IBM 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Overview

The financial section of the International Business Machines Cor-

por ation (IBM or the company) 2010 Annual Report includes the

Management Discussion, the Consolidated Financial State ments

and the Notes to the Consolidated Financial State ments. This

Over view is designed to provide the reader with some perspective

regarding the information contained in the financial section.

Organization of Information

• The Management Discussion is designed to provide readers

with an overview of the business and a narrative on the com-

pany’s financial results and certain factors that may affect

its future prospects from the perspective of the company’s

management. The “Management Discussion Snap shot” on

pages 18 to 20 presents an overview of the key performance

drivers in 2010.

•

Beginning with the “Year in Review” on page 25, the Manage ment

Discussion contains the results of operations for each reportable

segment of the business and a discussion of the company’s

financial position and cash flows. Other key sections within the

Management Discussion include: “Looking Forward” on pages

46 and 47 and “Liquidity and Capital Resources” on pages 47

to 50. It is useful to read the Management Dis cussion in conjunc-

tion with note V, “Segment Information,” on pages 126 to 130.

• Global Financing is a reportable segment that is measured as

a standalone entity. A separate “Global Financing” section is

included beginning on page 55.

• The Consolidated Financial Statements are presented on pages

62 through 67. These statements provide an overview of the

company’s income and cash flow performance and its financial

position.

• The Notes follow the Consolidated Financial Statements.

Among other items, the Notes contain the company’s accounting

policies (pages 68 to 79), acquisitions and divestitures (pages

81 to 86), detailed information on specific items within the finan-

cial statements, certain contingencies and commitments (pages

103 through 105), and retirement-related benefits information

(pages 112 through 126).

• The Consolidated Financial Statements and the Notes have been

prepared in accordance with accounting principles generally

accepted in the United States (GAAP).

• The references to “adjusted for currency” or “at constant cur-

rency” in the Management Discussion are made so that certain

financial results can be viewed without the impact of fluctuations

in foreign currency exchange rates, thereby facilitating period-

to-period comparisons of business performance. Financial

results adjusted for currency are calculated by translating

current period activity in local currency using the comparable

prior year period’s currency conversion rate. This approach is

used for countries where the functional currency is the local

country currency. See “Currency Rate Fluctuations” on page

53 for additional information.

•

Within the financial statements and tables in this Annual Report,

certain columns and rows may not add due to the use of rounded

numbers for disclosure purposes. Percentages reported are

calculated from the underlying whole-dollar numbers.

Forward-Looking

and Cautionary Statements

Certain statements contained in this Annual Report may constitute

forward-looking statements within the meaning of the Private Secur-

ities Litigation Reform Act of 1995. Any forward-looking statement

in this Annual Report speaks only as of the date on which it is made;

the company assumes no obligation to update or revise any such

statements. Forward-looking statements are based on the com-

pany’s current assumptions regarding future business and financial

performance; these statements by their nature address matters that

are uncertain to different degrees. Forward-looking statements

involve a number of risks, uncertainties and other factors that could

cause actual results to be materially different, as discussed more

fully elsewhere in this Annual Report and in the company’s filings

with the Securities and Exchange Commission (SEC), including the

company’s 2010 Form 10-K filed on February 22, 2011.

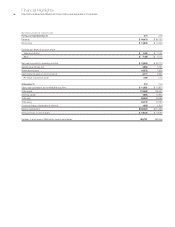

Management Discussion Snapshot

($ and shares in millions except per share amounts)

Yr.- to -Yr.

Percent/

Margin

For the year ended December 31: 2010 2009 Change

Revenue $ 99,870 $ 95,758 4.3%*

Gross profit margin 46.1% 45.7% 0.3 pts.

Total expense and other income $ 26,291 $ 25,647 2.5%

Total expense and other

income-to-revenue ratio 26.3% 26.8% (0.5) pts.

Income before income taxes $ 19,723 $ 18,138 8.7%

Provision for income taxes 4,890 4,713 3.8%

Net income $ 14,833 $ 13,425 10.5%

Net income margin 14.9% 14.0% 0.8 pts.

Earnings per share of

common stock:

Assuming dilution $ 11.52 $ 10.01 15.1%

Weighted-average shares

outstanding:

Assuming dilution 1,287.4 1,341.4 (4.0)%

Assets** $113,452 $109,022 4.1%

Liabilities** $ 90,279 $ 86,267 4.7%

Equity** $ 23,172 $ 22,755 1.8%

* 3.3 percent adjusted for currency.

** At December 31.

In 2010, the company delivered strong financial results highlighted

by improved revenue performance, continued margin expansion,

solid cash generation and record levels of net income and earnings

per share. The financial performance continues to be driven by the