IBM 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 85

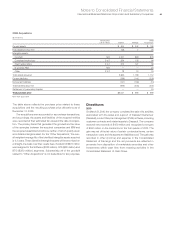

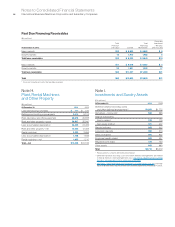

2008 Acquisitions

($ in millions)

Amortization Other

Life (in Years) Cognos Telelogic Acquisitions

Current assets $ 504 $ 242 $ 185

Fixed assets/noncurrent 126 7 75

Intangible assets:

Goodwill N/A 4,207 690 676

Completed technology 3 to 7 534 108 94

Client relationships 3 to 7 512 127 39

In-process R&D N/A — — 24

Other 3 to 7 78 15 19

Total assets acquired 5,960 1,189 1,112

Current liabilities (798) (141) (233)

Noncurrent liabilities (141) (163) (14)

Total liabilities assumed (939) (304) (247)

Settlement of preexisting litigation — — 24

Total purchase price $5,021 $ 885 $ 889

N/A—Not applicable

The table above reflects the purchase price related to these

acquisitions and the resulting purchase price allocations as of

Decem ber 31, 2008.

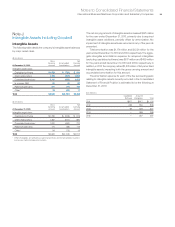

The acquisitions were accounted for as purchase transactions,

and accordingly, the assets and liabilities of the acquired entities

were recorded at their estimated fair values at the date of acquisi-

tion. The primary items that generated the goodwill are the value

of the synergies between the acquired companies and IBM and

the acquired assembled workforce, neither of which qualify as an

amortizable intangible asset. For the “Other Acquisitions,” the over-

all weighted-average life of the identified intangible assets acquired

is 4.3 years. These identified intangible assets will be amortized on

a straight-line basis over their useful lives. Goodwill of $676 million

was assigned to the Software ($328 million), GTS ($68 million) and

STG ($280 million) segments. Substantially, all of the goodwill

related to “Other Acquisitions” is not deductible for tax purposes.

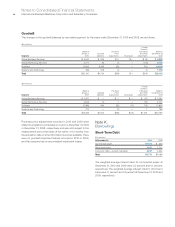

Divestitures

2010

On March 31, 2010, the company completed the sale of its activities

associated with the sales and support of Dassault Systemes’

(Dassault) product lifecycle management (PLM) software, including

customer contracts and related assets to Dassault. The company

received net proceeds of $459 million and recognized a net gain

of $591 million on the transaction in the first quarter of 2010. The

gain was net of the fair value of certain contractual terms, certain

transaction costs and the assets and liabilities sold. The gain was

recorded in other (income) and expense in the Consolidated

Statement of Earnings and the net proceeds are reflected in

proceeds from disposition of marketable securities and other

investments within cash flow from investing activities in the

Consolidated Statement of Cash Flows.