IBM 2010 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Year in Review

Segment Details

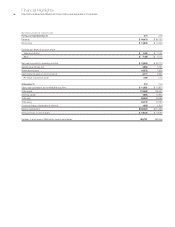

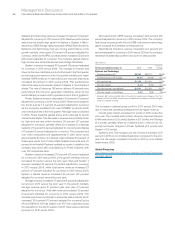

The following is an analysis of the 2010 versus 2009 reportable segment results. The table below presents each reportable segment’s

external revenue and gross margin results.

($ in millions)

Yr.-to-Yr. Yr.-to-Yr.

Percent/ Change

Margin Adjusted

For the year ended December 31: 2010 2009 Change for Currency

Revenue:

Global Technology Services $38,201 $37,347 2.3% 0.7%

Gross margin 34.7% 35.0% (0.3) pts.

Global Business Services 18,223 17,653 3.2% 1.6%

Gross margin 28.3% 28.2% 0.0 pts.

Software 22,485 21,396 5.1% 4.8%

Gross margin 86.9% 86.0% 0.9 pts.

Systems and Technology 17,973 16,190 11.0% 11.1%

Gross margin 38.5% 37.8% 0.7 pts.

Global Financing 2,238 2,302 (2.8)% (4.3)%

Gross margin 51.3% 47.5% 3.8 pts.

Other 750 869 (13.7)% (13.8)%

Gross margin (0.9)% 11.6% (12.5) pts.

Total revenue $99,870 $95,758 4.3% 3.3%

Gross profit $46,014 $43,785 5.1%

Gross margin 46.1% 45.7% 0.3 pts.

global resource centers of excellence located where it made the

most business sense. Since 2005, global integration has enabled

the company to reduce spending by over $5 billion and improve

service quality, speed and risk management. The company has

shifted resources toward building client relationships and employees

skills, while positioning the company for new market opportunities.

During this period, IBM has pioneered this new operating model,

changing from a classic “multinational”, with smaller versions of

the parent company replicated in countries around the world, to

a global model with one set of processes, shared services and

broadly distributed decision making.

The company is now embarking on the next generation of

its transformation in which new capabilities and technologies

like business analytics and cloud computing will drive performance.

The proven principles of the globally integrated enterprise will

be applied to all of the company’s spending to continue to drive

additional productivity benefits in shared services, integrated

operations and end-to-end process transformation.

Integrated Supply Chain

Consistent with the company’s work with clients to transform their

supply chains for greater efficiency and responsiveness to global

market conditions, the company continues to derive business value

from its own globally integrated supply chain, thereby providing a

strategic advantage for the company to create value for clients.

IBM leverages its supply-chain expertise for clients through its

supply-chain business transformation outsourcing service to opti-

mize and help operate clients’ end-to-end supply-chain processes,

from procurement to logistics.

IBM spends approximately $35 billion annually through its

supply chain, procuring materials and services globally. The supply,

manufacturing, and logistics and customer fulfillment operations

are integrated in one operating unit that has optimized inventories

over time, improved response to marketplace opportunities and

external risks, and converted fixed costs to variable costs. Simplifying

and streamlining internal processes has improved operations,

sales force productivity and processes.