Capital One 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

Recent Accounting Pronouncements

In December 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standard No. 160,

Noncontrolling Interests in Consolidated Financial Statementsan amendment of ARB No. 51, (SFAS 160). This Statement applies

to all entities that prepare consolidated financial statements, except not-for-profit organizations, but will affect only those entities that

have an outstanding noncontrolling interest in one or more subsidiaries or that deconsolidate a subsidiary. This Statement amends

ARB 51 to establish accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a

subsidiary. It clarifies that a noncontrolling interest in a subsidiary is an ownership interest in the consolidated entity that should be

reported as equity in the consolidated financial statements. This Statement is effective for fiscal years, and interim periods within

those fiscal years, beginning on or after December 15, 2008. The adoption of SFAS 160 is not expected to have a material impact on

the consolidated earnings or financial position of the Company.

In December 2007, the FASB issued Statement of Financial Accounting Standard No. 141(R), Business Combinations (SFAS

141(R)). This Statement replaces SFAS 141, Business Combinations. It retains the fundamental requirements in SFAS 141; however,

the scope is broader than that of SFAS 141 by applying to all transactions and other events in which one entity obtains control over

one or more other businesses. SFAS 141(R) requires an acquirer to recognize the assets acquired, the liabilities assumed, and any

noncontrolling interest in the acquiree at the acquisition date, at their fair values as of that date, with limited exceptions, thereby

replacing SFAS 141s cost-allocation process. This Statement also changes the requirements for recognizing acquisition related costs,

restructuring costs, and assets acquired and liabilities assumed arising from contingencies. It also changes the accounting for step

acquisitions. The Company will apply the provisions of SFAS 141(R) when applicable.

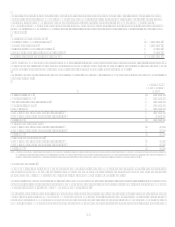

In September 2006, the FASB issued Statement of Financial Accounting Standard No. 158, Employers Accounting for Defined

Benefit Pension and Other Postretirement Plans, an amendment of FASB Statements No 87, 88, 106, and 132(R), (SFAS 158).

SFAS 158 requires plan sponsors of defined benefit pension and other postretirement benefit plans (collectively, defined benefit

plans) to recognize the funded status of their defined benefit plans in the Consolidated Balance Sheet, measure the fair value of plan

assets and benefit obligations as of the date of the fiscal year-end Consolidated Balance Sheet, and provide additional disclosures. On

December 31, 2006, the Company adopted the recognition and disclosure provisions of SFAS 158. The effect of adopting SFAS 158

on the Companys financial condition for the years ended December 31, 2007 and 2006, has been included in the accompanying

consolidated financial statements. SFAS 158 did not have an effect on the Companys consolidated financial condition at

December 31, 2005. SFAS 158s provisions regarding the change in the measurement date of defined benefit plans are effective for

fiscal years ending after December 15, 2008. The adoption of SFAS 158 did not have a material impact on the consolidated earnings

or financial position of the Company. See Note 12 for further discussion.

In September 2006, the FASB issued Statement of Financial Accounting Standard No. 157, Fair Value Measurements (SFAS 157).

This statement defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value

measurements. SFAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007. The initial

adoption of SFAS 157 did not have a material impact on the consolidated earnings or financial position of the Company.

In February 2007, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standard No. 159,

The Fair Value Option for Financial Assets and Liabilities, (SFAS 159). SFAS 159 permits entities to choose to measure many

financial instruments and certain other items at fair value with changes in fair value included in current earnings. The election is made

on specified election dates, can be made on an instrument by instrument basis, and is irrevocable. SFAS 159 is effective for financial

statements issued for fiscal years beginning after November 15, 2007. The initial adoption of SFAS 159 did not have a material impact

on the consolidated earnings or financial position of the Company.

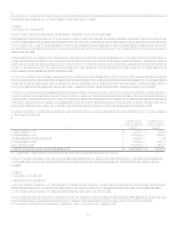

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an Interpretation of FASB

Statement No. 109, (FIN 48). FIN 48 clarifies the accounting treatment for uncertainty in income taxes recognized in an enterprises

financial statements in accordance with FASB Statement No. 109, Accounting for Income Taxes. This interpretation prescribes a

recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. This interpretation also provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure, and transition. The Company adopted the provisions of FIN 48 effective January 1, 2007. As

a result of adoption, the Company recorded a $29.7 million reduction in retained earnings.

In March 2006, the FASB issued Statement of Financial Accounting Standard No. 156, Accounting for Servicing of Financial Assets-

an amendment of FASB Statement No. 140, (SFAS 156). SFAS 156 amends FASB Statement No. 140, Accounting for Transfers and

Servicing of Financial Assets and Extinguishments of Liabilities, (SFAS 140), with respect to the accounting for separately

recognized servicing assets and servicing liabilities. SFAS 156 requires an entity to recognize a servicing asset or servicing liability

each time it undertakes an obligation to service a financial asset by entering into a servicing contract in certain situations prescribed by

SFAS 156. All separately recognized servicing assets and servicing liabilities are to be initially measured at fair value, if practicable,

and SFAS 156 permits an entity to choose either the amortization method or fair value measurement method for subsequent

measurement methods for each class of separately recognized servicing assets and servicing liabilities. SFAS 156 was effective as of