IBM 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Management Discussion

International Business Machines Corporation and Subsidiary Companies

forward-looking product information such as marketing plans and

technological innovations. Residual value estimates are periodically

reviewed and “other than temporary” declines in estimated future

residual values are recognized upon identification. Anticipated

increases in future residual values are not recognized until the

equipment is remarketed. Factors that could cause actual results

to materially differ from the estimates include significant changes

in the used-equipment market brought on by unforeseen changes

in technology innovations and any resulting changes in the useful

lives of used equipment.

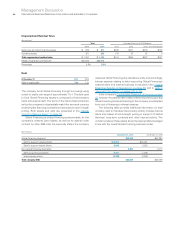

To the extent that actual residual value recovery is lower than

management’s estimates by 10 percent, Global Financing’s

segment pre-tax income and the company’s consolidated income

before income taxes for 2010 would have been lower by an esti-

mated $120 million. If the actual residual value recovery is higher

than management’s estimates, the increase in income will be

realized at the end of lease when the equipment is remarketed.

Currency Rate Fluctuations

Changes in the relative values of non-U.S. currencies to the U.S.

dollar affect the company’s results. At December 31, 2010, currency

changes resulted in assets and liabilities denominated in local

currencies being translated into more U.S. dollars than at year-end

2009. The company uses financial hedging instruments to limit

specific currency risks related to financing transactions and other

foreign currency-based transactions. Further discussion of currency

and hedging appears in note L, “Derivative Financial Instruments,”

on pages 96 through 101.

In 2010, the company’s revenue increased 4.3 percent as

reported and 3.3 percent adjusted for currency, the difference

driven from the company’s operations in currencies other than the

U.S. dollar. The company maintains currency hedging programs

for cash planning purposes which mitigate, but do not eliminate,

the volatility of currency impacts on the company’s financial results.

In addition to the translation of earnings, the impact of currency

changes also may affect the company’s pricing and sourcing

actions. For example, the company may procure components and

supplies in multiple functional currencies and sell products and

services in other currencies. The company believes that some of

these currency-based changes in cost impact the price charged

to clients. However, the company estimates that the maximum

effect of currency, before taking pricing or sourcing actions

into account, and net of hedging activity, decreased total diluted

earnings per share growth by approximately $0.11 in 2010.

For non-U.S. subsidiaries and branches that operate in U.S.

dollars or whose economic environment is highly inflationary, trans-

lation adjustments are reflected in results of operations. Generally,

the company manages currency risk in these entities by linking

prices and contracts to U.S. dollars.

The company continues to monitor the economic conditions in

Venezuela. Due to the significant reduction of currency approvals

by the Venezuela government, in December 2009, the company

determined that the rate for translation should be changed to the

parallel rate at December 31, 2009.

In addition, due to the fact that the blended CPI/NCPI three-

year cumulative inflation rate in Venezuela reached 100 percent,

the country was considered highly inflationary, consistent with

accounting standards, effective January 1, 2010.

On January 8, 2010, a devaluation of the Venezuelan currency

was announced. The currency market in Venezuela will continue

to be fully controlled by the government through the Central Bank.

A two-tiered official rate structure was implemented and will be

managed by the Central Bank. In the first quarter of 2010, the

ability to obtain U.S. dollars remained severely restricted, even at

the new devalued rates. The parallel market remained the primary

method to obtain U.S. dollars. Therefore, in the first quarter, the

company continued to remeasure utilizing the parallel rate.

On May 17, 2010, the parallel market was suspended by the

Venezuela government. The new parallel fluctuating market

(“SITME”) opened on June 9, 2010, controlled by the Central Bank,

and with a set daily trading rate band that was significantly lower

than the previous parallel market rate. Tight volume restrictions

have been established for the new banded market, which has

been thinly traded since being opened. The SITME market is the

current viable option for obtaining currency exchange as the official

rates have not been accessible. Therefore, in the second, third and

fourth quarters, the company utilized the banded rate for remea-

surement purposes. This resulted in the recording of an immaterial

gain in the second quarter of 2010.

On December 30, 2010, the official rate for essential goods

was eliminated, with no change to the SITME rate. Future gains or

losses from devaluation of the SITME rate are not expected to

have a material impact given the size of the company’s operations

in Venezuela (less than 1 percent of total 2009 and 2010 revenue).

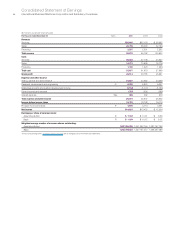

Market Risk

In the normal course of business, the financial position of the

company is routinely subject to a variety of risks. In addition to the

market risk associated with interest rate and currency movements

on outstanding debt and non-U.S. dollar denominated assets and

liabilities, other examples of risk include collectibility of accounts

receivable and recoverability of residual values on leased assets.

The company regularly assesses these risks and has established

policies and business practices to protect against the adverse

effects of these and other potential exposures. As a result, the

company does not anticipate any material losses from these risks.

The company’s debt, in support of the Global Financing

business and the geographic breadth of the company’s operations,

contains an element of market risk from changes in interest and

currency rates. The company manages this risk, in part, through

the use of a variety of financial instruments including derivatives,

as explained in note L, “Derivative Financial Instruments,” on pages

96 through 101.

To meet disclosure requirements, the company performs a

sensitivity analysis to determine the effects that market risk

exposures may have on the fair values of the company’s debt and

other financial instruments.