Capital One 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

Tax issues for years 1995-1999 are pending in the U.S. Tax Court. The ultimate resolution of these issues is not expected to have a

material effect upon the Companys operations or financial condition.

Note 22

Restructuring

During the second quarter of 2007, the Company announced a broad-based initiative to reduce expenses and improve the competitive

cost position of the Company. The 2007 cost initiative includes actions already taken during the second through fourth quarters of

2007 across the Company.

Restructuring initiatives leverage the capabilities of recently completed infrastructure projects in several of the Companys businesses.

The scope and timing of the expected cost reductions are the result of an ongoing, comprehensive review of operations within and

across the Companys businesses, which began early in 2007.

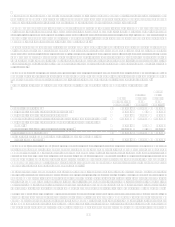

The Company anticipates recording charges of approximately $300.0 million pre-tax over the course of the cost reduction initiative

through 2008. Approximately $150.0 million of these charges are related to severance benefits, while the remaining charges are

associated with items such as contract and lease terminations and consolidation of facilities and infrastructure.

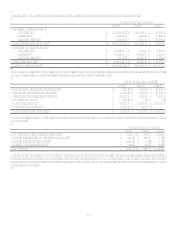

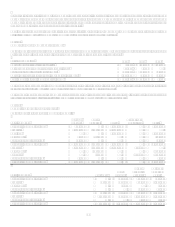

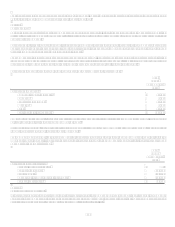

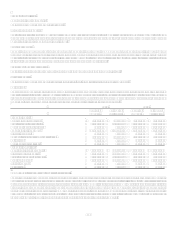

Restructuring expenses associated with continuing operations were comprised of the following:

Year

ended

December 31,

2007

Restructuring Expenses:

Employee termination benefits $ 86,714

Occupancy 6,628

Supplies and equipment 20,246

Marketing 1,057

Other 23,592

Total Restructuring Expenses $ 138,237

Employee termination benefits include charges for executives and charges for associates of the Company of $20.1 million and $66.6

million, respectively, for the year ended December 31, 2007.

Included in the $23.6 million of other restructuring expenses for the year ended December 31, 2007 are $17.9 million of contract

termination costs and $4.6 million of software impairment.

The Company made $37.2 million in cash payments for restructuring charges during the year ended December 31, 2007 that related to

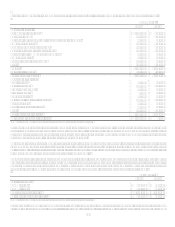

employee termination benefits. Restructuring accrual activity associated with the Companys 2007 cost initiative for the year ended

December 31, 2007 was as follows:

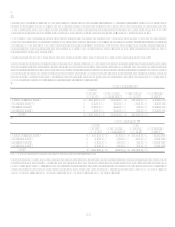

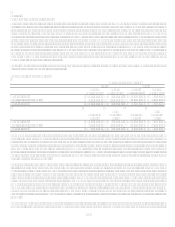

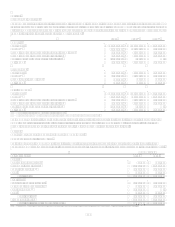

Year

ended

December 31,

2007

Restructuring accrual activity:

Balance, beginning of period $

Restructuring charges 138,237

Cash payments (37,165)

Noncash write-downs and other adjustments (33,111)

Balance, end of period $ 67,961

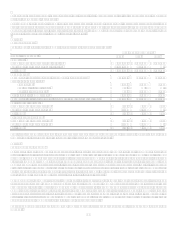

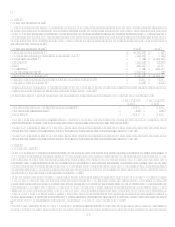

Note 23

Related Party Transactions

In the ordinary course of business, executive officers and directors of the Company may have consumer loans issued by the Company.

Pursuant to the Companys policy, such loans are issued on the same terms as those prevailing at the time for comparable loans to

unrelated persons and do not involve more than the normal risk of collectibility.