versus 2009.

Overall, the increase was driven by acquisition-related spending

(3 points) and currency impacts (1 point), while operational expense

was essentially flat. Workforce reductions expense increased $167

million due primarily to actions taken in the first quarter of 2010,

with the majority of the spending in Europe and Asia Pacific. Bad

debt expense decreased $107 million reflecting the improving

credit environment. The allowance for credit losses coverage rate

at December 31, 2010 was 1.8 percent, a decrease of 20 basis

points from year-end 2009.

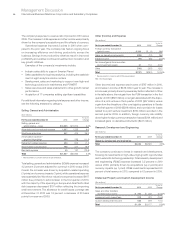

Other (Income) and Expense

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2010 2009* Change

Foreign currency transaction

(gains)/losses $ 303 $ (1) NM

Gains on derivative instruments (239) (12) NM

Interest income (92) (94) (2.3)%

Net losses/(gains) from securities

and investment assets 31 112 (72.1)

Other (790) (357) 121.2

Tot a l $(787) $(351) 124.5%

* Reclassified to conform with 2010 presentation.

NM—Not meaningful

Other (income) and expense was income of $787 million in 2010,

an increase in income of $436 million year to year. The increase in

income was primarily driven by several key factors reflected in Other

in the table above: the net gain from the PLM transaction in the first

quarter of 2010 ($591 million); a net gain associated with the dispo-

sition of a joint venture in third quarter of 2010 ($57 million) versus

a gain from the divestiture of the core logistics operations to Geodis

in the first quarter of 2009 ($298 million); and a provision for losses

related to a joint venture investment ($119 million) recorded in the

second quarter 2009. In addition, foreign currency rate volatility

drove higher foreign currency transaction losses ($304 million) and

increased gains on derivative instruments ($227 million).

Research, Development and Engineering

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2010 2009 Change

Research, development and engineering

Tot a l $6,026 $5,820 3.5%

The company continues to invest in research and development,

focusing its investments on high-value, high-growth opportunities

and to extend its technology leadership. Total research, development

and engineering (RD&E) expense increased 3.5 percent in 2010

versus 2009, primarily driven by acquisitions (up 2 points) and

currency impacts (up 1 point). RD&E investments represented 6.0

percent of total revenue in 2010, compared to 6.1 percent in 2009.

Intellectual Property and Custom Development Income

($ in millions)

Yr.-to-Yr.

For the year ended December 31: 2010 2009 Change

Sales and other transfers

of intellectual property $ 203 $ 228 (10.8)%

Licensing/royalty-based fees 312 370 (15.6)

Custom development income 638 579 10.3

Tot a l $1,154 $1,177 (1.9)%