IBM 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies 119

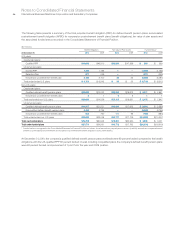

For the U.S. defined benefit pension plans, the changes in the

discount rate assumptions impacted the net periodic (income)/cost

and the PBO. The changes in the discount rate assumptions

resulted in a decrease in 2010 net periodic income of $40 million,

a decrease in 2009 net periodic income of $70 million and an

increase in 2008 net periodic income of $67 million. The changes

in the discount rate assumptions resulted in an increase in the PBO

of $2,943 million and $703 million at December 31, 2010 and 2009,

respectively.

For the nonpension postretirement benefit plans, the changes

in the discount rate assumptions had no material impact on net

periodic cost for the years ended December 31, 2010, 2009 and

2008 and resulted in an increase in the APBO of $240 million and

$140 million at December 31, 2010 and 2009, respectively.

Expected Long-Term Returns on Plan Assets

Expected returns on plan assets, a component of net periodic

(income)/cost, represent the expected long-term returns on plan

assets based on the calculated market-related value of plan assets.

Expected long-term returns on plan assets take into account long-

term expectations for future returns and the investment policies

and strategies as described on page 120. These rates of return are

developed by the company, calculated using an arithmetic average

and are tested for reasonableness against historical returns. The

use of expected long-term returns on plan assets may result in

recognized pension income that is greater or less than the actual

returns of those plan assets in any given year. Over time, however,

the expected long-term returns are designed to approximate the

actual long-term returns, and therefore result in a pattern of income

and cost recognition that more closely matches the pattern of the

services provided by the employees. Differences between actual

and expected returns are recognized as a component of net loss

or gain in accumulated other comprehensive income/(loss), which

is amortized as a component of net periodic (income)/cost over

the service lives or life expectancy of the plan participants, depend-

ing on the plan, provided such amounts exceed certain thresholds

provided by accounting standards. The market-related value of

plan assets recognizes changes in the fair value of plan assets

systematically over a five-year period in the expected return on

plan assets line in net periodic (income)/cost.

For the U.S. defined benefit pension plan, the Qualified PPP,

the expected long-term rate of return on plan assets of 8.00 percent

remained constant for the years ended December 31, 2010, 2009

and 2008 and, consequently, had no incremental impact on net

periodic (income)/cost.

For the nonpension postretirement benefit plans, the company

maintains a nominal, highly liquid trust fund balance to ensure timely

payments are made. As a result, for the years ended December 31,

2010, 2009 and 2008, the expected long-term return on plan assets

and the actual return on those assets were not material.

Rate of Compensation Increases and Mortality Rate

The rate of compensation increases is determined by the com pany,

based upon its long-term plans for such increases. The rate of

compensation increase is not applicable to the U.S. defined ben-

efit pension plans as benefit accruals ceased December 31, 2007

for all participants. Mortality rate assumptions are based on life

expectancy and death rates for different types of participants.

Mortality rates are periodically updated based on actual experience.

Interest Crediting Rate

Benefits for certain participants in the PPP are calculated using a

cash balance formula. An assumption underlying this formula is

an interest crediting rate, which impacts both net periodic (income)/

cost and the PBO. This assumption provides a basis for projecting

the expected interest rate that participants will earn on the benefits

that they are expected to receive in the following year and is based

on the average from August to October of the one-year U.S.

Treasury Constant Maturity yield plus one percent.

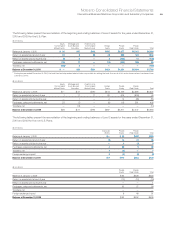

For the PPP, the change in the interest crediting rate to 1.4

percent for the year ended December 31, 2010, from 2.8 percent

for the year ended December 31, 2009, resulted in an increase in

2010 net periodic income of $62 million. The change in the interest

crediting rate to 2.8 percent for the year ended December 31, 2009,

from 5.2 percent for the year ended December 31, 2008, resulted

in an increase in 2009 net periodic income of $151 million. The

change in the interest crediting rate to 5.2 percent for the year

ended December 31, 2008, from 6.0 percent for the year ended

December 31, 2007, resulted in an increase in 2008 net periodic

income of $65 million.

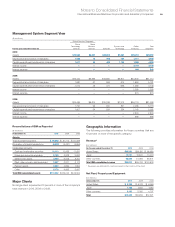

Healthcare Cost Trend Rate

For nonpension postretirement benefit plan accounting, the company

reviews external data and its own historical trends for healthcare

costs to determine the healthcare cost trend rates. However, the

healthcare cost trend rate has an insignificant effect on plan costs

and obligations as a result of the terms of the plan which limit the

company’s obligation to the participants. The company assumes

that the healthcare cost trend rate for 2011 will be 7.5 percent. In

addition, the company assumes that the same trend rate will

decrease to 5 percent over the next three years. A one percentage

point increase or decrease in the assumed healthcare cost trend

rate would not have a material effect on 2010, 2009 and 2008 net

periodic cost or the benefit obligations as of December 31, 2010

and 2009.