IBM 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

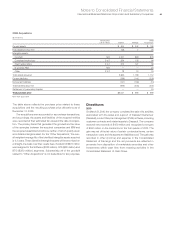

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies76

Changes in the fair value of a derivative that is designated as

a fair value hedge, along with offsetting changes in the fair value

of the underlying hedged exposure, are recorded in earnings each

period. For hedges of interest rate risk, the fair value adjustments

are recorded as adjustments to interest expense and cost of

financing in the Consolidated Statement of Earnings. For hedges

of currency risk associated with recorded financial assets or

liabilities, derivative fair value adjustments are recognized in other

(income) and expense in the Consolidated Statement of Earnings.

Changes in the fair value of a derivative that is designated

as a cash flow hedge are recorded, net of applicable taxes, in

accumulated other comprehensive income/(loss), a component

of equity. When net income is affected by the variability of the

underlying cash flow, the applicable offsetting amount of the gain

or loss from the derivative that is deferred in equity is released to

net income and reported in interest expense, cost, SG&A expense

or other (income) and expense in the Consolidated Statement of

Earnings based on the nature of the underlying cash flow hedged.

Effectiveness for net investment hedging derivatives is measured

on a spot-to-spot basis. The effective portion of changes in the

fair value of net investment hedging derivatives and other non-

derivative financial instruments designated as net investment

hedges are recorded as foreign currency translation adjustments,

net of applicable taxes, in accumulated other comprehensive

income/(loss) in the Consolidated Statement of Changes in Equity.

Changes in the fair value of the portion of a net investment hedging

derivative excluded from the effectiveness assessment are

recorded in interest expense.

If the underlying hedged item ceases to exist, all changes in the

fair value of the derivative are included in net income each period

until the instrument matures. When the derivative transaction

ceases to exist, a hedged asset or liability is no longer adjusted

for changes in its fair value except as required under other relevant

accounting standards. Derivatives that are not designated as

hedges, as well as changes in the fair value of derivatives that do

not effectively offset changes in the fair value of the underlying

hedged item throughout the designated hedge period (collectively,

“ineffectiveness”), are recorded in net income each period and

are reported in other (income) and expense.

The company reports cash flows arising from derivative financial

instruments designated as fair value or cash flow hedges consistent

with the classification of cash flows from the underlying hedged

items that these derivatives are hedging. Accordingly, the cash flows

associated with derivatives designated as fair value or cash flow

hedges are classified in cash flows from operating activities in the

Consolidated Statement of Cash Flows. Cash flows from derivatives

designated as net investment hedges and derivatives that do not

qualify as hedges are reported in cash flows from investing activities.

For currency swaps designated as hedges of foreign currency

denominated debt (included in the company’s debt risk manage-

ment program as addressed in note L, “Derivative Financial

Instruments,” on pages 96 through 101), cash flows directly associ-

ated with the settlement of the principal element of these swaps

are reported in payments to settle debt in cash flows from financing

activities in the Consolidated Statement of Cash Flows.

Financial Instruments

In determining the fair value of its financial instruments, the company

uses a variety of methods and assumptions that are based on

market conditions and risks existing at each balance sheet date.

Refer to note E, “Financial Instruments (Excluding Derivatives),” on

pages 88 and 89 for further information. All methods of assessing

fair value result in a general approximation of value, and such value

may never actually be realized.

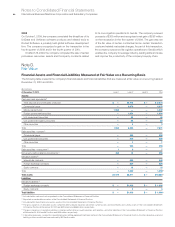

Fair Value Measurement

Exit prices are used to measure assets and liabilities that fall within

the scope of the fair value measurements guidance. Under this

guidance, the company is required to classify certain assets and

liabilities based on the following fair value hierarchy:

• Level 1—Quoted prices in active markets that are unadjusted

and accessible at the measurement date for identical, unre-

stricted assets or liabilities;

• Level 2—Quoted prices for identical assets and liabilities

in markets that are not active, quoted prices for similar assets

and liabilities in active markets or financial instruments

for which significant inputs are observable, either directly or

indirectly; and

• Level 3—Prices or valuations that require inputs that are both

significant to the fair value measurement and unobservable.

The guidance requires the use of observable market data if such

data is available without undue cost and effort.

When available, the company uses unadjusted quoted market

prices to measure the fair value and classifies such items within

Level 1. If quoted market prices are not available, fair value is based

upon internally developed models that use current market-based

or independently sourced market parameters such as interest

rates and currency rates. Items valued using internally generated

models are classified according to the lowest level input or value

driver that is significant to the valuation.

The determination of fair value considers various factors

including interest rate yield curves and time value underlying the

financial instruments. For derivatives and debt securities, the

company uses a discounted cash flow analysis using discount

rates commensurate with the duration of the instrument.