IBM 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies88

Note E.

Financial Instruments

(Excluding Derivatives)

Fair Value of Financial Instruments

Cash and cash equivalents, debt and marketable equity securities

are recognized and measured at fair value in the Consolidated

Financial Statements. Notes and other accounts receivable and

other investments are financial assets with carrying values that

approximate fair value. Accounts payable, other accrued expenses

and short-term debt are financial liabilities with carrying values that

approximate fair value. In the absence of quoted prices in active

markets, considerable judgment is required in developing estimates

of fair value. Estimates are not necessarily indicative of the amounts

the company could realize in a current market transaction. The

following methods and assumptions are used to estimate fair values:

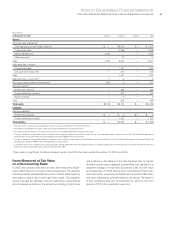

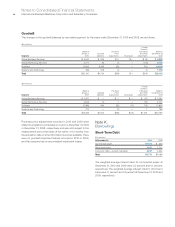

Loans and Long-Term Receivables

Fair values are based on discounted future cash flows using current

interest rates offered for similar loans to clients with similar credit

ratings for the same remaining maturities.

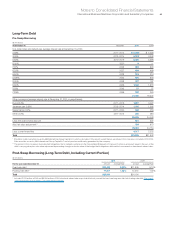

Long-Term Debt

Fair value of publicly traded long-term debt is based on quoted

market prices for the identical liability when traded as an asset in

an active market. For other long-term debt for which a quoted

market price is not available, an expected present value technique

that uses rates currently available to the company for debt with

similar terms and remaining maturities is used to estimate fair value.

The carrying amount of long-term debt is $21,846 million and

$21,932 million and the estimated fair value is $24,006 million and

$23,748 million at December 31, 2010 and 2009, respectively.

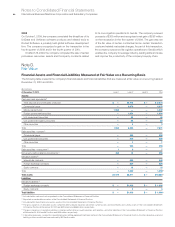

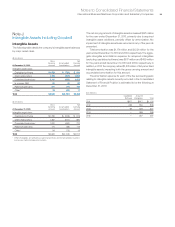

Debt and Marketable Equity Securities

The following tables summarize the company’s debt and marketable equity securities all of which are considered available for sale and

re cord ed at fair value in the Consolidated Statement of Finan cial Position.

($ in millions)

Gross Gross

Adjusted Unrealized Unrealized Fair

At December 31, 2010: Cost Gains Losses Value

Cash and cash equivalents

(1)

Time deposits and certificates of deposit $2,473 $ — $(0) $2,473

Commercial paper 2,673 — (0) 2,673

Money market funds 1,532 — — 1,532

Foreign government securities 1,054 — — 1,054

U.S. government securities 44 0 (0) 44

U.S. government agency securities 22 0 (0) 22

Other securities 3 — — 3

Tot a l $7,801 $ 0 $(0) $7,801

Debt securities—current

(2)

Commercial paper $ 490 $ — $(0) $ 490

U.S. government securities 500 — (0) 500

Other securities 1 — (0) 1

Tot a l $ 990 $ — $(0) $ 990

Debt securities—noncurrent

(3)

Other securities $ 6 $ 1 $(0) $ 7

Tot a l $ 6 $ 1 $(0) $ 7

Non-equity method alliance investments

(3) $ 194 $264 $(0) $ 458

(1) Included within cash and cash equivalents in the Consolidated Statement of Financial Position.

(2)

Reported as marketable securities in the Consolidated Statement of Financial Position.

(3) Included within investments and sundry assets in the Consolidated Statement of Financial Position.