Capital One 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

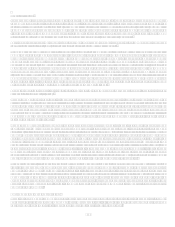

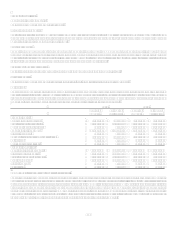

Financial Liabilities

Non-interest bearing deposits

The carrying amount approximates fair value.

Interest-bearing deposits

The fair values of savings, NOW accounts and money market accounts were the amounts payable on demand at December 31, 2007

and 2006. The fair value of other interest-bearing deposits was calculated by discounting the future cash flows using estimates of

market rates for corresponding contractual terms.

Other borrowings

The carrying amount of federal funds purchased and resale agreements, FHLB advances, and other short-term borrowings

approximates fair value. The fair value of secured borrowings was calculated by discounting the future cash flows using estimates of

market rates for corresponding contractual terms and assumed maturities when no stated final maturity was available. The fair value of

the junior subordinated debentures were determined based on quoted market prices.

Senior and subordinated notes

The fair value of senior and subordinated notes was determined based on quoted market prices.

Interest payable

The carrying amount approximates the fair value of this liability due to its relatively short-term nature.

Derivatives

The carrying amount of derivatives approximates fair value and was estimated using present value valuation techniques. This value

generally reflects the estimated amounts that the Company would have paid to terminate the interest rate swaps, currency swaps and

f/x contracts at the respective dates, taking into account the forward yield curve on the swaps and the forward rates on the currency

swaps and f/x contracts. These derivatives are included in other liabilities on the balance sheet.

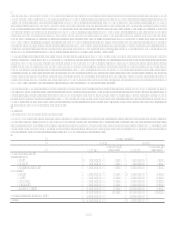

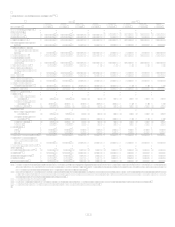

2007 2006

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

Estimated

Fair Value

Financial Assets

Cash and cash equivalents $ 4,821,409 $ 4,821,409

$ 4,660,496 $ 4,660,496

Securities available for sale 19,781,587 19,781,587

15,452,047 15,452,047

Mortgage loans held for sale 315,863 315,863

10,435,295 10,435,739

Loans held for investment 101,805,027 104,822,251

96,512,139 98,057,383

Interest receivable 839,317 839,317

816,426 816,426

Accounts receivable from securitization 4,717,879 4,717,879

4,589,235 4,589,235

Derivatives 542,743 542,743

326,892 326,892

Mortgage servicing rights 247,589 247,589

252,295 252,295

Financial Liabilities

Non-interest bearing deposits $ 11,046,549 $ 11,046,549

$ 11,648,070 $ 11,648,070

Interest-bearing deposits 71,943,913 70,528,579

74,122,822 71,438,918

Senior and subordinated notes 10,712,706 10,141,310

9,725,470 9,811,459

Other borrowings 26,583,683 26,290,579

24,257,007 23,852,818

Interest payable 631,609 631,609

574,763 574,763

Derivatives 529,390 529,390

218,604 218,604

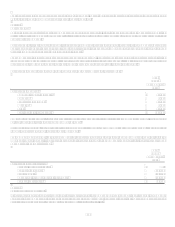

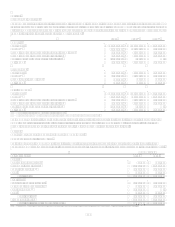

Commitments to extend credit and letters of credit

These financial instruments generally are not sold or traded. The fair value of the financial guarantees outstanding at December 31,

2007 that have been issued since January 1, 2003, was $2.9 million and was included in other liabilities. The estimated fair values of

extensions of credit and letters of credit are not readily available. However, the fair value of commitments to extend credit and letters

of credit is based on fees currently charged to enter into similar agreements with comparable credit risks and the current

creditworthiness of the counterparties. Commitments to extend credit issued by the Company are generally short-term in nature and, if

drawn upon, are issued under current market terms and conditions for credits with comparable risks. At December 31, 2007 and 2006,

there was no material unrealized appreciation or depreciation on these financial instruments.