Capital One 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

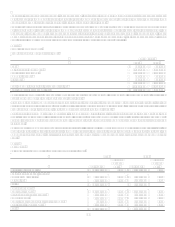

the NYSE of the Companys common stock during the five trading days ending the day before the completion of the merger, which

was $80.32.

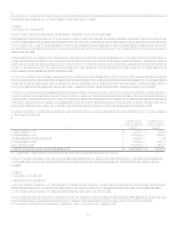

In 2006, the Company recorded certain refinements to its initial estimates of the fair value of the assets and liabilities related to the

Hibernia acquisition. These adjustments resulted in a $33.6 million decrease to goodwill.

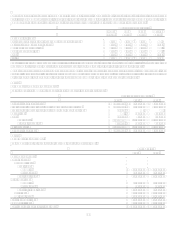

Note 4

Segments

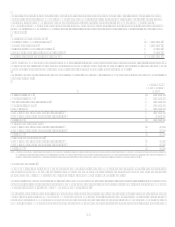

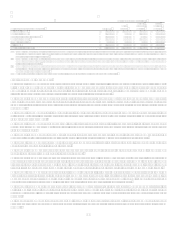

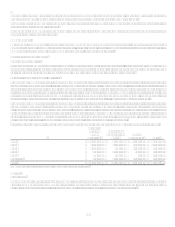

The segments reflect the manner in which financial information is currently evaluated. The Company strategically manages and

reports the results of its business through two operating segment levels: Local Banking and National Lending. Local Banking includes

consumer, small business and commercial deposits and lending conducted within its branch network. The Company diversified into

banking through the acquisition of Hibernia Corporation in late 2005 and the acquisition of North Fork in fourth quarter 2006. The

National Lending segment consists of the following three sub-segments:

U.S. Card sub-segment which consists of domestic consumer credit and certain debit card activities.

Auto Finance sub-segment which includes automobile and other motor vehicle financing activities.

Global Financial Services sub-segment consisting of international lending activities, small business lending, installment

loans, home loans, healthcare financing and other diversified activities.

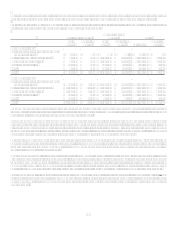

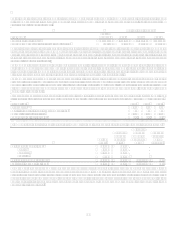

In the third quarter of 2007, the Company shut down mortgage origination operations of its wholesale mortgage banking unit,

GreenPoint, which was acquired in December 2006 through the North Fork acquisition. The results of the mortgage origination

operations are being reported as discontinued operations for 2007 and 2006, and are not included in segment results of the Company.

The results of GreenPoints held for investment portfolio were reported as discontinued operations for the year ended December 31,

2007. The results of GreenPoints mortgage servicing business were reported as part of the Companys continuing operations and

included in the Local Banking segment for 2007. GreenPoints commercial and consumer mortgage held for investment portfolios

were moved into the Local Banking Segment and Other category, respectively, in the fourth quarter of 2007.

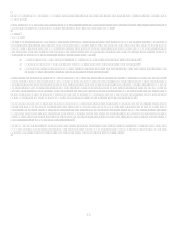

The Local Banking and National Lending Banking segments are considered reportable segments based on quantitative thresholds

applied to the managed loan portfolio for reportable segments provided by SFAS No. 131, Disclosures about Segments of an

Enterprise and Related Information, and are disclosed separately. The Other category includes the Companys liquidity portfolio,

emerging businesses not included in the reportable segments, and various non-lending activities. The Other category also includes the

net impact of transfer pricing, certain unallocated expenses, gains/losses related to the securitization of assets, and restructuring

charges related to the Companys 2007 cost initiative.

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in conformity with

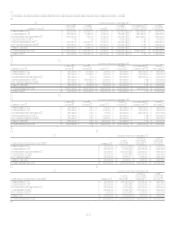

GAAP. The following tables present information prepared from the Companys internal management information system, which is

maintained on a line of business level through allocations from the consolidated financial results.