IBM 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies82

Each acquisition further complemented and enhanced the

company’s portfolio of product and services offerings. Lombardi is

a leading provider of business process management software and

services, and became part of the company’s application integration

software portfolio. Intelliden is a leading provider of intelligent

network automation software and will extend the network manage-

ment offerings. Initiate is a market leader in data integrity software

for information sharing among healthcare and government

organizations. Cast Iron Systems, a leading Software as a Service

(SaaS) and cloud application integration provider, enhances the

WebSphere business integration portfolio. BigFix, Inc. is a leading

provider of high-performance enterprise systems and security

management solutions that revolutionizes the way IT organizations

manage and secure their computing infrastructure. Coremetrics,

a leader in Web analytics software, will expand the company’s

business analytics capabilities by enabling organizations to use

cloud computing services to develop faster, more targeted market-

ing campaigns. Datacap will strengthen the company’s ability to

help organizations digitize, manage and automate their information

assets. Unica, a leading provider of software and services used to

automate marketing processes, will expand the company’s ability

to help organizations analyze and predict customer preferences

and develop more targeted marketing campaigns. PSS Systems

is a leading provider of legal information governance and information

management software. OpenPages is a leading provider of soft-

ware that helps companies more easily identify and manage risk

and compliance activities across the enterprise through a single

management system. Clarity Systems delivers financial governance

software that enables organizations to automate the process of

collecting, preparing, certifying and controlling financial statements

for electronic filing. Wilshire’s mortgage servicing platform will

continue the company’s strategic focus on the mortgage services

industry and strengthens its commitment to deliver mortgage

business process outsourcing solutions. National Interest Security

Company will strengthen the ability to deliver advanced analytics

and IT solutions to the public sector. Storwize, a provider of in-line

data compression appliance solutions, will help the company to

make it more affordable for clients to analyze massive amounts of

data in order to provide new insights and business outcomes.

BLADE provides server and top-of-rack switches as well as software

to virtualize and manage cloud computing and other workloads.

Purchase price consideration for the “Other Acquisitions” as

reflected in the table above, is paid primarily in cash. All acquisitions

are reported in the Consolidated Statement of Cash Flows net of

acquired cash and cash equivalents.

The acquisitions were accounted for as business combinations

using the acquisition method, and accordingly, the identifiable

assets acquired, the liabilities assumed, and any noncontrolling

interest in the acquired entities were recorded at their estimated

fair values at the date of acquisition. The primary items that gen-

erated the goodwill are the value of the synergies between the

acquired companies and IBM and the acquired assembled work-

force, neither of which qualify as an amortizable intangible asset.

For the “Other Acquisitions,” the overall weighted-average life of the

identified intangible assets acquired is 6.4 years. These identified

intangible assets will be amortized on a straight-line basis over

their useful lives. Goodwill of $2,312 million has been assigned to

the Software ($1,653 million), GTS ($32 million), GBS ($252 million)

and STG ($375 million) segments. It is expected that approximately

10 percent of the goodwill will be deductible for tax purposes.

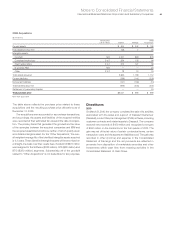

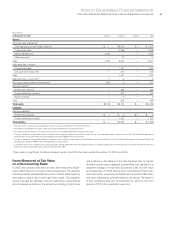

The table below reflects the purchase price related to these acquisitions and the resulting purchase price allocations as of December

31, 2010:

2010 Acquisitions

($ in millions)

Amortization Sterling Other

Life (in Years) Netezza Commerce* Acquisitions

Current assets $ 218 $ 196 $ 377

Fixed assets/noncurrent assets 73 106 209

Intangible assets:

Goodwill N/A 1,410 1,032 2,312

Completed technology 3 to 7 202 218 493

Client relationships 2 to 7 52 244 293

In-process R&D 5 4 — 17

Patents/trademarks 1 to 7 16 14 27

Total assets acquired 1,975 1,810 3,728

Current liabilities (9) (129) (161)

Noncurrent liabilities (120) (266) (291)

Total liabilities assumed (128) (395) (452)

Total purchase price $1,847 $1,415 $3,277

N/A—Not applicable

* Reflects the reclassification of $184 million related to deferred tax liabilities from current to noncurrent liabilities from amounts previously reported in the table on page 31 in the

company’s third quarter 2010 Form 10-Q filed on October 26, 2010.