IBM 2010 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Global Technology Services revenue of $38,201 million

increased 2.3 percent (1 percent adjusted for currency) in 2010

versus 2009. The rate of year-to-year revenue growth, adjusted

for currency, demonstrated an improving trend over the second

half of 2010. In the first half, revenue, adjusted for currency, was

flat versus the prior year, and in the second half, revenue increased

1 percent, at constant currency, compared to the prior year period.

GTS Outsourcing revenue increased 2.9 percent (1 percent

adjusted for currency) in 2010 with fairly consistent year-to-year

growth, adjusted for currency, throughout the year. Revenue growth

was led by performance in the growth markets, up 18.4 percent

(8 percent adjusted for currency), as the company’s outsourcing

offerings help clients build out their IT infrastructures. Integrated

Technology Services (ITS) revenue decreased 0.6 percent (2 percent

adjusted for currency) in 2010 versus 2009. Revenue performance,

adjusted for currency, in ITS improved over the course of 2010 and

the growth markets had good year-to-year growth, up 8 percent

at constant currency, throughout 2010. Maintenance revenue

increased 4.2 percent (3 percent adjusted for currency) compared

to 2009 with consistent performance, at constant currency,

throughout the year.

Global Business Services revenue increased 3.2 percent

(2 percent adjusted for currency) in 2010 and delivered growth in

outsourcing and the transactional businesses: consulting and

systems integration. Revenue growth was strongest in North

America, up 8.5 percent (7 percent adjusted for currency) and was

broad based across the industry sectors with Financial Services,

Distribution, Industrial, Public and General Business each delivering

growth on a constant currency basis. GBS had good performance

in its growth initiatives in 2010, with revenue and transactional

signings growth in the growth markets and revenue growth of

over 35 percent in business analytics. GBS added over 4,000

consultants in 2010 and now has over 7,800 dedicated consultants

in its business analytics practice.

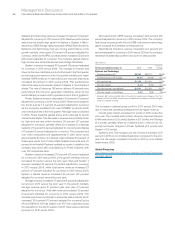

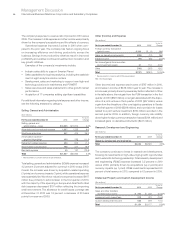

($ in millions)

Yr.- to -Yr.

For the year ended December 31: 2010 2009 Change

Global Services:

Global Technology Services:

External gross profit $13,267 $13,081 1.4%

External gross profit margin 34.7% 35.0% (0.3) pts.

Pre-tax income $ 5,568 $ 5,537 0.6%

Pre-tax margin 14.1% 14.3% (0.2) pts.

Pre-tax income—normalized* $ 5,840 $ 5,571 4.8%

Pre-tax margin—normalized 14.8% 14.4% 0.4 pts.

Global Business Services:

External gross profit $ 5,148 $ 4,979 3.4%

External gross profit margin 28.3% 28.2% 0.0 pts.

Pre-tax income $ 2,569 $ 2,555 0.5%

Pre-tax margin 13.5% 13.8% (0.3) pts.

Pre-tax income—normalized** $ 2,697 $ 2,632 2.5%

Pre-tax margin—normalized 14.2% 14.2% 0.0 pts.

* Excludes $273 million and $115 million of workforce rebalancing charges in the first

quarter of 2010 and 2009, respectively, and ($81) million related to the Geodis gain

in the first quarter of 2009.

** Excludes $128 million and $123 million of workforce rebalancing charges in the first

quarter of 2010 and 2009, respectively, and ($46) million related to the Geodis gain

in the first quarter of 2009.

GTS gross profit margin declined 0.3 points to 34.7 percent in 2010.

Segment pre-tax profit increased to $5,568 million with a pre-tax

margin of 14.1 percent. On a normalized basis, segment pre-tax

income in 2010 increased 4.8 percent and margin expanded

0.4 points to 14.8 percent reflecting the benefits from workforce

rebalancing and an improved revenue growth trend.

GBS gross profit increased 3.4 percent in 2010, in line with

revenue growth. Gross profit margin of 28.3 percent was flat year-

to-year. Segment pre-tax profit improved 0.5 percent to $2,569

million with a pre-tax margin decline of 0.3 points year over year.

On a normalized basis, segment pre-tax income in 2010 increased

2.5 percent with a pre-tax margin of 14.2 percent, flat compared

to 2009. Throughout 2010, GBS improved utilization and delivery

excellence, while continuing to invest in globally integrated capa-

bilities and skills to support growth initiatives.

Global Services Signings

Total Global Services signings of $57,696 million increased 1.1

percent (flat adjusted for currency) compared to 2009. Outsourcing

signings for the year of $33,064 million increased 0.2 percent

(decreased 1 percent adjusted for currency). In the fourth quarter,

outsourcing signings increased 24.2 percent, after declining by

14.9 percent in the third quarter when compared to the prior year

periods. On a dollar basis, fourth quarter outsourcing signings

exceeded the third quarter by $8,458 million ($14,138 million versus

$5,680 million). These quarterly dynamics are a good example of

the volatility that can occur with outsourcing signings. Due to this

volatility, outsourcing signings are not a good predictor of revenue.

This is due to the many factors that impact how signings translate

to revenue, such as duration, start date of the contract, and