IBM 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 89

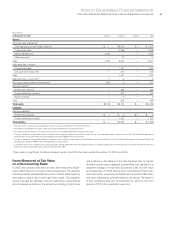

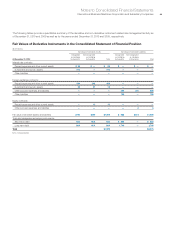

Based on an evaluation of available evidence as of December 31,

2010, the company believes that unrealized losses on debt and

marketable equity securities are temporary and do not represent

a requirement for an other-than-temporary impairment provision.

Proceeds from sales of debt securities and marketable equity

securities were approximately $16 million and $24 million during

2010 and 2009, respectively. The gross realized gains and losses

(before taxes) on these sales totaled $6 million and less than $(1)

million, respectively, in 2010. The gross realized gains and losses

(before taxes) on these sales totaled $3 million and $(40) million,

respectively, in 2009.

The after-tax net unrealized holding gains/(losses) on available-

for-sale debt and marketable equity securities that have been

included in accumulated other comprehensive income/(loss) and

the after tax net gains/(losses) reclassified from accumulated other

comprehensive income/(loss) into net income were as follows:

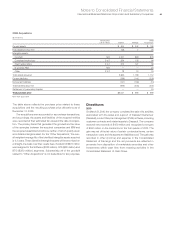

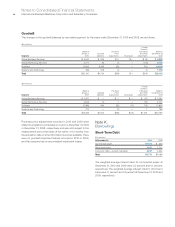

Net Change in Unrealized Gains/(Losses)

on Marketable Securities (Net of Tax)

($ in millions)

For the period ended December 31: 2010 2009

Net unrealized gains/(losses)

arising during the period $51 $ 72

Less: Net (losses)/gains included

in net income for the period* (0) (39)

Net unrealized gains/(losses)

on marketable securities $51 $111

* Includes writedowns of $3.6 million and $16.2 million in 2010 and 2009, respectively.

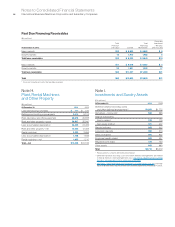

The contractual maturities of substantially all available-for-sale

debt securities are less than one year at December 31, 2010.

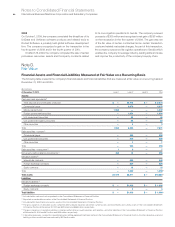

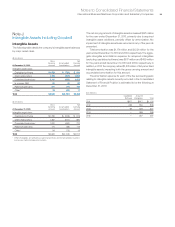

($ in millions)

Gross Gross

Adjusted Unrealized Unrealized Fair

At December 31, 2009: Cost Gains Losses Value

Cash and cash equivalents

(1)

Time deposits and certificates of deposit $4,324 $ 0 $ — $4,324

Commercial paper 2,099 — (0) 2,099

Money market funds 2,780 — — 2,780

Other securities 74 — — 74

Tot a l $9,277 $ 0 $ (0) $9,277

Debt securities—current

(2)

Commercial paper $1,491 $ — $ (0) $1,491

U.S. government securities 300 0 — 300

Tot a l $1,791 $ 0 $ (0) $1,791

Debt securities—noncurrent

(3)

Other securities $ 9 $ 0 $ (0) $ 9

Tot a l $ 9 $ 0 $ (0) $ 9

Non-equity method alliance investments(3) $ 183 $201 $(10) $ 374

(1) Included within cash and cash equivalents in the Consolidated Statement of Financial Position.

(2)

Reported as marketable securities in the Consolidated Statement of Financial Position.

(3) Included within investments and sundry assets in the Consolidated Statement of Financial Position.