Capital One 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the first place. We made these choices well before the industry was under a spotlight.

And we believe that they are driving long-term customer loyalty and profitability.

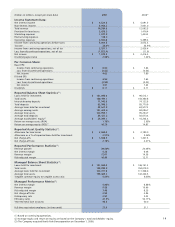

Auto Finance

This was a particularly challenging year for the auto finance industry and for

Capital One Auto Finance (COAF). COAF’s net loss for the year was $34 million, down

114 percent from 2006, with credit deterioration driving the bulk of the profitability

decrease. Origination volumes were up 5 percent year-over-year, adjusted for the

addition of the North Fork auto portfolio. Over the years, we have built a competitive,

scale business in auto finance, becoming the second largest non-captive auto lender in

the United States. However, COAF’s results this year were unsatisfactory.

We have taken decisive action to address the challenges in our auto finance business.

We introduced second and third generation credit models in our prime auto business

that have much tighter credit criteria. We pulled back from selected segments of the

auto finance market, scaling back originations to reflect the uncertainties in the credit

environment and focusing only on the most profitable and resilient segments. We took

advantage of market opportunities later in 2007 to make loans with significantly higher

credit scores and leveraged our pricing power to improve margins. We continued to

aggressively reduce costs and increase operating leverage. We slowed or stopped

growth in areas most impacted by home price depreciation. And we cut higher risk

dealerships that have worse overall credit performance on a portfolio basis.

The year’s brightest spot for COAF was the introduction of our new dealer relationship

model. We have integrated the various programs from our legacy auto acquisitions and

now are presenting one integrated face to the dealer. Early returns are promising. Our

dealer satisfaction, as measured by J.D. Power, went up 32 percent in a short amount

of time. Our deeper dealer relationships typically generate more loans from each dealer

with better credit quality.

Global Financial Services

Global Financial Services, or GFS, is our portfolio of emerging national scale growth

businesses, including small business, home loans, installment lending, healthcare

finance, and our UK and Canadian businesses. GFS delivered a solid year, despite credit

pressures in the United States and the UK, with net income of $299 million in 2007,

up 9 percent from 2006, and managed loan growth of $2 billion, or 9 percent. GFS

continued to provide meaningful diversification and growth to the company, while

delivering solid returns on allocated capital of 17 percent.

9